How The Pandemic’s Recessionary Pressures Shape Beauty Consumers

COVID-19 has ushered us into an incredibly uncertain time without an existing model to follow. The pandemic has caused fear, isolation, government lockdowns, unemployment, and extreme changes in consumer behavior resulting in demand surges for merchandise in a few essential categories like hygiene, home, personal care and groceries.

At StorySaves, the consultancy I lead, we applied findings from an in-depth consumer survey and beauty brand founder interviews we conducted to rubrics established in the Harvard Business Review article How To Market In A Downturn by John Quelch and Katherine E. Jocz that was published in April 2009.

According to the HBR article, “In recessions, marketers have to stay flexible, adjusting their strategies and tactics on the assumption of a prolonged, severe slump and yet be able to respond quickly to the upturn when it comes. This means, for example, having a pipeline of innovations ready to roll out on short notice. Most consumers will be ready to try a variety of new products once the economy improves. Companies that wait until the economy is in full recovery to ramp up will be at the mercy of better-prepared competitors.”

The current crisis has had a dual impact. First, the closure of businesses, particularly service-related operations, has generated unemployment and lack of disposable income. Second, government restrictions, quarantining at home and social distancing has produced behavior unique to the pandemic. Meanwhile, purchases of products used outside of the home have been reduced to close to zero. The pandemic has forced consumers to focus spend on hygiene and health basics, and divert money from spending on other essentials and non-essentials.

