Why Hims & Hers Is Winning Over Wall Street As It Clobbers Traditional Beauty Companies

Recent headlines have focused on the beatdown publicly traded beauty companies have taken. Puig, Beiersdorf and L’Oréal’s stocks are hovering just above their 52-week lows and significantly underperforming the S&P. The stocks of other beauty conglomerates like Estée Lauder, Shiseido, Olaplex and E.l.f. Beauty have suffered meltdowns. To be fair, E.l.f.’s plunge came after an extraordinary two-year rally that saw its stock surge over 600%.

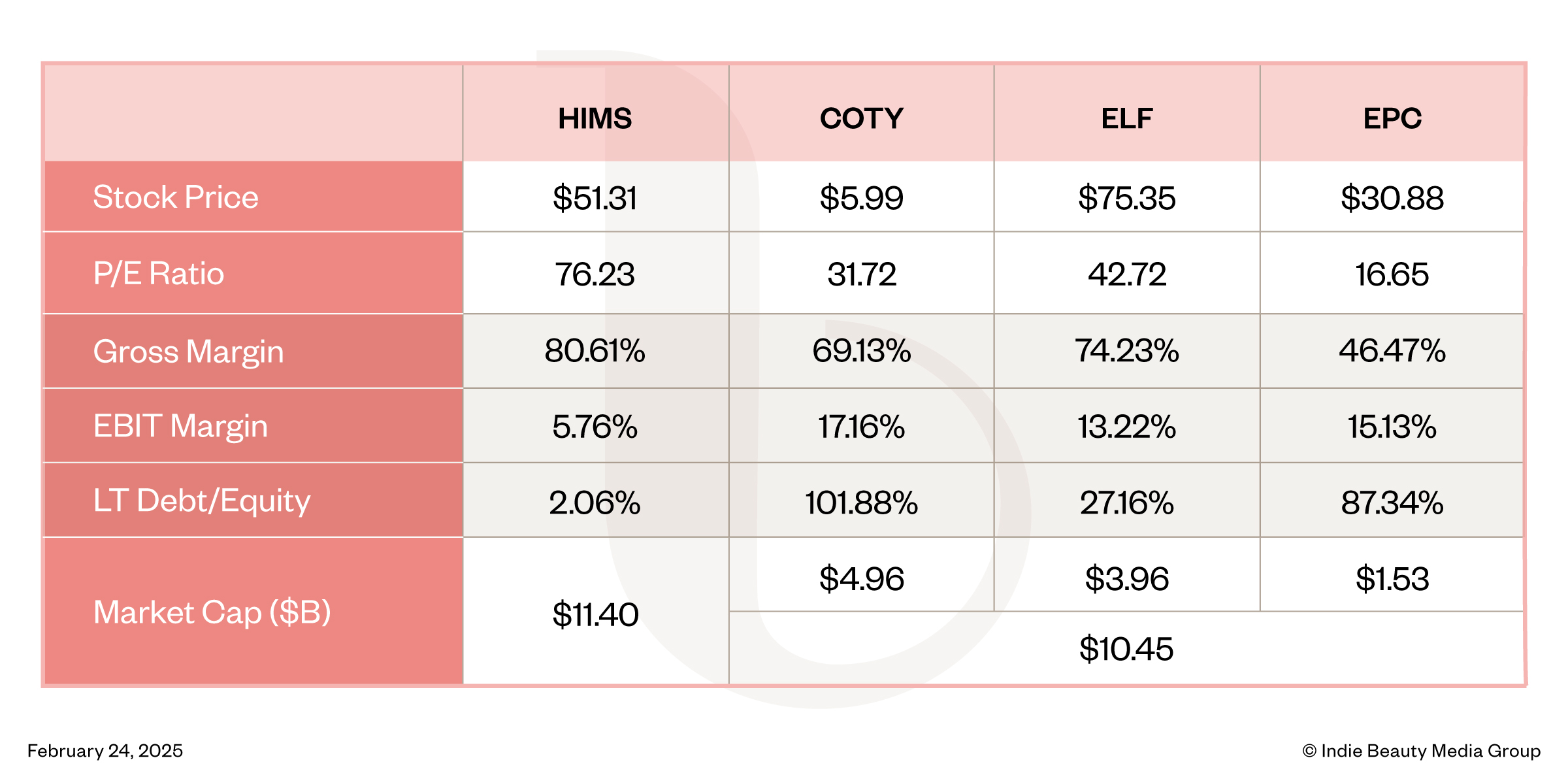

In stark contrast, Hims & Hers is on a tear. Over the past 12 months, its stock has multiplied nearly fivefold, and with a staggering P/E ratio of 76.23 as of Feb. 24 compared to the S&P average P/E ratio of under 29, the market seems to believe the party is just getting started. As a result, the company is now valued at as much as Coty, Edgewell and E.l.f., once a market darling, combined.

To examine Hims & Hers’ run-up relative to traditional beauty companies, for our ongoing series posing questions informative for indie beauty, we asked a dozen beauty investment and finance insiders the following: Why is the market so bullish on Hims & Hers while it’s gone sour on traditional beauty powerhouses? Do you think it has it right, and what does it mean for the beauty industry?

- Elizabeth Lim Strategic Advisor, Joyance Partners

Hims & Hers has established a unique niche at the intersection of beauty, health and wellness, creating a modern, direct-to-consumer platform that is redefining the industry. By seamlessly integrating telehealth, subscription services and e-commerce, the company has developed an innovative and dynamic model that deeply resonates with tech-savvy, health-conscious consumers. This forward-thinking approach enables them to offer highly personalized solutions that cater to the specific needs of their customers, all while maintaining a fresh and accessible brand image.

The company’s rapid success is fueled by its strategic focus on underserved and niche categories, areas often overlooked by traditional beauty conglomerates. Hims & Hers provides products that address sexual health, hair loss, mental wellness and more in ways that feel approachable and deeply relevant. By embracing these important and sometimes neglected areas, the company is able to make a real impact, offering solutions that are both innovative and empowering.

