Create & Cultivate Founder Jaclyn Johnson Is Connecting Brands And Angel Investors At Cherub

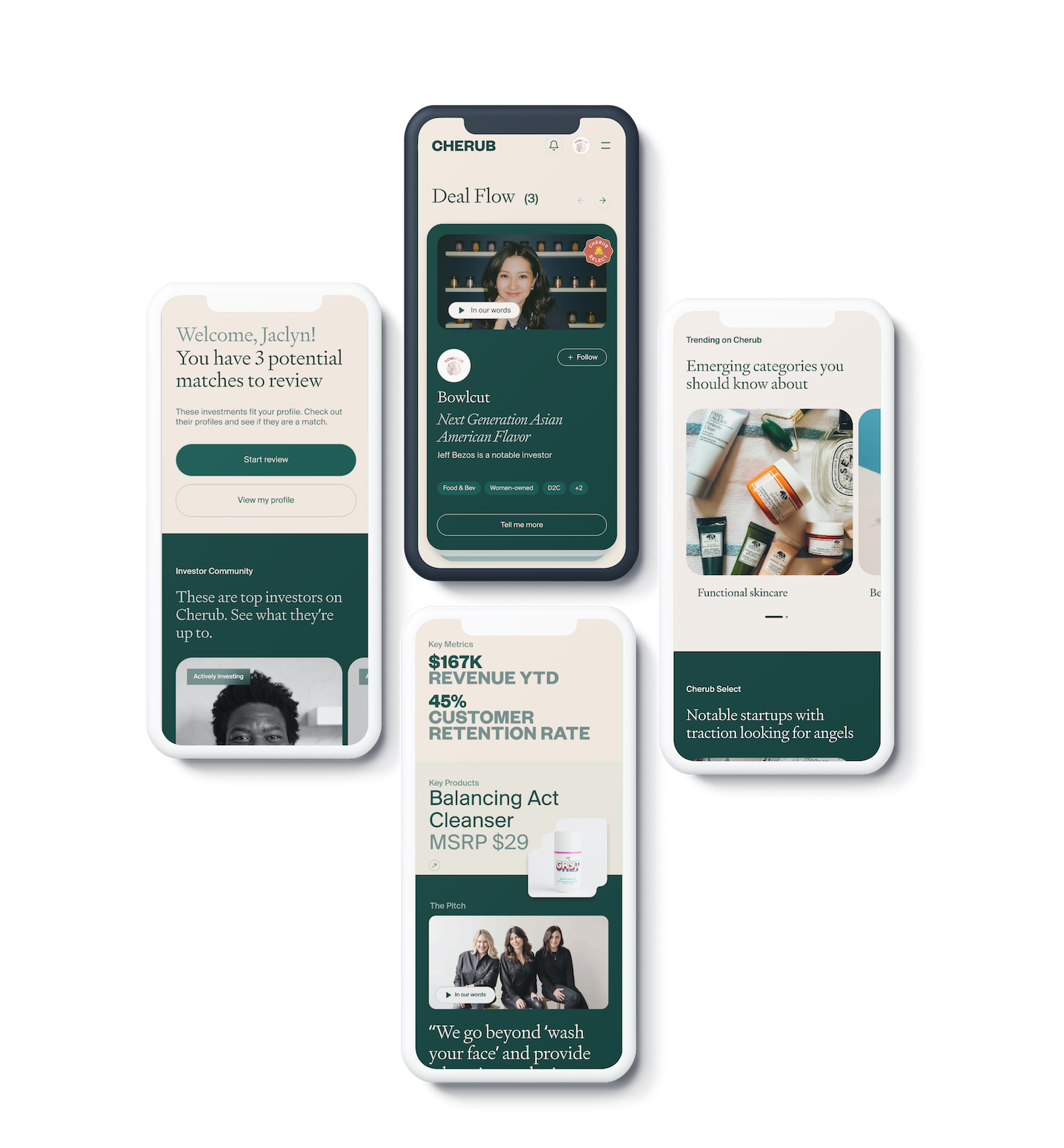

Co-founder Jaclyn Johnson wants Cherub, a digital membership community connecting startups and angel investors, to do for angel investing what Coinbase has done for crypto.

