Beauty Content Platform Hue Raises $4.5M In Seed Funding To Expand Its Client Universe

Hue has raised $4.5 million in seed funding to power its next phase of growth.

B2B software venture capital firms Fika Ventures and Underscore VC led the user-generated content creation software platform’s seed round, with participation from Sequoia Scouts, The MBA Fund, Heirloom Fund, Glasswing Ventures, Courtyard Ventures and Phoenix Fund. Underscore VC and MBA Fund are returning investors, and they along with NFX were involved in an earlier $2 million raise. Hue also previously received a $150,000 equity-free grant from Google via its Startups Founders Funds and a Project Connect grant from Unilever Prestige and Women’s Wear Daily.

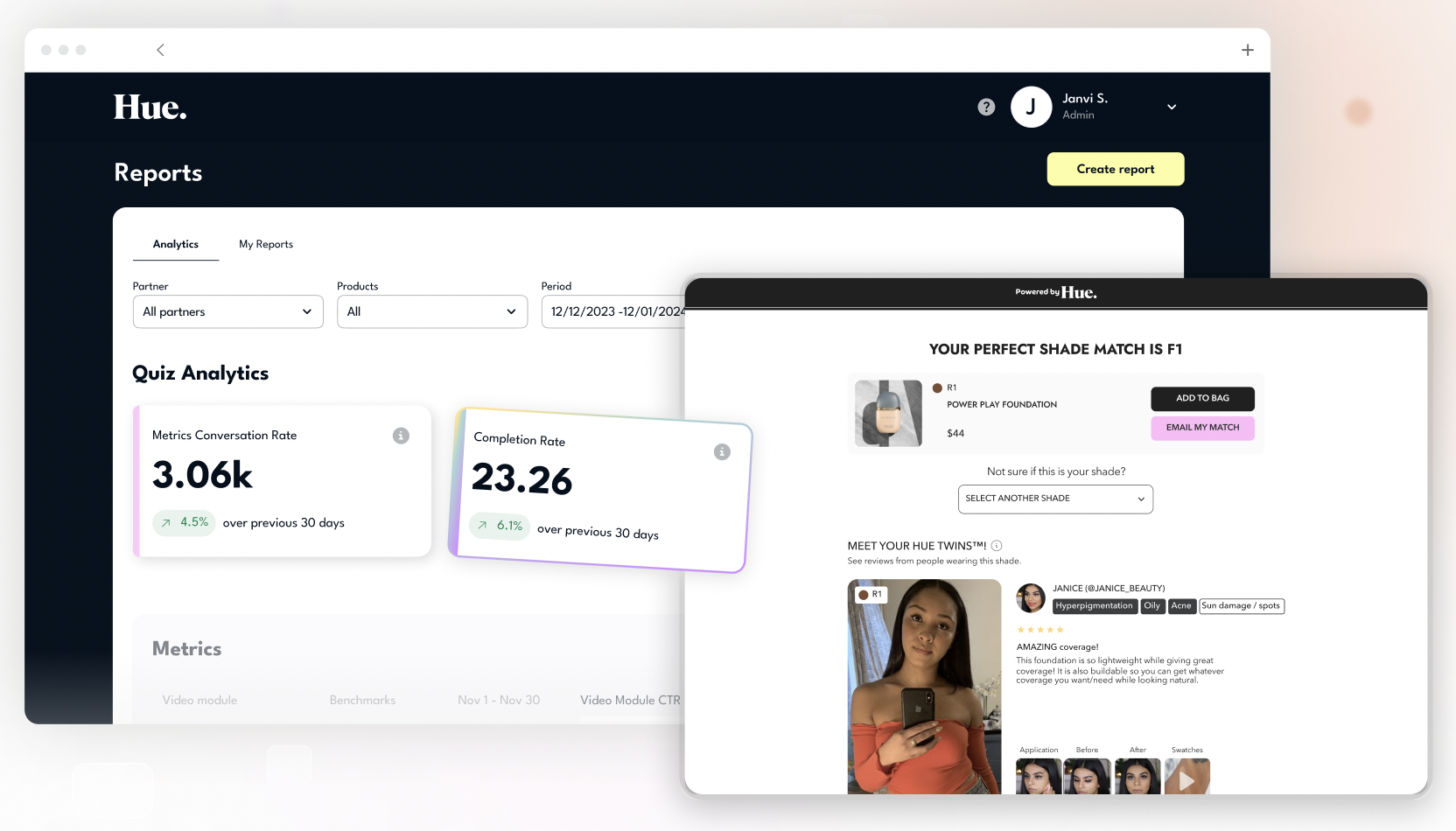

Hue, which partners with beauty brands and retailers to produce UGC for their digital channels such as websites and social media feeds, will put the funding toward expanding into apparel, footwear and accessories. Launched in 2022 by Janvi Shah, Nicole Clay and Sylvan Guo, MBA classmates at Harvard Business School, the platform has 45 brand and retail clients, including Credo, Thirteen Lune, Tatcha, Make Beauty, Lawless Beauty, Surratt Beauty and Good Weird. Ninety-six percent of its clients are in the makeup, skincare, haircare, body care and wellness categories.

Hue’s clients tap its community of over 2,000 content creators to populate their sites and feeds with video, photo and written content. The company typically vets creators based on the audio and visual quality of video testimonials and grants brands and retailers full licensing rights on the content it sources in perpetuity. CMO Clay, who had an around seven-year stint at L’Oréal prior to attending Harvard Business School and co-founding Hue, says nearly all of the company’s clients utilize the content on at least one channel outside of their sites.

Hue reports its clients have registered 5X to 10X return on their spending with it as conversion rates on their sites, social media accounts and paid advertising have risen 5% to 25%. In addition, Hue reports the time visitors devote to its clients’ sites climb 60% to 100% with its integration of UGC on them. Over 4 million users across the internet have engaged with Hue’s technology, and they’ve played more than 6 million videos that the software company has imbedded on brands’ sites.