What truly sets Hims & Hers apart is its seamless integration of telehealth services, allowing customers to access licensed professionals for personalized advice and treatments. Whether it’s for hair loss, acne or mental health, the ability to consult with a medical professional and receive prescription products through a simple, subscription-based model creates a deeply engaging and sustainable customer experience. This unique combination of healthcare, beauty and wellness, all delivered through the convenient platform, positions Hims & Hers as an interesting investment.

While established beauty giants like Coty and L'Oréal boast expansive portfolios, they often fall short in the specialized, tech-forward capabilities that Hims & Hers excels in. These larger companies tend to be slower in adapting to the evolving needs of today’s consumers, who are increasingly looking for integrated, technology-driven wellness solutions. With its agile, innovative approach, Hims & Hers is well-positioned to meet this rising demand, making it an exciting prospect for the market to be bullish.

- Henry Barton Head of Community and Venture Scout, Duel Tech and Ada Ventures

Brands like Hims & Hers have enjoyed market enthusiasm because of their disruptive approach to an often stuffy industry. They have found a way to blend DTC convenience and subscription models to really hammer home personalized care. Therefore, combining its rapid growth in telehealth along with their incredibly strong digital marketing prowess has positioned them as this super high margin, high growth business which shines in contrast to the rest of the industry where legacy brands are currently struggling with sluggish retail sales and shifting consumer preferences.

Hims & Hers also benefits massively from agility. As a challenger brand, their ability to operate at speed, pivot at a moment’s notice and explore true data-driven and community-driven customer acquisition techniques has allowed them to scale their way to profitability. These are opportunities not often enjoyed by the traditional beauty giants who instead find themselves burdened by laborious wholesale relationships and often slower innovation cycles (both product and marketing).

But while brands like Hims & Hers have enjoyed meteoric rises, history suggests that beauty’s powerhouses won’t stay down for long. Traditional brands like Estée Lauder, L’Oréal and Shiseido have survived economic downturns, shifting trends and competitive upstarts for decades, and their ability to adapt should not be underestimated.

Their global reach, distribution networks and deep-rooted consumer trust remain unparalleled, and with new talent coming through drawn to the power and the legacy of these brands, you can bet your bottom dollar that approaches across every function will soon rival that of the most agile scaleups.

