Coefficient Capital’s Anna Whiteman On The Biggest Trends Transforming Beauty And Wellness

Coefficient Capital, the consumer-focused venture capital firm, prides itself on investing in transformational consumer shifts, and partner Anna Whiteman is one of its chief identifiers of such shifts.

Like most investors, she digs into the numbers to surface them—Coefficient Capital has plenty of them. In partnership with publication The New Consumer, it’s conducted 10 surveys of 3,000-plus consumers—but she also keeps a close watch on consumer behavior that’s not readily revealed in the numbers.

Whiteman, former senior associate at Tribeca Venture Partners, associate at VMG Partners and University of Pennsylvania graduate, says, “I was a philosophy major, and I think about consumers buying products to enhance their lives, fulfill a fundamental need or make them happier.”

As 6-year-old Coefficient Capital seeks to back digitally savvy businesses enhancing consumers’ lives, it’s added beauty and wellness brands to its portfolio, including Lemme, Hawthorne, Hydrant, Gorgie and Zoe, and continues to explore beauty and wellness for deal opportunities. The firm raised $170 million in 2020 for its first fund.

To delve into Coefficient Capital’s understanding of the beauty and wellness landscape, Beauty Independent asked Whiteman about subcategories she believes are on the upswing, the impact of aesthetics’ rise on skincare, Sephora’s role as an M&A kingmaker, what clinical differentiation entails and whether TikTok Shop is the new Amazon.

You started as a consumer brand investor at VMG and arrived at Coefficient when it started in 2018. Tell us about how you got into this area.

There was an interesting dynamic at play in growth-stage consumer that kicked off 10 years ago when digital started to penetrate the consumer ecosystem in a way that was very novel. Nobody was talking about LTV to CAC ratios 10 years ago. You were talking about field marketing and demos in store and trade spend.

The different subsectors of consumer started to fall in line digitally. Beauty really came first honestly because it’s so visual, and Instagram and Facebook lent themselves to digital penetration for the consumer, and then the buying process through e-commerce became much easier.

There was this window that opened on the investor side for funds because, while the bulk of transaction volume was through retail, you were getting conversations on digital channels and customer connectivity online. If you could understand both sides of that equation, there is a real opportunity for you to be a valuable investor on the cap table. That’s what we’ve tried to build at Coefficient, which is balancing deep technical expertise in e-commerce and understanding how to leverage that into success on shelf.

What’s your role at Coefficient?

I sit on the investment team. We have a full-service model, so we develop deep relationships with brands. We try to get to know them really well before ultimately investing down the line. I do a lot of the sourcing and relationship building with the early-stage brands and get to know subcategories of consumer that we’re looking at.

We try to post-investment support our businesses in a number of ways. We have a talent practice, so we do help building out the org chart of the companies that we invest in, and we keep A-team players around our ecosystem so they can be valuable to brands down the line.

We manage retail and strategic relationships. I’m consistently in front of any of the big retailers—i.e., Sephora, Ulta, Target, Walmart—that could end up being points of sale for the brands we invest in, maintaining a beat on what they want or don’t want in the store. Also, as we invest, the intent is to be attractive to acquirers down the line and understand the portfolios of the big strategics, the L’Oréals, Estées of the world.

We work with our brands really fluidly over the course of the investment to guide fundraising strategy and org chart buildout and channel strategy. So, when is the right time to enter a retailer, and what is the right balance sheet for a brand to set themselves up for success at the retailer? We are all hands on deck across our organization and are very flat. We all try to chip in where we have strengths to help our brands.

What subcategories are you most interested in now?

Longevity and nutrition have been a big area of focus for us. As Ozempic starts to become more pervasive of an influence in the U.S. and the world, what are categories that are going to be affected, and what are the big macro trends around weight loss and health in general as we get smarter about metabolic nutrition and science?

Within beauty, we are most interested in businesses that have real technical differentiation, whether that’s patented new molecules that help identify signs of aging or cosmetic dermatology as it creeps into skincare.

We are constantly evaluating and looking at brands that have strong organic content flywheels. That lends itself to categories like OTC supplements, where there’s a high bar for consumer education and you can leverage the organic content model to create consumer education in service of a product that’s going to be foundational for consumers on a day-to-day basis. We are interested in brands with strong repeat purchase behavior, so a consumer staple.

How do you think about the term “clinically proven,” and how do consumers think about it?

We do a lot of work in diligence on what is true clinical differentiation. Some of it pertains to the size of the study that is done, whether it’s done on 18 people versus 100 people. We look for brands that have done clinical studies on their formulations rather than just having clinically validated ingredients. In beauty and skincare specifically, it really needs to be done on the full formulation.