Four Types Of Recessionary Consumers

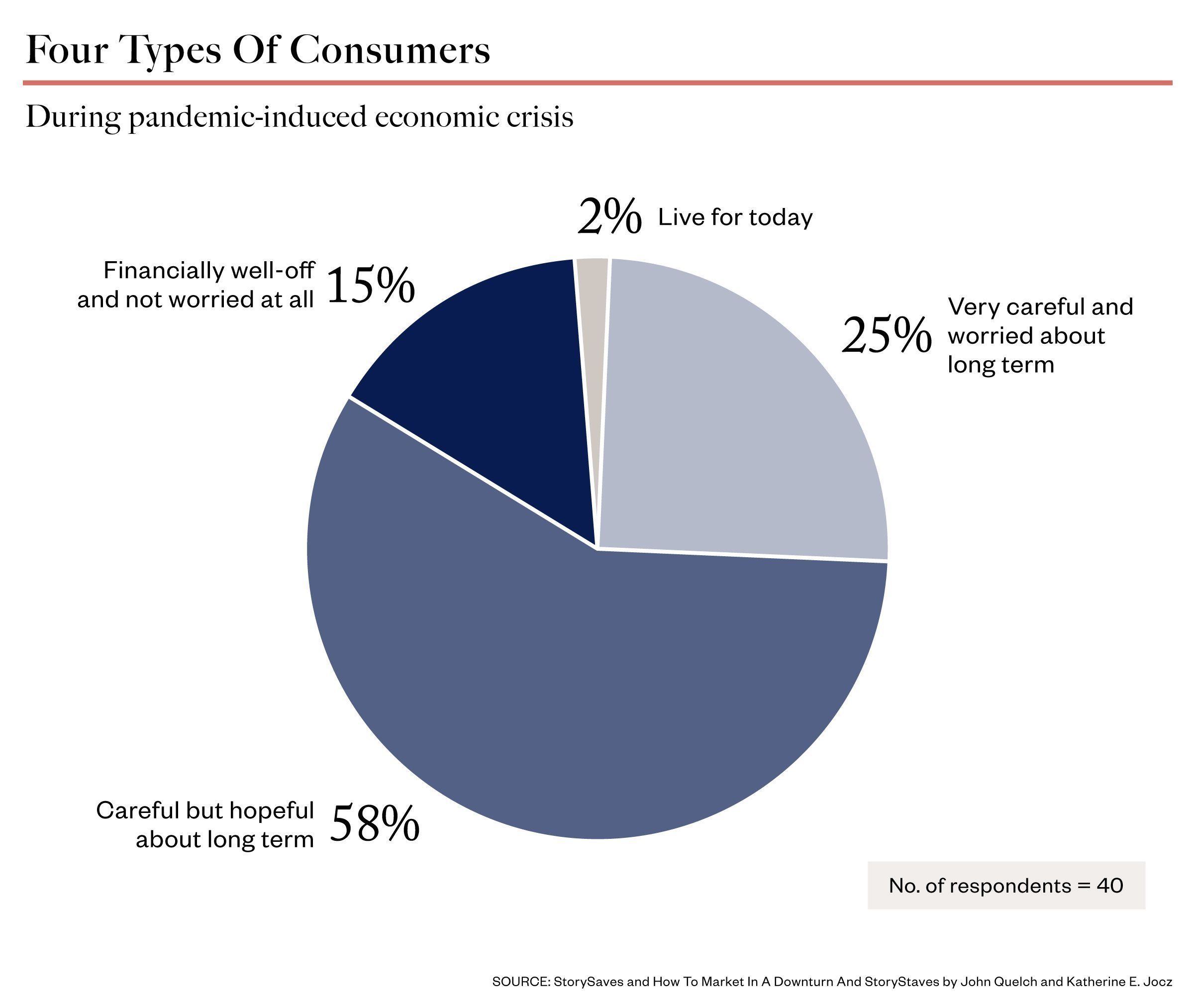

In line with Jocz’s and Quelch’s article, there are four types of consumers during a recession, which is confirmed by our research.

Very careful right now and worried about the long term

This consumer feels most anxious and hardest hit monetarily. “This group reduces all types of spending by eliminating, postponing, decreasing, or substituting purchases,” explained Jocz and Quelch. Among the respondents in the StorySaves’ survey, 25% belong in this category.

In today’s crisis and according to our current survey, this segment is likely to be in both low- and high-income segments. The financial position of consumers in it is attributable primarily due to widespread layoffs, leaving them with little disposable income and worsened by the uncertainty surrounding the economic future and public health.

Careful right now but hopeful for the future

This consumer, in the words of Jocz and Quelch, “tends to be positive about the long term but less confident about the prospects for recovery in the short term or their ability to maintain their standard of living.”

Like very careful consumers, they economize in all areas, though less aggressively. They constitute the largest segment—60% of respondents in the current survey—which aligns with Jocz’s and Quelch’s claim that this will generally be the biggest segment.

The unemployment rate for this segment stands at 26% versus 38% for the very careful segment, and the group contains a wide range of income levels. As the situation worsens, this segment is highly likely to move into the very careful segment.

Financially well-off segment

This consumer feels confident about their ability to face current and future issues in the economy. “They consume at near-pre-recession levels, though now they tend to be a little more selective (and less conspicuous) about their purchases,” wrote the authors of the HBR study. “The segment consists primarily of people in the top 5% income bracket.”

The StorySaves survey consisted of six respondents or 17% of the 40 respondents within the top 5% of consumers. However, some of these consumers also reported behaviors and concerns that fit the thought processes of consumers in the very careful and worried, and careful and hopeful categories.

Today’s financially well-off category includes earners below the top 5% income bracket who feel confident about their finances. This group is slightly older overall and naturally very health-conscious.

The live-for-today segment

This group spends similarly to how they have always spent and isn’t too worried about savings. The consumers in this group respond to the crisis mainly by delaying important buys. Jocz and Quelch defines them as,“Typically urban and younger…more likely to rent than to own and they will spend on experiences rather than stuff (with the exception of consumer electronics).”

These consumers could be some of the hardest hit by restaurants and services businesses closing due to the pandemic. At the same time, they are saving money that they would otherwise spend on dining and wining outside, which they could spend on stockpiling hygiene items and groceries or other essentials.

In the recent survey, two respondents at most were within this segment. The reason could be the size of the response panel or the current situation that has everyone worried to some extent.