“Buying Bitcoin 10 to 15 years ago felt kind of scary, kind of hard to figure out, where do I go, how do I do it? It was just this really complicated process. And then Coinbase comes in and democratizes that entire experience with crypto where you can connect your PayPal, you can buy Bitcoin, you can log in, you can see it,” she says. “That’s really what Cherub is trying to do for angel investing. We’re really trying to democratize this space, provide education and make it really easy and simple to learn and invest in companies.”

Johnson, who’s also likened Cherub to “Raya for deal flow” and “Linkedin meets Robinhood,” has been on both sides of the investing coin, giving her deep understanding of how tough it is to uncover investors not in the traditional venture capital pool. She began Create & Cultivate in 2011 and sold her stake in it a decade later for $22 million before buying the events and media company back earlier this year, and she’s invested in 25-plus brands, mostly female-led brands such as beauty brands Ceremonia, Crown Affair and Live Tinted.

At Cherub, which she started with Angeline Vuong, former head of buyer product at online real estate company Opendoor, Johnson has raised $1.7 million in angel funding, not surprisingly using its platform to reach investors, including Alli Webb, co-founder of Drybar, and Morgan DeBaun, founder and CEO of Blavity. It expects to raise venture capital funding next year. There are currently about 1,000 angel investors and 700 startups active on Cherub. Ceremonia, Thirteen Lune, Hyper Skin, Pink Moon and Range Beauty are among its startup members.

Ahead, Johnson fills us in about the conversation that led to Cherub, what it looks for in brands, beauty concepts that intrigue her and her forecast for the fundraising environment next year.

How did Cherub start?

Since I’m a well-known angel investor, I get a lot of pitches, and I was with my co-founder, Angeline Vuong, on a hike and telling her about a deal I thought she’d be interested in. She was like, “I’d love to angel invest. I definitely would write checks, but I don’t get any deal flow. I actually don’t even know where I would find opportunities to invest in.” And I was like, “That’s so interesting, I wonder how many people out there are interested in angel investing, but they just don’t have access to this type of deal flow.”

Less than 3% of accredited angel investors invest. We believe that’s not because they’re not interested. We think they don’t have access to deal flow. So, she was like, “We can build something to solve this problem.” I was like, “Let’s see if there’s any interest.” Last March, we started a newsletter called “Deal Flow,” where we ask people, “Hey, would you be interested in getting deal flow in your inbox? Sign up if you are.” We got 1,500 signups in two weeks. We launched that newsletter with a 95% open rate. People were really excited about it.

We then bootstrapped to build an alpha product on a no-code platform to test our theory of, would people pay for introductions to angel investors where there’s a double opt-in? We ran 40 companies through the newsletter and that alpha product. Of that 40, 50% got interest from investors. Of that 50%, 30% were funded in three months or less. Over $1 million was deployed, which is crazy.

There’s obviously this gap of amazing companies and founders, angels that are writing checks, and they’re just not finding each other. This is the problem that needs to be solved. We built our beta product, launched this March at South by Southwest and since then over $2.5 million has been deployed to Cherub brands.

How have you gotten angel investors involved, and how does Cherub’s membership work?

There’s four different memberships. One is free for founders and funders. You can sign up and get limited access to our directory to view brands. You get a few intros, but not as many intros as you would with our pro accounts. There’s pro accounts for founders and funders, which give you more access, intros, content.

We haven’t spent a dollar on marketing, and our wait list is over 7,000 founders and funders, probably split 50/50. We’re always trying to keep the funnel fuller on the angel side, and we’re trickling in more every single day. The demand has been there.

Forty percent of the people who’ve written checks to a Cherub brand that they discovered through the platform were accredited angel investors writing their first check, proving out the thesis that, if they got good deal flow, they would invest.

Our biggest marketing value prop is that founders tell other founders because they’re getting funded. Also, from the investor side, it’s really cool because it’s international. You really get this wide swath of people who are writing checks. We have a large contingency of influential angels on the platform: Morgan DeBaun, Alli Webb, Hannah Bronfman, Sophia Amoruso.

How do people get off the wait list?

We are slowly moving through the wait list. We have partnerships in place with amazing cohorts like Dream Ventures, Sephora Accelerate to get their cohorts onto the platform. For now, you can also join for free.