I think about it on two levels, I think about how a consumer and how a strategic thinks about it. There is a very strong bent of transparency today. Someone will go on TikTok, will have studied a brand’s claims and that will be made public. If you are brand builder, you have to assume everything you do will be under a microscope and therefore building with the highest integrity from the outset is important.

The consumer is smart, and brands are going to get smarter and the bar is going to be higher. Strategics almost preempt the consumer there. They have a very high bar and strong R&D teams that are going to do work on these brands before they are acquired. To the extent that we can front-load our diligence, it’s a good thing because we know that’s coming from strategics and the consumer.

Are consumers really looking at the sample sizes of clinical studies?

I don’t think that’s necessarily front of mind. If you back to the basics of what a consumer looks for, a product has to work. You are not going to get repeat purchases or a consumer talking about you to their friends and family unless the product does what it says it’s going to do.

For us, sample size is important because it can show what is fitting into the law of large numbers versus what might be incidental. It is hard to do it at the early stage of a brand because it takes a long time and a lot of money to conduct a clinical trial, but, done successfully, it can prove the efficacy of products to make claims around and claims are powerful to the consumer.

In beauty, the world of claims in haircare is much more loose than it would be in skincare because hair is dead, so you can make a lot of claims about what something can do to something that is already dead versus a living organism like skin. We have been more cautious as it pertains to claims in the skincare space knowing that the level of scrutiny is higher.

Do you believe TikTok is the new Amazon?

Obviously, there is a regulatory component to that we are all watching, but it’s a powerful flywheel for brands. You hear about TikTok building content centers in LA for brands to film content and proliferate it. You hear about them building out more of an infrastructure to support logistics to get brands on TikTok Shop and into consumers’ hands faster.

The GMV over the course of just a month on TikTop Shop is insane, and the average order value and spontaneity of purchase is strong. People are seeing one video and buying something that costs $10. They have a much stronger hold on attention than Amazon. You aren’t scrolling on Amazon for hours. To the extent that TikTok Shop can be as seamless as Amazon, you are going to see large businesses emerge out of that.

Sephora has been a beauty M&A kingmaker. Will that continue?

Sephora and Ulta are the two primary gatekeepers of beauty, and for a brand, it’s an important decision early in the brand’s life to say, do I have more of a Sephora customer or more of an Ulta customer?

For more high-end products, Sephora is the biggest portfolio manager of successful beauty brands. The data that comes out of Sephora and the ability to underwrite strong momentum and velocity can set a brand apart. They are a large portion of the conversation when it comes to brands that can be successful past the point of $25 million, $50 million of revenue. That’s valuable to companies like L’Oréal and Estée Lauder. They are a kingmaker in that regard.