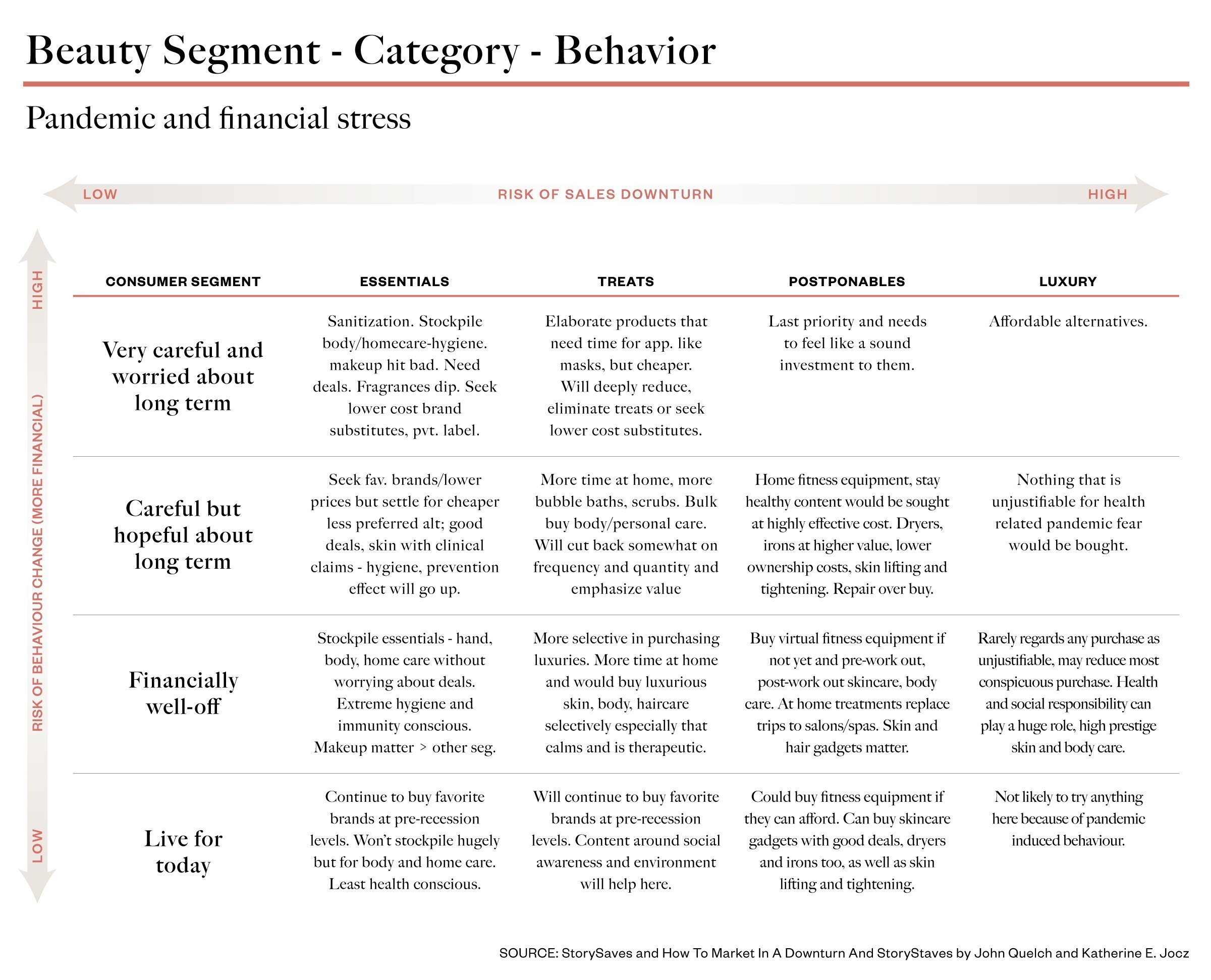

Brands will need to study their current consumer bases and understand which segment they fall into, along with understanding their consumers’ thought processes and current behaviors when it comes to brands’ specific product categories.

Four Product Categories For Recessionary Marketing

Jocz’s and Quelch’s article classifies products into categories. They write, “All consumers consider basic levels of food, shelter, and clothing to be essentials, and most would put transportation and medical care in that category. Beyond that, the assignment of particular goods and services to the various categories is highly idiosyncratic.”

In our survey, the product categories have been applied to skincare, body care, hair care and makeup to help define the consumers’ thought processes or, in other words, to determine the products they find essential, non-essential, a treat, expendable and a luxury. Different categories of consumers classify products differently.

Essentials

Essential products fit consumers’ needs for survival or are perceived as integral to physical and mental well-being. We have also defined some products as non-essential. Our modification to Jocz’s and Quelch’s report refers to products that have low functional and low treat utility for the consumer.

Skincare: Hand cream, face cleanser and sunscreen are considered essential by 91%, 80% and 77% of consumers, respectively. Sleep masks (71%), chemical peels (60%), toners (57%), face oils (48%), and anti-blemish treatments and fragrances are mostly considered non-essentials by respondents.

Makeup: Makeup products are largely deemed non-essential. Specifically, of the survey respondents, 43% regard lipstick as non-essential. Other non-essential rates are 54% for foundation, 43% for concealer, 49% for nail paint, 63% for primer, and 57% for highlighter.

Body Care and Personal Care: Body and face wash, soaps, sanitizers, shampoos are considered essentials by respondents. However, dry shampoo and hairstyling products aren’t regarded as essentials. Deodorant and lip care are considered essential by 71% and 74% consumers, respectively.

