Kline Report: VC- And PE-Backed Chains Dominate Skincare And Wellness Service Provider Growth

With more Americans getting Botox every year than getting a new driver’s license, consumers are on the hunt for the best places to have their faces and bodies smoothed, sculpted and sucked. As they get injected, investors and med-spa operators are injecting dollars into the med-spa business.

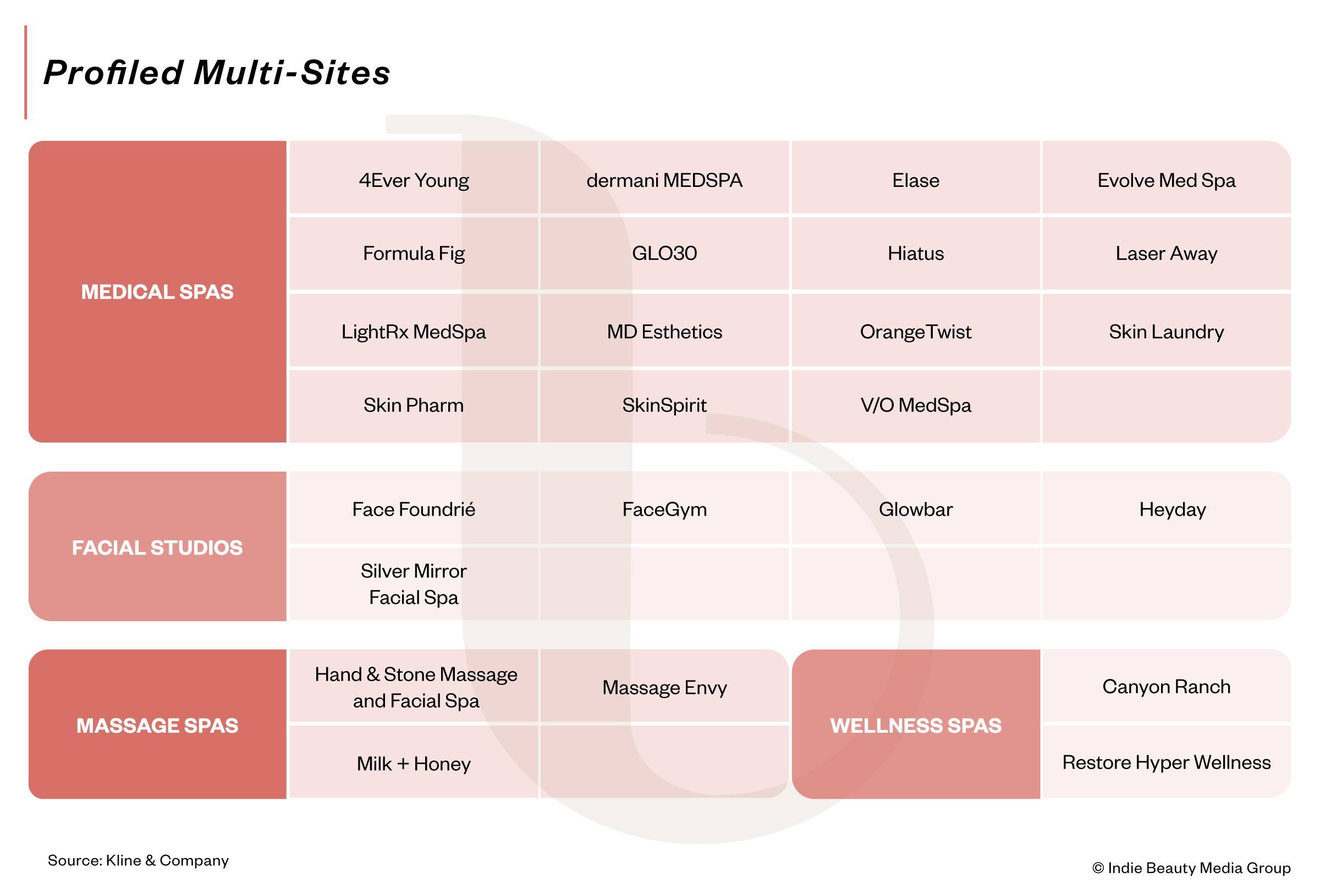

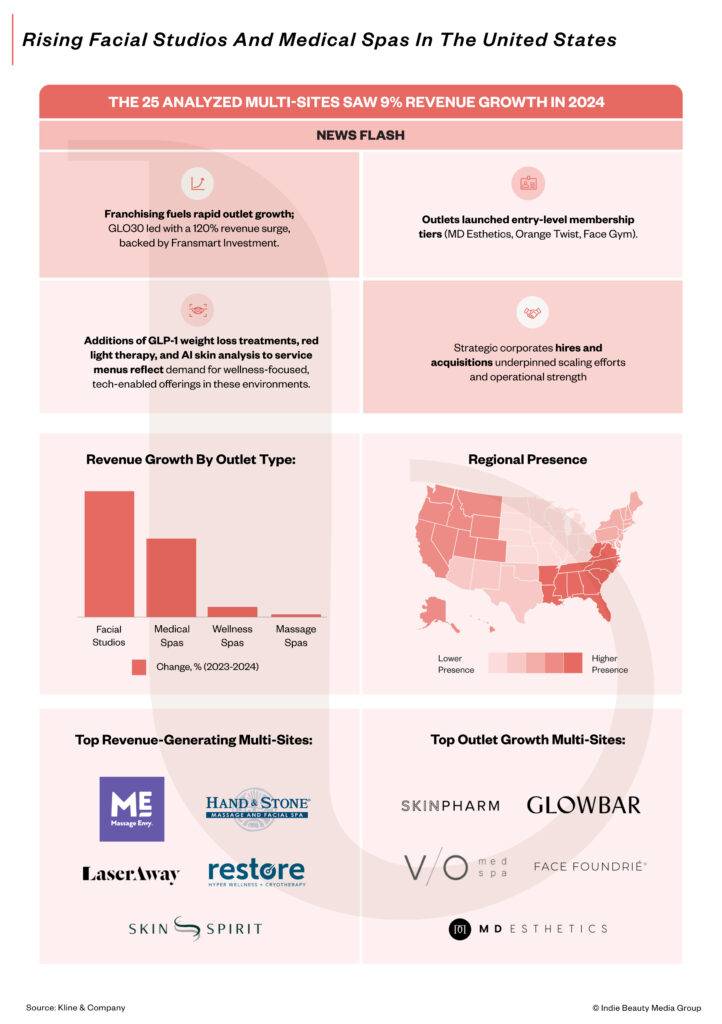

Amid the med-spa boom, which has multiplied their numbers to over 10,000 in the United States, market research firm Kline + Co. has identified the top 25 med-spas, facial studios, massage spas and wellness spas from last year in a new report, including massage spa chains Massage Envy and Hand & Stone, which generated the most 2024 revenue, at $1.1 billion and $850 million, respectively.

Massage Envy operates about 1,100 locations through franchising, while Hand & Stone operates around 850 locations across the country. Med-spas Laser Away, with 180 units, SkinSpirit, with 58 units, and wellness spa Restore Hyper Wellness, with 240 units via franchise, joined Massage Envy and Hand & Stone in the top five skin service providers by revenue last year.

The report also mentions facial studios and med-spas Skin Pharm, with 12 units, V/O Med Spa, with 47 units via franchising, MD Esthetics, with 12 units, Face Foundrie, with about 56 units via franchise, and Glowbar, with 20 units, accelerated revenues the fastest last year. On the whole, facial studio sales growth outpaced med-spas’ sales growth last year due to footprint expansion, simplified service menus, compelling prices and membership offerings. Face Foundrie and Glowbar, specifically, saw double-digit growth, according to Kline.

Collectively, the 25 outlets that Kline analyzed increased sales 9% last year and are projected to boost sales 10% this year, driven primarily by facial studios and med-spas expanding locations. Kline’s report excludes single-unit operators.