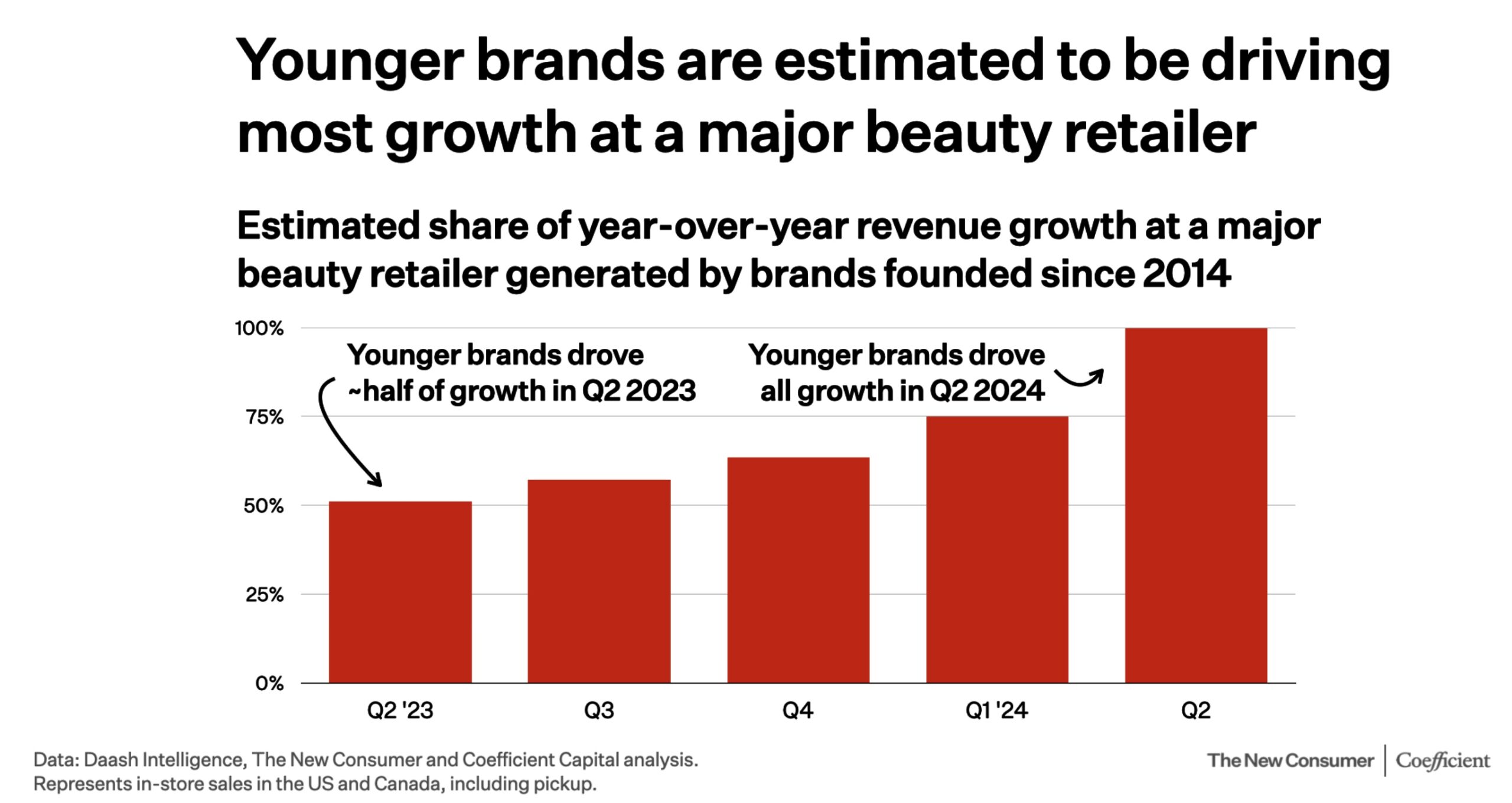

Sephora has an interesting decision to make now that we have seen the Drunk Elephant effect and the average age going down in the population set at Sephora. Where is the high-end consumer now shopping if they have been driven out of Sephora? Sephora is going to think about its set in a way that’s more premium to bring back that customer and trying to drive to more categories outside of makeup.

Ulta has done an amazing job capturing spaces that Sephora doesn’t necessarily hold. They’ve done well in ingestible wellness, and that’s not something that Sephora is known for. The Ulta customer is more representative of a large share of the country. When we look at Ulta data, we can extrapolate, what’s this going to look like at Target or Walmart?

People in beauty are wondering if there’s going to be any break to the duopoly of retailers. Target is doing interesting work building its beauty set. They just launched Blake Lively’s brand, and they are punching above their weight when it comes to new brands and exclusivity. Look at what they did with Vacation.

What are you considering when it comes to gen alpha?

