Cult Capital Examines How Brands Can Succeed In A Crowded And Confusing Skincare Market

Amid the noise in the skincare market, Cult Capital is zeroing in on brands that can rise above it by advancing ingredient delivery systems and cut through it with transparency and edited routines.

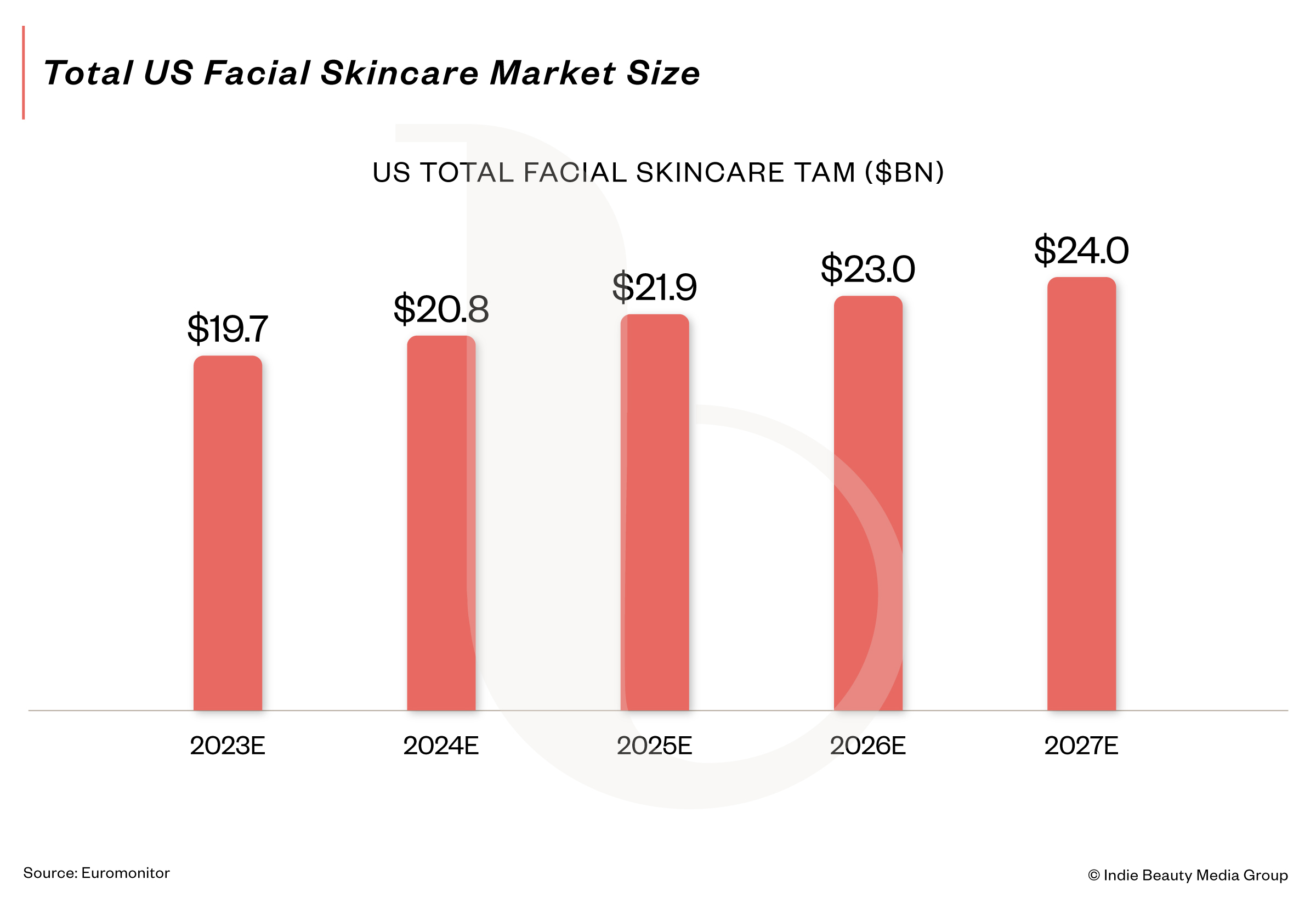

The venture capital firm with high-growth beauty brands Subtl, Act+Acre and Lawless in its portfolio has spent three months doing a deep dive into skincare to inform its investment perspective, leading it to the conclusion that consumer demand in skincare remains strong and the category won’t abdicate its role as the chief driver of beauty deals. However, its research indicates that skincare brands shouldn’t stick to their predecessors’ scripts to succeed because star ingredients have lost their differentiating sizzle, and brand crowds and consumer smarts are elevating product expectations.