Dana Kreutzer, project manager for beauty and wellbeing at Kline, says that skincare and wellness service businesses that lean into franchising, service innovation, membership and loyalty programs, personalization and offerings like GLP-1 weight loss treatments, red light therapy and artificial intelligence-powered skin analysis will propel the industry’s future growth.

Companies that form strategic partnerships to drum up brand awareness and acquire new customers will continue to capture market share, too. Kreutzer highlighted the SkinSpirit and Nordstrom partnership struck earlier this year for aesthetic treatments in the department store retailer’s flagship New York City store as notable strategic partnership.

“[Growth comes from] not one thing, but a layered, multi-pronged approach that allows these businesses to scale, retain customers and maintain quality simultaneously,” she says. “However, price sensitivity and operational execution are growing headwinds, particularly for outlets that fail to balance speed with quality or innovation with efficacy.”

According to the American Med Spa Association, the U.S. med-spa industry is valued at $17 billion and is growing by about $1 billion every year. The average revenue per location rose from roughly $1.3 million to $1.39 million in the same time period from 2022 to 2023. The number of med-spas is expected to hit around 11,550 this year.

Consumer caution could impede skincare and wellness service companies’ growth this year if customers reduce visit frequency, opt for comparatively cheaper treatments or cancel or downgrade memberships to conserve cash. Kreutzer says, “Brands with strong value propositions, flexible pricing and loyalty drivers are likely to sustain at the expense of less nimble competitors/single-location or independent aesthetic outlets.”

Christin Trujillo, founding partner of Maven Financial Partners, a fractional CFO firm serving the aesthetics industry, hasn’t seen much evidence of an aesthetics consumer cooldown. She notes that regenerative treatments involving platelet-rich plasma (PRP), platelet-rich fibrin (PRF) and exosomes that kickstart the body’s collagen production are gaining traction.