Treats

Treats are indulgences, and the immediate purchases of them are justified for pleasure and stress relief, especially during the current trying conditions.

Skincare: In the survey, 51% of respondents see essential oils as treats, while 29% consider night face creams and 26% consider face treatments treats.

Makeup: Bronzers (43%), concealers (34)%, nail polish (25%) and highlighters (29% ) are classified as treats by respondents more often than as essential or non-essential.

Body Care and Personal Care: Body lotions and treatments fall into this category. Due to more bath and personal time, the frequency of use of these treats is likely higher.

Postponables

Postponables are needed or desired items the purchases of which can be put off. Professional products and durables fall into this category. Hair dryers are an example.

Expendables/Luxury

Luxury items are perceived as unnecessary. These items include expensive items by upscale beauty brands, and high-end, prestige services at salons and spas.

Current Observable Consumer Behavior

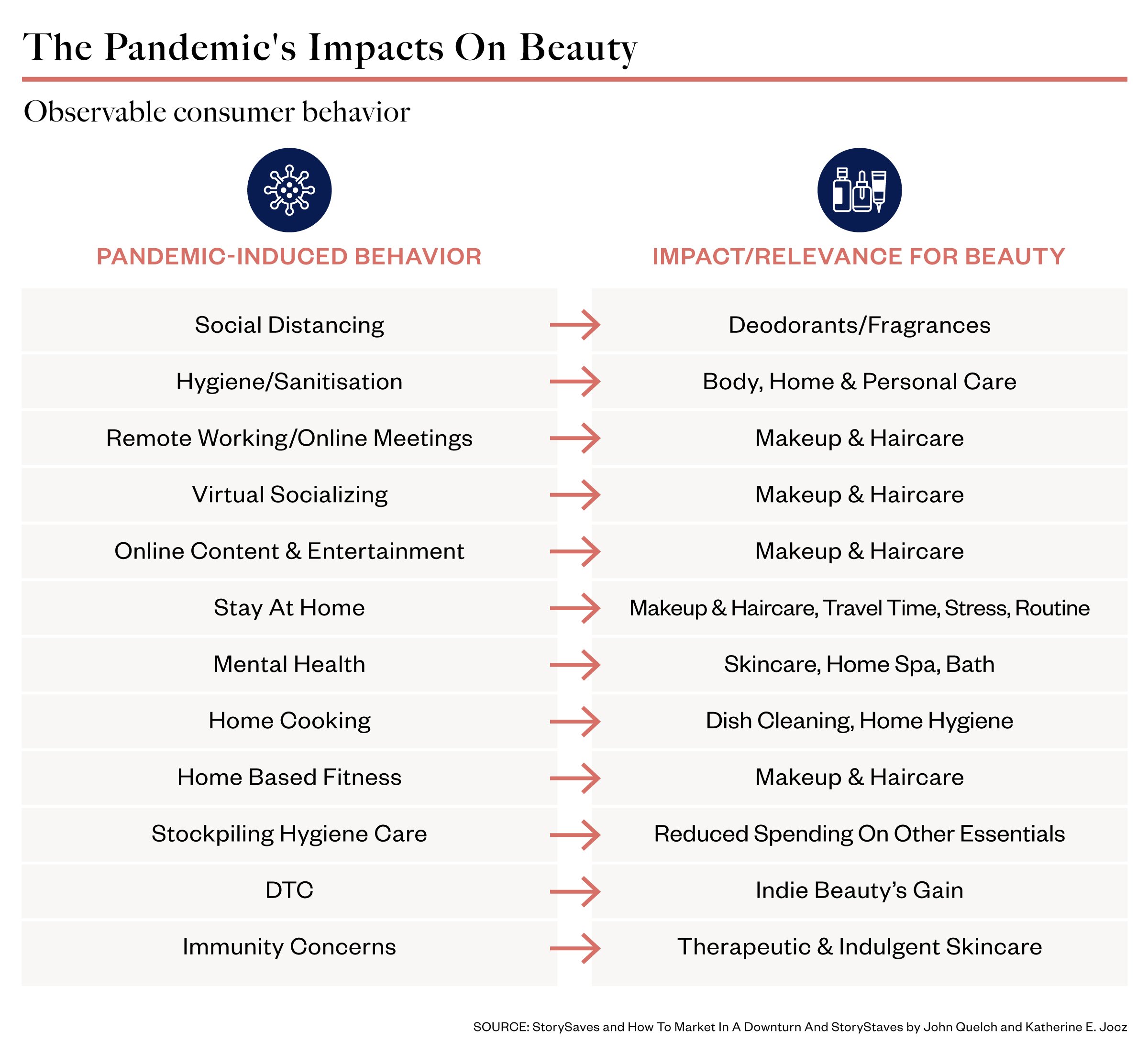

Consumers are looking for safety and health benefits over performance benefits unless performance is directly related to hygiene and safety like disinfecting from bacteria and viruses. People are highly concerned about their immunity and have more time at home because they are not traveling for work, grocery shopping and entertainment. Also, they are spending more time in the bathroom.

Physical and mental health are becoming more important than before. Quite a few consumers report slogging less than usual and living more holistically, meaning they are not all about work during these times. However, there is a portion of consumers who need to slog to keep their jobs or put in extra hours to meet a surge in demand. For beauty daredevils, there is more time to experiment with their looks with a lower risk of embarrassment.

In our survey, home-based fitness is up for net 26% of respondents, virtual socializing is up for net 50% of respondents, video conferencing for net 40% of respondents, Netflix and online content consumption is up for net 55% of respondents and net 58% of respondents are indulging and destressing more at home. Remote working has obviously skyrocketed.

A majority of respondents feel the current crisis is an “opportunity for a mental shift in individual and collective consciousness” as the whole world has come together to fight a common enemy.

The survey revealed that more than 80% of respondents are using much less makeup than before, and more are turning to skincare and body care for indulgence versus nail color and lipstick. Makeup is impacted due to the effort-benefit theory. Because people are not going out, the returns on spending elaborate effort and time on makeup are low.

A common sentiment among consumers is the time spent indulging on their skin, face and body provides the benefit of looking good and enhancing self-care with relaxation and rejuvenation.

Today’s Beauty Purchases And Routines