How does someone become an accredited angel investor? How are you vetting investors?

You don’t have to do anything to be an accredited angel investor. It is a set of guidelines from the government essentially to protect you from the risk of angel investing. The SEC makes it so that you have to either have a net worth over $1 million or income individually at the $200,000 or $300,000 levels with a spouse or a partner. We ask if everyone is an accredited investor, and brands have to do their own vetting as they sign on.

“What drives innovation is early-stage companies getting funding, not necessarily these later-stage companies.”

What are you looking for from brands?

What performs best is having some kind of product or service in the market. Obviously, revenue is always great as well. That being said, we do have everything from pre-seed early idea all the way to successful companies that have been in market for a while. We vet every application before we let them on the site, but what we really look for is the storytelling piece of it.

On Cherub, you get access to a plug-and-play data room in the same way you would use DocSend. You can create a founder video, you can upload your pitch deck, you get analytics. So, if you’re telling a cohesive story with the right materials, you are a good candidate for Cherub. If you don’t have all the materials to fill into that data room, you probably will get rejected. We’ve been really fortunate in that the people who’ve come into the Cherub community have been really strong candidates.

What are you providing brands outside of connecting them with angel investors?

We have monthly webinars tied to different content pieces. You also can hear live pitches from founders. We interview seasoned angel investors to talk about what they’re looking for. We also host quarterly founder/funder mixers. These were really born out of a launch party that we did.

We did a launch party last December in partnership with Sophia Amoroso and Trust Fund VC. Everything at the event was investable, from the food to the drinks. We also had a pop-up shop featuring CPG products you test drive and take home. From that event alone, over $400,000 was deployed to the founders on-site. It was insanely successful. We do those quarterly.

We also host panels. You get to hear from both founders and angel investors on what they’re looking for and obviously meet them IRL. We also have an SPV cohort with three brands that we just launched, which is essentially a bootcamp for founders to launch their SPV.

Do you find there are misconceptions that founders or investors have when it comes to raising angel investment?

The market has fundamentally shifted since the collapse of Silicon Valley Bank, which was right when we launched. It was much easier to get venture capital as an early-stage company three to five years ago. For early-stage companies, angel investment is what is propelling innovation. Maybe it’s that $100,000, $200,000 you need to get started or to give your idea more traction to then get to the venture level.

What drives innovation is early-stage companies getting funding, not necessarily these later-stage companies. What we’re excited about is that innovation gap that we’re trying to fill by giving access to these angel investors. That being said, angel investors are much savvier than they’ve ever been. So, when it comes to raising, we really preach you need to have all of your ducks in a row both on the pitch storytelling side of things as well as the legal and accounting side of things.

What do you think the funding landscape will be like in 2025?

We’re seeing a lot of VCs exercise pro rata in their existing companies performing well, which is great. Obviously, you want to see those companies continue to grow, but, at the same time, there is a want and a need to have these smaller companies get off the ground. In terms of categories, people are moving more into AI, tech, B2B tech, SaaS products, and there’s been a pullback on the CPG market given cost and inflation unless it’s a further along business.

I think we’ll start to see some companies that have raised from angels get the traction they need to get in front of the right VCs. I don’t think anything will be as bad as the market was the last two years. Hopefully, we’ll keep going in the right direction, and more capital is getting deployed to not only the later-stage companies, but the early-stage ones as well.

Are there categories within beauty you have seen people want to put their money behind?

Angel investors like to invest in brands they use and love. That’ll never go away. Some of the things that we’ve seen pop up is in terms of AI is more customization down the line.

For instance, there’s a company called Vain Market. It hasn’t launched yet, but it’s using AI to look at your skin and recommend specific products based on your needs. They will source for you from a Sephora-type experience based on what you’re looking for versus having to go and figure it out.

You really have to have something that sets you apart. That could be a technology, it could be an ingredient. When you look at the brands on our site, there is a lot of innovation. I really love Swet, they’re reimagining dry shampoo for people who work out. It’s so cool and something different.

What’s a goal you have for Cherub?

Our goal is to get to 10,000 members in the next two years. It’s an aggressive goal, but we’re really excited.

This interview has been edited for clarity and brevity.

Leave a Reply

You must be logged in to post a comment.