What Private Equity’s Big Deal Energy Means For Emerging Beauty Brands And Consumers

Private equity firms, backers of some of the hottest brands in beauty, including Summer Fridays, DIBS Beauty, Rare Beauty and Makeup by Mario, have become the dominant player in beauty transactions.

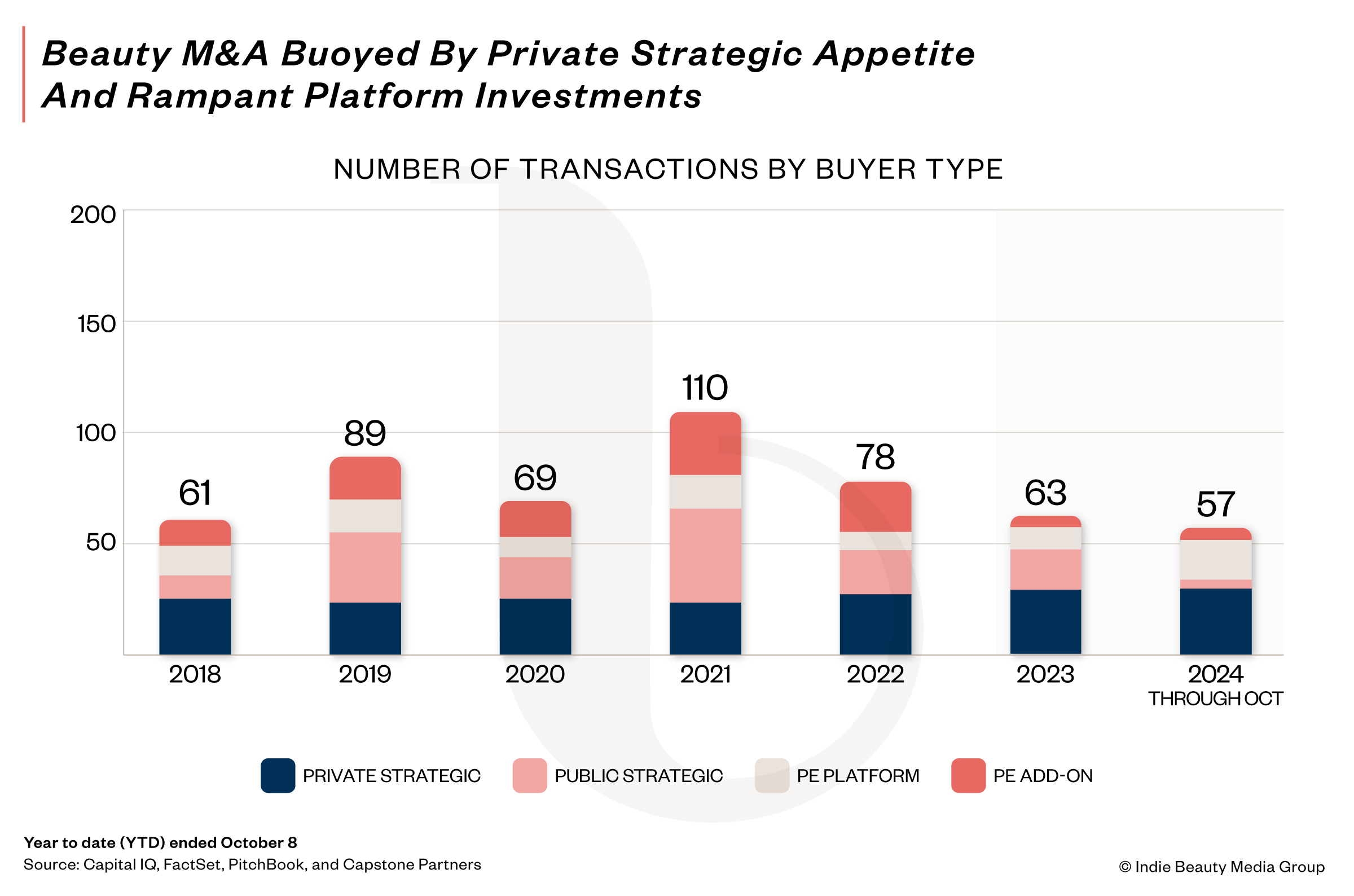

According to Megamarket data cited by investment bank DC Advisory in a report on beauty and personal care M&A activity last year, in 2019, private equity accounted for less than a majority—specifically 45%—of deals. From 2022 to early 2024, it accounted for over a majority—specifically 62%—of beauty and personal care deals.