More importantly, they have something that digital-first brands struggle to build at scale: community. These heritage brands have cultivated loyal followings over generations, and as they double down on DTC channels, social commerce, influencer/creator-driven strategies, and niche brand acquisitions, they are likely to regain favor.

But a message of warning to these brands. They have to be wary of not just paving their own way, but instead taking a leaf out of the challenger brands’ playbook and building with consumer behavior, wants and needs in mind, otherwise a short gully in stock performance can turn into something a bit more serious.

However, if history is any indicator, the pendulum will swing back, and today’s underdogs may soon reclaim their dominance reminding the market that, in beauty, longevity often wins.

- Jaime Schmidt Co-Founder, Color Capital

While Hims & Hers employs an omnichannel strategy, their direct-to-consumer, subscription-based approach is a key strength, especially as traditional beauty brands struggle with retail slowdowns. This model delivers higher margins, recurring revenue and strong customer retention—all factors that boost investor confidence.

Additionally, the company has cultivated a massive customer base by expanding into high-growth wellness categories beyond personal care products. Its rapid growth is also fueled by shifting consumer preferences toward personalized beauty and wellness solutions, which offer a more intimate experience and greater control over one’s health.

While Hims & Hers’ sky-high valuation may be challenging to sustain, its success signals a major industry shift that legacy brands can’t afford to ignore.

- Anna Sweeting Founder, The Equity Studio

Hims & Hers has really shown us that a keen understanding of modern consumers’ desires—wellness, authenticity, ease—can unlock tremendous value. More and more, people are embracing a holistic view of beauty, one that’s about looking good and feeling good, and they expect digital convenience and personalization as part of that package. Investors are therefore no longer assessing traditional beauty brands in isolation but rather weighing their ability to compete in a broader self-care ecosystem.

This isn’t just a story of one company versus others, it’s a story of an industry in transformation. In this context, the legacy strength of established brands is a foundation, not a fortress. It must be embraced internally as a springboard, not a safety net. The beauty market today is driven as much by experience, engagement and outcomes as it is by formulations and heritage.

It’s true that some legacy players are at an inflection point. They still command massive scale and resources, but they are being challenged to evolve faster than ever. Wall Street is actively recalibrating its views, and I believe the market’s reward mechanism will only continue to shift, favoring innovators and expressing caution towards those relying on past playbooks.

That said, the opportunity remains vast for established brands to tap into consumers’ 360-degree self-care needs in a way that integrates seamlessly into their lifestyles, whether through strategic innovation, partnerships, or expansion into wellness. Those that recognize and act on these shifts won’t just stay relevant, they’ll deepen loyalty and capture both consumer trust and investor confidence.

- Drew Fallon Co-Founder and CEO, Iris Finance

Hims & Hers is a unique business in the sense that it is really what DTC was always supposed to be—a highly loyal, owned customer. The rest of these beauty companies listed have omnichannel distribution, which is great, but not better than DTC when it works.

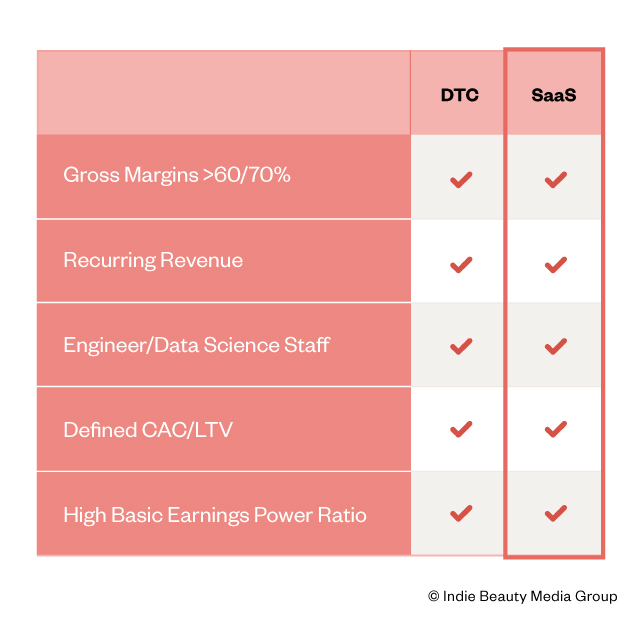

Below I've included a graphic that compares DTC to SaaS. In the best DTC models (high margin, high recurring revenue), the financial model of the business looks almost identical to a SaaS model. In turn, it is more reasonable for a company like Hims & Hers to be valued more similarly to a SaaS company as opposed to a company like Olaplex that, while high margin, has fragmented sales channels that each carry different margin profiles, making the gross margin (and dollars) less predictable.