“Beauty consumers spend more time thinking through and spending on their skincare routine than they do cosmetics. Obviously, cosmetics is really buzzy right now and exciting because it’s growing since people are back in the office and going to meetings again post-COVID,” says Christine Conway, VP at Cult Capital. “But I do think there were lasting effects from COVID on how consumers view skincare that’s really sustaining. There’s a lot of opportunity in the category. History has told us there’s a lot of strategic interest, and I think people will continue investing in the category. I just think it’s more expensive, and there’s fiercer competition than ever.”

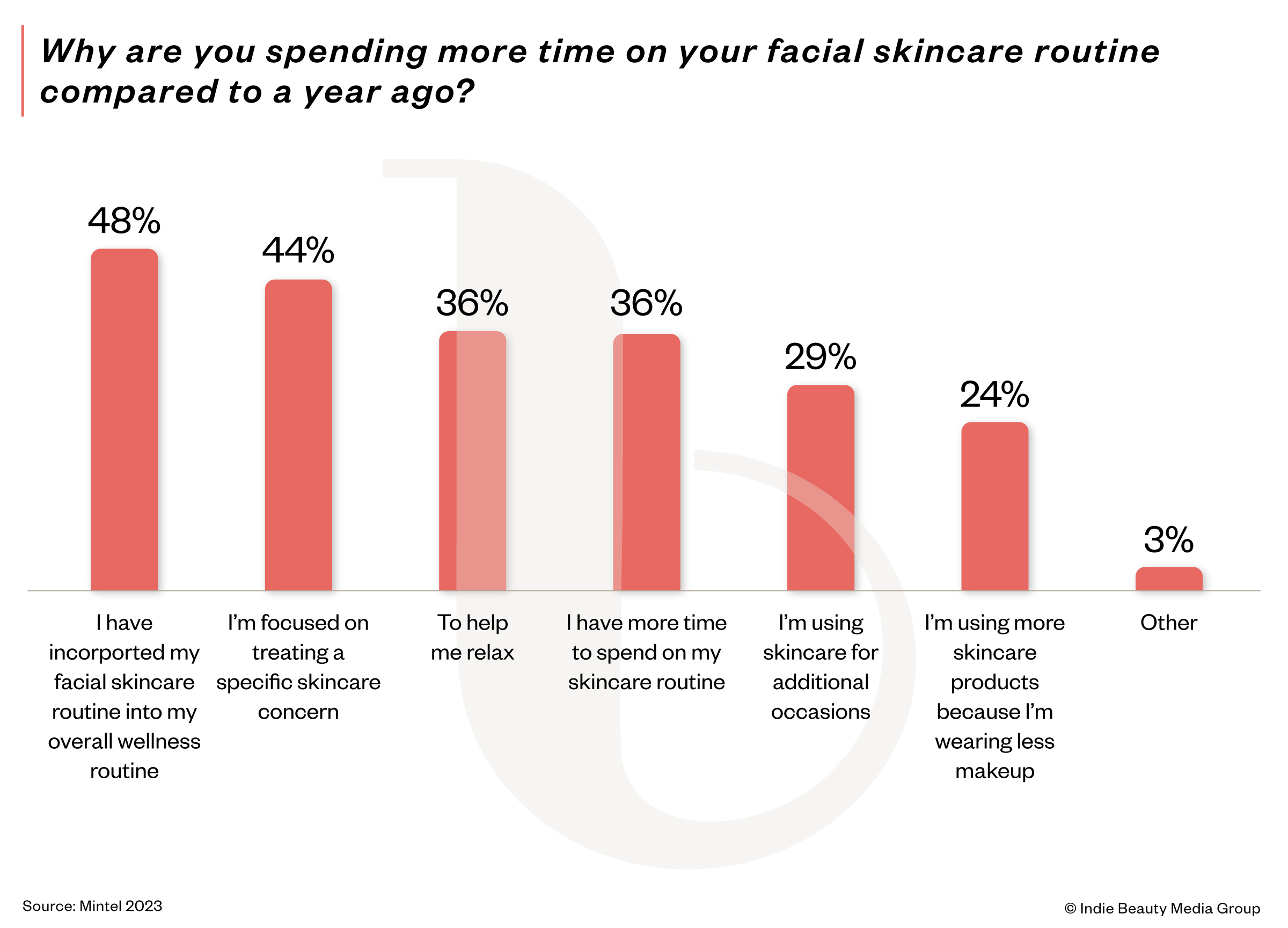

Data collected by Cult Capital from market research firm Mintel validates that consumers are investing in skincare. Thirty-six percent of consumers used at least five skincare products at home in 2023, up from 28% in 2022, 24% reported they dedicated a greater amount of time to skincare in 2023 than 2022, and 70% said their attention to the skin barrier escalated from the prior year. Of those spending a greater amount of time on skincare, 44% said they’re treating a specific concern.