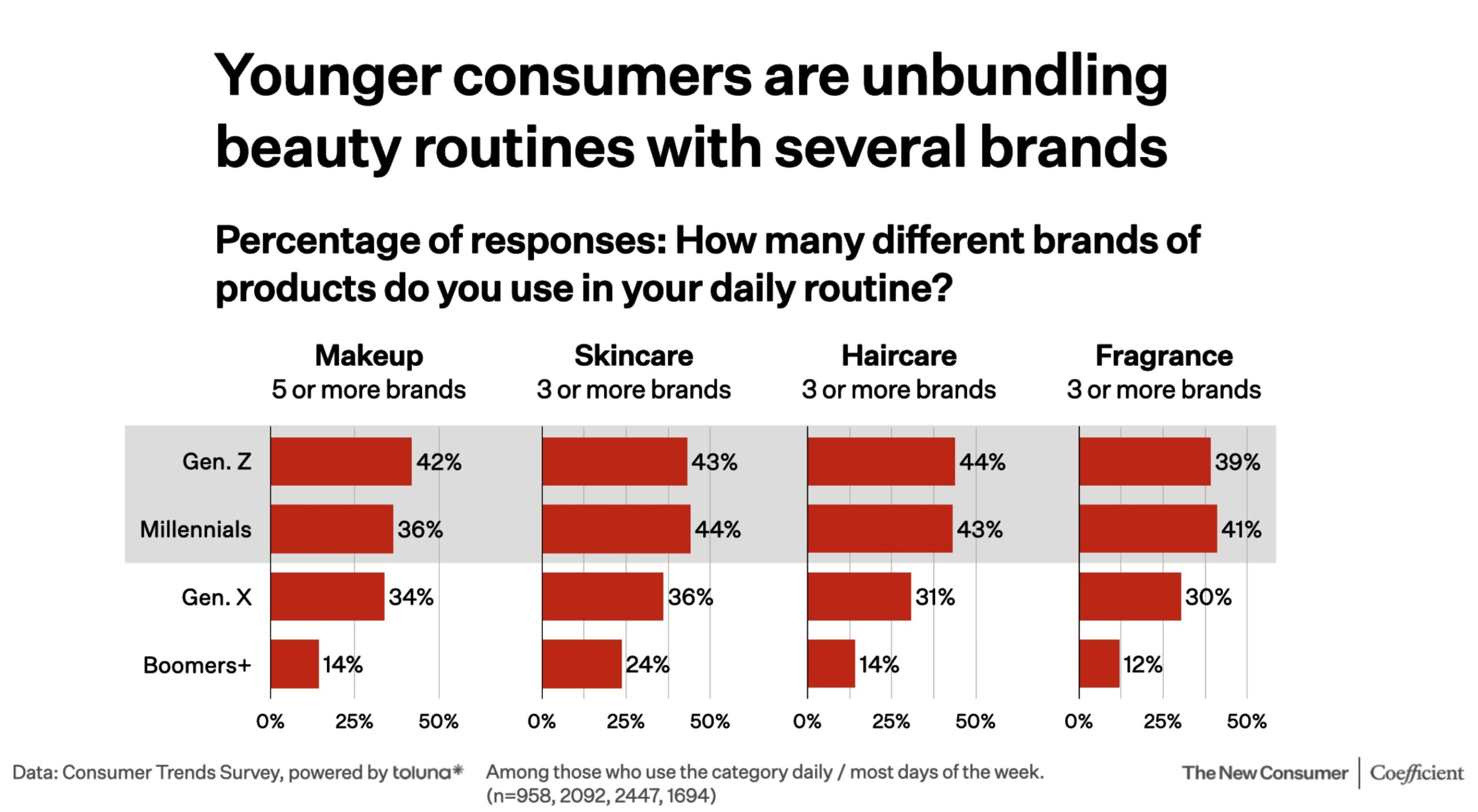

What I’m thinking about with the younger consumers is where the retention and loyalty piece will come in. There’s a lot of promiscuity on the part of the younger consumers. Gen alpha and gen Z consumers have five or six brands making up their skincare routine and more on top of that with makeup.

A lot has been said about gen z using retinol and what that means. They are just experimental. They are talking to each other and sharing. There’s a lot of trial there, and they are shopping on TikTok. Which brands can say those customers are coming back two, three times to purchase? Where can you zone in from top of funnel to what is driving retention?

A lot of brands are focused on profitability today because of where the market is and repeat is a stronger path to having a sustainable, profitable brands than one that is going to have to acquire customers for one-off sales. There are a handful of brands that are becoming differentiated there.

What about injectables and their impacts on beauty?

We look less at the four-wall retail side where injectables are going into needles in faces. There’s a whole lot of interesting work being done around topicals addressing what injectables do. You have the plumping or firming products where there is clinical innovation so that the products can comp what you go a clinic for. There’s huge value in the ability to have that at home, and brands are doing work to drive that comparability. Can you make claims that can help you comp one to one with what is going on in a clinic?

When I was 15, I thought Botox was vanity-driven, and now I understand that it’s preventative and people are doing it for headaches and other medicinal purposes. As the industry gets destigmatized, you are seeing post-Botox topical care. There are interesting brands to be built around that, and the consumer has high intentionality when they are going to a Botox or PRP clinic. What does their post-care routine look like? As people do these things younger and younger, how is the industry going to expand horizontally into new consumer segments?

A few years ago, customization was a big trend, but it seems like expertise has taken over. Where do you see customization going?

Personalization has moved from the space of what could have been called many years ago gimmicky, and it is bottoms up in the sense that you are going from the root level of a person. You are doing blood and microbiome tests. You’re starting with truly unique customer data. That’s different from going to a website and clicking on how often you go out into the sun.

To the extent that personalization can help consumers get closer to their goals of fulfilling fundamental needs, becoming happier or enhancing their lives, a brand can interact with them in a real way. The more data points you can create to get a picture of a consumer, you could solve for a fundamental need state. The more technology and AI we can use to put together that picture, it’s only going to improve.

The thing I will say I got wrong 10 years ago about personalization is how it would play out in retail. You have Function of Beauty that’s attempting to bring interactivity to the store, but it’s been hard to pull off personalization at the retail level, and we want to invest in brands that are omnichannel. How far can personalization brands go online before you have to meet people offline? It’s widely underdeveloped in terms of where it could be in store.

Leave a Reply

You must be logged in to post a comment.