In short, if we just break down the mechanics of Hims & Hers from a financial model perspective, it's much more comparable to software than typical CPG. Further, Hims & Hers participates in a massive market, so in essence investors are getting the earnings power of a SaaS business with the market opportunity of a consumer market, it's the perfect storm.

I believe the stock has rallied so much because GLP-1s drew more investor awareness to the stock, and the market is now trying to price in this reality in a more efficient way.

- Hayden Williams Partner, BrandProject

The market is pricing in higher growth for Hims versus traditional beauty powerhouses due to the strategic advantages of the markets Hims operates in and their direct-to-consumer distribution model.

Hims’ product portfolio occupies a unique space at the intersection of beauty, health and wellness, offering solutions to needs-based, pain-point-driven consumer concerns like hair loss, sexual health and weight loss. Traditional beauty products tend to be more discretionary.

Additionally, Hims' DTC model bypasses retail markups, preserving margins and allowing the company to leverage customer data effectively. This enables them to upsell and cross-sell within a growing portfolio of products.

Regarding the outlook for the beauty industry, I expect that the outperforming companies will be those who focus on science-backed products that provide tangible functional benefits over purely image-driven offerings.

- Joel Palix Founder, Palix Unlimited

Hims & Hers is an exciting health tech brand offering telehealth services and generic medications that address common male and female health concerns. By combining medical consultations with direct-to-consumer pharmaceutical offerings, the company is disrupting both the traditional doctor-patient model and the pharmacy business with a strong, branded approach.

Last year, the company grew by 65%, supported by a highly loyal base of 2.2 million subscribers and solid profitability despite significant spending on customer acquisition. While I won’t comment on its stock price, it’s easy to see why investors are excited about its scalable business model in the massive healthcare sector.

In contrast, Coty and Edgewell operate in the highly competitive beauty and personal care space, managing portfolios of legacy brands with varying performance levels or licensed brands with expiration dates, adding another layer of risk. Their current valuations appear to reflect both their market position relative to larger industry leaders and the challenges they face in becoming more agile and profitable.

E.l.f., a relative newcomer, has successfully grown its core brands while making strategic acquisitions. It is emerging as a strong beauty platform, a status reflected in its market valuation and high P/E ratio. Another comparable example in the beauty sector is Oddity, which has a similar high valuation profile because of its data-led business modeL

Ultimately, industries and business models cannot be directly opposed. Market valuations are driven by each company's unique growth potential and profitability prospects.

- Daniel Faierman Partner, Habitat Partners

H&H is the epitome of DTC is not dead! The company has done a tremendous job growing its subscriber base and AOV (up >50% y-o-y) with top tier unit economics. Despite a challenging customer acquisition environment, H&H has kept CAC intact while continuing to expand gross margin. This has led to a surge in operating cash flow, an accomplishment few beauty giants can claim as of late.

Equally importantly, I'd argue H&H is more consumer-centric than many beauty competitors, innovating rapidly to launch new offerings that meet incremental needs of their core consumer (a major driver of the aforementioned successful AOV expansion). H&H innovates more like a startup than a bureaucratic giant, strategic.

With that said, the P/E ratio is very rich. The correction that took place, initially catalyzed by the Novo Nordisk announcement, over the last few weeks from the company's one-year high of ~70/share on Feb. 19 is healthy and pushes H&H closer to realistic valuation fundamentals. Institutional investors may also perceive H&H as more of a tech-enabled healthcare company closing in on SaaS-like margins than a CPG beauty conglomerate, pricing in more optimistic growth expectations.

- Elizabeth Edwards Founder and Managing Partner, H Venture Partners

I think Hims & Hers is a telemedicine company and not a beauty company. Therefore, it can't really be used as a comparison. It's a whole different business model than Coty or E.l.f.