Product specialization boosts consumer willingness to pay. For example, only 1% of consumers report they’ll typically spend $45 or above on a lip balm while 16% report they’ll typically spend $45 or above on a serum. Still, there’s a tall hurdle for products to be deemed truly special. Almost three-quarters of consumers think affordable brands are just as good as premium brands.

“The bar for innovation is higher than it’s ever been.”

For brands looking to release specialized products, Conway says, “Having a vitamin C serum is no longer a differentiator as more mass brands like E.l.f. come out with the exact same products using the exact same ingredients at a cheaper price. And with TikTok in particular, consumers are smarter and savvier than ever and more likely to trade down. The bar for innovation is higher than it’s ever been.”

She adds, “We see the future of skincare being focused on a novel delivery mechanism to the skin. There is vitamin C, and there are retinol serums, but those two ingredients are notoriously [difficult] to put together. Then, they become incredibly unstable and irritating to the skin. Creating a unique delivery system allows you to create this skincare cocktail and combine multiple ingredients into one product and deliver those ingredients to the skin in a more efficacious manner versus chasing percent concentration.”

To convey the impact of a delivery system or scientific breakthrough to consumers and potential acquirers, Conway highlights the importance of clinical studies and intellectual property is mounting. On clinical studies, she says they should be “actual clinical studies on products as a system.” On IP related to a delivery system, she stresses, “That delivery system needs to be patented for it to be acquired by a strategic. That’s what the strategics are interested in is, how is it defensible, and is it something we couldn’t access otherwise?”