She says, “There will still be a place for traditional med-spas offering only ‘tox and facials, but a growing segment are considering consumer demands and blending total wellness care for patients to look and feel good.”

The popularity of GLP-1 weight loss medications has drawn a whole new cohort of customers into the aesthetics space and heightened sales for providers that offer them. According to data from healthcare analytics provider Guidepoint Qsight, 40% of GLP-1 customers in 2024 were new to their practices, and GLP-1 medications were responsible for about 15% of monthly revenue to practices offering them. Practices offering weight loss treatments saw sales climb an average of 9% last year compared to a 2% decline at practices that didn’t have them.

Body tightening and contouring services, typically for post-GLP-1 users that have lost considerable weight, are also becoming a growing area of focus for many providers now. Kline also pointed to rising interest in newer injectable hydrators such as SkinVive and advanced laser facials.

Attracted by aesthetics providers’ scalability, high consumer loyalty and all-cash business models, investor interest in the sector has been steadily advancing. According to Kreutzer, investment has spurred a series of improvements across the med-spa industry, including operational maturity, improving standards and differentiation through branded products. Glowbar has just launched a cleanser, and Formula Fig will soon introduce a biotechnology-fueled skincare line.

Nearly 80% of the outlets included in Kline’s report are either owned by investment firms or have received venture capital or private equity funding despite private equity’s penetration in the med-spa industry sitting at a mere 3%, according to the American Med Spa Association. Recent investment deals include Evolve Med Spa and Hiatus, which were both acquired in 2024, and MD Esthetics, which received a capital injection from New Harbor Capital earlier this month.

The vast majority of aesthetics providers in the U.S. are owned and managed by independent operators. Per the association, 81% of American med-spas only have a single location. As more multi-site providers obtain investment, they’re giving single operators a run for their money. Trujillo says the industry is in a period of beta growth, where momentum is achieved largely through stealing market share from others.

Remarking that 2024 was a challenging period for individual operators, she says, “Allergan, Galderma and all of the vendors are giving better pricing to these multi-location private equity firms because they’re purchasing more.”

Some aesthetics providers argue that investor influence is starting to degrade aesthetic provider quality as profits are prioritized and investor-backed providers entice consumers by lowering prices. Chris Bustamante, an aesthetic nurse practitioner operating single-site med-spa Lushful Aesthetics in New York City, told Beauty Independent last year that Botox injections generally clock in around $14 per unit. PE-backed med-spas with greater buying power are offering them for about $8 per unit, creating an environment where customer outcomes could become jeopardized. “It’s a huge issue,” he said.

The aesthetics explosion in the U.S. isn’t without controversy. On June 8, the HBO show “Last Week Tonight with John Oliver” delved into how a lack of federal regulation in the med-spa industry has created a “wild west,” where state regulations are uneven, unlicensed practitioners perform medical procedures and doctors oversee aesthetics practices in name only or remotely.

High-profile stories of botched procedures have grabbed headlines over the years. Model Linda Evangelista famously sued Zeltiq Aesthetics Inc., parent company of CoolSculpting, in 2021 for $50 million after she claimed the popular fat-freezing procedure left her disfigured and unable to work. She settled in 2022. Last year, the U.S. Center for Disease Control found that an unlicensed aesthetics practice in New Mexico infected three women with HIV through a PRP treatment dubbed “the vampire facial” in which platelets drawn and separated from clients’ blood are injected into their skin to spur collagen production and cell turnover.

Alex Thiersch, founder and CEO of American Med Spa Association, argues that, while bad actors certainly exist in the aesthetics space, they represent “a sliver of the industry.” He stresses med-spas are overwhelmingly safe for customers and that reports of complications and side effects are rare.

“Evidence of this exists in the cost of professional insurance policies for medical spas, which remain far below national averages,” he says. “Contrary to what’s been published, most of the medical regulation governing medical spas is consistent across state lines, but, because of the rapid growth of the industry, the education of those rules has lagged behind. Release of a set of consistent standards or guidelines would go a long way to help educate the public and new med spas of the state of the law.”

Regulation and competition aren’t the only challenges facing the med-spa industry. Many operators in the space are struggling to make profits due to their lack of business acumen. Bryan Durocher, founder of med-spa consulting firm Durocher Enterprises, told Beauty Independent last year that, “Most of the operators are not business people. Cost of goods is high, and the benchmarks and consumables are different from other businesses.” He elaborated, “It’s about product, publicity and distribution. You have to run a med-spa like a retail business. If you try to run it like a doctor’s office, you’ll fail.”

Trujillo argues that smaller med-spas will need to lean into emerging treatments, cutting-edge technology, marketing, cross-selling and back-end automation like customer relationship management software to survive in today’s crowded market. She says, “Practices that are maximizing patient appointments by treatment planning, cross-selling and add-ons are experiencing growth despite lower patient volumes due to saturated markets.”

Leave a Reply

You must be logged in to post a comment.