They are not selling beauty products. They are selling pharmaceuticals via telemedicine. A $200 per month Ozempic subscription has no comparison to a $15 tube of mascara.

Hims & Hers has a really high P/E ratio. I would argue too high, and I think that's more about enthusiasm for GLP-1s, Viagra and hair loss than anything.

Second, I'm not sure that Coty and E.l.f.’s P/E ratios necessarily mean that the market is souring. The whole stock market is overpriced, but the top 10 stocks (Apple, etc.) in particular. If you look at the S&P historically, a P/E ratio of 20 is still pretty respectable.

E.l.f. has nothing to be ashamed of. They have a fantastic growth story with 600% growth.

- Christina Yu Investment Director, NextWorld

I don’t believe the public markets view Hims & Hers as a beauty company. Hims & Hers is positioned as a digital health/pharmaceutical company, which has a much larger total addressable market (TAM) than the beauty industry.

Additionally, I think the company has benefited from the significant sector tailwinds related to weight loss drugs and doesn’t face the headwinds in Asia, particularly China, which large beauty strategics are battling. So, in short, I think Hims & Hers trades fundamentally differently from publicly traded beauty companies.

- Tina Bou-Saba Investor

Hims stock has been on a tear over the past year. Keep in mind that Hims went public via a SPAC in January 2021 during the frothy pandemic IPO (and SPAC) times. At the time, the business was a telehealth platform that connected consumers to licensed professionals, and it primarily focused on sexual health (largely erectile dysfunction) and hair loss.

Until around mid-2024, Hims stock had not significantly appreciated compared to its initial offering price. However, last year, Hims began to offer compounded GLP-1 drugs at $199 per month, a massive discount to the out-of-pocket price of the branded versions of these extraordinarily popular medications. This shrewd move was permitted based on the FDA rules around drugs that are experiencing shortages. Hims stock rose something like 30% on the day that this was announced.

Since then, the stock has experienced dramatic swings based on news related to GLP-1 supply and its branded competitors' pricing moves. Overall, it's up about 310% since it went public, compared to 94% for the S&P over that time period. This is also a lot better than many of Hims' 2021 SPAC peers have performed!

On the consensus 2026 earnings estimate of $1.31 per share, according to Bloomberg, Hims trades at 31X, which actually is not an unusual multiple for a high-growth company. The trailing P/E multiple is very high because the company's earnings are growing quickly.

The bottom line is that Hims trades like a telehealth company with a massive GLP-1 opportunity in front of it. Its customers are sticky subscribers who will continue to pay for months, if not years. This is a completely different business model and financial profile than that of a beauty conglomerate.

In many ways, Hims is selling "dupes" of exorbitantly priced branded medications that millions of people benefit from and will need to stay on indefinitely in order to remain healthy. Great business to be in!

- Qasim Mohammad Director, Wittington Ventures

The market's bullish stance on Hims & Hers while traditional beauty powerhouses struggle reflects the convergence of telehealth, beauty and wellness. It should be noted that Hims & Hers faces significant risks particularly due to the potential loss of compounded semaglutide offerings, which have driven considerable growth to date. Despite this, the GLP-1 market remains vast and represents a significant wellness opportunity.

GLP-1 medications such as semaglutide improve not only weight management, but also skin health, aligning with broader wellness trends. This convergence creates opportunities for platforms integrating clinical efficacy with cultural relevance, a space where Hims & Hers has been successful.

For traditional beauty companies, this trend highlights the need for a 360-degree approach to wellness. Notably, L'Oréal has recently emphasized the future of beauty as being a mix between topicals, procedures and oral supplements, a vision that aligns with the evolving wellness landscape and represents a step in the right direction towards integrating healthcare and lifestyle solutions.

Ultimately, the success of Hims & Hers demonstrates the market's appetite for integrated wellness solutions. The beauty industry must adapt by embracing a holistic approach to wellness, leveraging telehealth and creating culturally relevant narratives around self-care. This convergence presents opportunities for innovation and growth but requires incumbent companies to rethink their strategies.

If you have a question you'd like Beauty Independent to ask beauty investment and finance insiders, please send it to editor@beautyindependent.com.

Leave a Reply

You must be logged in to post a comment.