Hue is expanding into more product categories as TikTok has supercharged consumers and brands’ appetite for UGC. The number of active monthly TikTok users in the United States has quadrupled since 2021 to 170 million. In less than a year, TikTok’s e-commerce component Shop has jumped from 22nd to 9th in consumer insights firm NIQ’s ranking of the top beauty e-tailers in the country. Health and beauty sales on it totaled just under $400 million for the six-month period ending late January. However, TikTok’s fate is uncertain in the U.S. as President Joe Biden signed a law in April that will bar the network unless its Chinese owner ByteDance divests it.

Hue CEO and co-founder Shah, formerly a product manager at Google, said in a statement, “Thanks to TikTok, user-generated video content has transformed how customers shop online. Yet, e-commerce sites typically lack this type of authentic video content, resulting in poor conversion. With more than 20% of all retail purchases expected to take place online this year and the e-commerce market expected to total over $8.1 trillion by 2026, brands need to provide user-generated video content that’s relevant to each individual consumer.”

Market forecasts support Shah’s and Hue’s investors’ confidence in the continued spread of UGC and platforms that fuel it. According to insights firm Skyquest, the UGC platform market was valued at $4.4 billion in 2022 and is poised to advance at an annual growth rate of 29.4% to reach $44.75 billion by 2031. Richard Dulude, general partner at Underscore VC, stated, “In an e-commerce landscape starving for authenticity, their platform has the potential to not only reshape the industry, but capture a significant portion of this vast market.”

Clay identifies time, organizational challenges and quality assurance as reasons why beauty companies may still be hesitant to leverage UGC. “It can sometimes feel unpredictable,” she says. “For luxury or premium brands, this unpredictability can feel risky as they may fear diluting their brand’s perception, but brands trust us because we get it. Our team has worked at some of the largest luxury beauty brands in the world and understand what good quality content means to them.”

Hue partnered with Credo Beauty in 2022 on foundation shade-matching technology for the retailer’s in-house makeup line Exa. The technology connects customers with Hue Twins, a community of influencers with different skin tones and types that facilitate shoppers getting accurate shade recommendations through video and product reviews. On Hue’s site, it disclosed that its relationship with Exa resulted in 600-plus imbedded UGC assets and a 50% bump in sales.

Hue is in talks to partner with other beauty specialty and mass-market retailers next year. Clay says, “The future of beauty e-commerce is video, community and relevancy.”

Leave a Reply

You must be logged in to post a comment.