Only net 10% and net 20% of total respondents reported reducing their skincare and body care usage, respectively. Bathing has shown an increase in frequency for net 3% of consumers. Makeup, hairstyling and fragrances are hit hard with a reduction in frequency for approximately 80%, 70% and 60% of respondents, respectively.

By type, consumers in the very careful/worried segment are stockpiling body care, personal care and home care essentials, and are focused on sanitization and hygiene. In order, hand cream, face cleanser, sunscreen and lip care are the essentials the group remains interested in. For skincare essentials, these consumers seek cheaper products, private-label options and attractive deals.

They have drastically reduced their makeup purchases. In contrast, bath essentials like body wash, lotion, gels are not impacted. Body moisturizer, deodorant and body butter are the least affected in the body care category.

For the careful/hopeful crowd, our survey found they have richer and more set routines governing their exercise, work, family time, hobbies, cooking, Netflix, meditation and indulgences as compared with the very careful/worried segment.

Within this segment, 30% apply skincare multiple times a day in spite of or because of the pandemic, and close to 60% apply skincare every day, including weekends. The routines do not stray from pre-COVID frequencies. However, more than two-thirds report a drop in hairstyling, with 31% consuming less haircare, 60% using makeup less frequently, and half using fewer fragrances.

About 30% of consumers in this segment cite the importance of natural and organic products. However, hygiene is the biggest driver for their skincare and body care buys currently. Price, antimicrobial properties and favorite brands with deals were each cited, separately, as crucial purchasing drivers by 13% of the segment. Skincare, body care and bath products present the biggest opportunities for consumption. As the economic downturn persists, this segment’s beauty purchases may become more conservative.

To the older, generally more affluent consumers in the financially well-off segment, hand cream, face cleanser, face treatment, sunscreen, eye care, lip care, face oil and night face cream are the least impacted essentials, ranked by descending order of importance. Makeup matters to them even though consumption is a little less than before. They consider lipstick and nail polish essential (50% of respondents) while they use lip gloss and eyebrow pencil more than the other segments.

Understanding current consumer mindsets and behaviors is the first step in the process of reacting to what will most likely be many phases of consumption and public health restrictions affecting beauty brands. For more information on how to market specific products to pandemic-era consumers, see the full report on StorySaves.

At StorySaves, Rohit Banota has transformed dozens of beauty brands with brand story, brand tribe and innovation for organic growth. He has over 15 years of marketing and business experience growing both big beauty and grooming brands while working with P&G and a multitude of indie beauty brands across North America.

Leave a Reply

You must be logged in to post a comment.