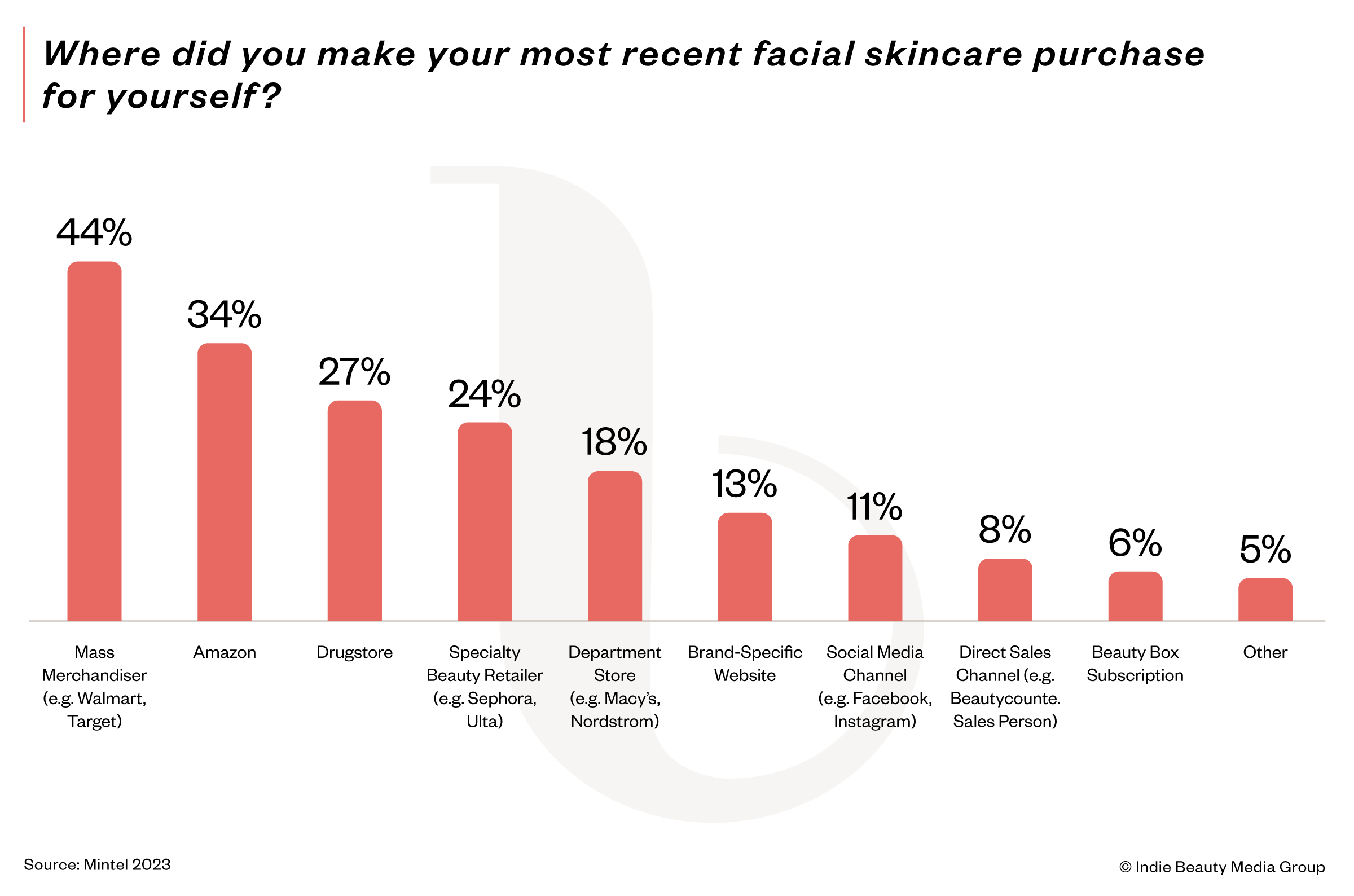

With consumers gravitating to premium skincare brands on the cutting edge in prestige distribution and cheap dupes in mass-market distribution, Conway argues masstige skincare is under threat. In Mintel’s data, 44% of consumers revealed their most recent skincare purchase was at a mass-market retailer, 34% made that purchase on Amazon, and 27% at a drugstore. Gen Z and younger millennials over-index as beauty shopping on Amazon and at mass-market stores, where they seek dupes.

“We see the future of skincare being focused on a novel delivery mechanism to the skin.”

“What’s getting cannibalized is masstige, not prestige,” says Conway. “Those middle-priced brands that are offering something that’s kind of innovative, but from a lab and easily replicated, those are the brands that are really suffering.”

The skincare hordes are stoking consumer confusion, and Cult Capital is drawn to brands that can confront it with education and authority. Conway explains the firm has a hypothesis that there will be a reversion to slow, edited skincare because of the overwhelming deluge of skincare information, brands and products. Forty percent of consumers note there’s beauty and personal care ingredient misinformation, 42% emphasize there should be clearer ingredient explanations, and 20% identify “trusted brand” as a top attribute in skincare.

In a skincare market Conway characterizes as “saturated,” she says, “The consumer is really fatiguing from all of the brands out there…They don’t know what to consume within the category.” To help them know what to consume, she predicts one to two brands may emerge as go-to authorities for trusted information and straightforward product routines.

“Authority and trust aren’t overnight,” says Conway. “This takes years and years of work. Otherwise, it just comes off as a marketing scheme. I almost don’t think you lead with saying, ‘Trust us,’ it’s through the content, educational materials and research that you’re putting out, not necessarily with a brand message.”

“The consumer is really fatiguing from all of the brands out there.”

As technological advancements and know-how fuel conversations in skincare, Conway has noticed the types of founders launching beauty brands have changed. At the outset of clean beauty, parents, disease survivors and others cautious about ingredients were common. Once they proved there was a mounting appetite for indie beauty, seasoned beauty executives populated the brand founder ranks. Today, scientists and doctors are increasingly jumping into the pool of beauty entrepreneurs.

“Maybe their background was in cancer research, and they always had a specific skin condition, and now they want to come into CPG and solve for that skin condition that they’ve had their entire life,” says Conway. “They’re like, oh, I can do all this cancer research, I could definitely start a skincare brand. And then they join and link arms with a really good operator to create those products.”

According to Cult Capital’s analysis of skincare transactions, there have been 40 in the last 24 months involving 104 investors and $200 million of disclosed capital, with an average check size of $9 million. True Beauty Ventures, Silas Capital and L Catterton have been among the most active skincare investors, and Irene Forte, BeautyStat, Dieux, Eighth Day and Cay Skin are among the skincare brands that have received investment.

For skincare brand exits, the average revenue multiple has been 4X to 5X. Generally, Conway details skincare brands are benchmarked to the following key performance indicators (KPIs) for investment purposes: at least 64% gross margin, 74% product margin, 75% year-over-year sales growth, 12-month retention rate of 27% to 31% and a 12-month customer lifetime value of $50 to $80.

New consumers rushing into the skincare space give Conway confidence that its long-term growth trajectory is solid, and it will persist as a transaction catalyst. “Men’s skincare will be a larger piece of the pie going forward,” she says. “Teens are engaging in skincare at a younger age because they have access to information that they didn’t have access to before. When I was growing up, no one was talking to me about skincare, and I couldn’t find any information online, but now with social media and particularly TikTok and Instagram, you’re just getting this education and information sooner. I think it’s very lasting.”

Leave a Reply

You must be logged in to post a comment.