With private equity’s role in beauty M&A not expected to diminish, especially with unallocated committed capital piling up and a big surge of strategic activity unlikely, for the latest edition of our ongoing series posing questions relevant to indie beauty, we asked a dozen investors and investment bankers the following: How has the dominance of private equity changed what you do? What does it mean for consumers and emerging brands in this space?

- Lauren Leibrandt Director, Global Consumer Investment Banking Group, Baird

We expect private equity will be more active in beauty and wellness in 2025. They are still sitting on near record levels of dry powder coming into this year. PE is also facing increasing pressure to both 1). put more money to work, and 2). exit companies in their current portfolio, which are long in the tooth from an investment perspective (five-plus year hold periods), so they can return money to their investment partners.

While the number of PE exits across the board in 2024 was up 20%-plus versus 2023, there is still a huge backlog of companies waiting to come to market. With the improving M&A environment, we expect many private equity firms to consider exiting their longer tenured investments this year. The latter is important to broader fundraising dynamics so that these sponsors can continue to raise new funds to put capital to work in the future.

In the context of fewer deals being completed by PE last year versus years prior, it is interesting that the large traditional beauty strategics were largely on the sidelines in 2024 due to a variety of factors, many of which were situation specific (e.g., leadership changes, poor stock performance, etc.).

One of the most asked questions we get from sponsors in our sell side processes is, are there strategics involved? In cases where they are, sponsors are concerned whether they'll be able to effectively compete from a valuation perspective so they may bow out of the process prematurely.

In cases where strategics are less relevant, private equity then questions the implications for their potential exit opportunities down the road if a strategic isn't interested today, especially if the business has meaningful scale. If strategics aren't showing up, it can lead to sponsors having less conviction around their investment theses.

So many deals that launched last year were unsuccessful in getting done. To be fair, we are still experiencing a system-wide dynamic where the bid/ask spread between seller and buyer can be misaligned, but the resurgence of strategic deal activity should also help close some of the gap between processes launched and deals completed. Overall, we expect deal activity in 2025 to see an increase in both strategic and sponsor transactions.

- Kelly Bottenfield CEO, K & C Ventures

Private equity’s growing dominance in beauty M&A has fundamentally reshaped the industry, creating more opportunities for emerging brands and founders. While PEs often receive criticism, like in any industry, there are both good and bad actors. Their increasing involvement has broadened the playing field for innovative brands looking for strategic partners.

The reality is that there are only so many strategic buyers globally, and even they can typically only execute one or two major deals per year. PE firms stepping in has accelerated the timeline for founders who might have otherwise had to wait much longer for an exit or growth investment.

Having recently gone through a majority stake sale of The Honey Pot Company to Compass Diversified (CODI), I can personally attest that when values and vision align, PE partnerships can be incredibly beneficial. Working with CODI this past year has reinforced the importance of finding the right partner, one that supports the brand’s long-term growth, innovation, and mission.

For consumers, increased PE involvement means continued investment in product innovation, expanded accessibility and operational excellence. For emerging brands, it provides a greater chance to scale and succeed with the right financial backing and strategic guidance. PE’s role in beauty M&A isn’t just about deals, it’s about creating pathways for brands to thrive.

- JAMIE WOODARD Partner, Conteur Capital Partners

Whether you are a financial sponsor (PE) or strategic acquirer, we’re seeing more discernment around operational excellence. As you know, PE firms aren’t focused on synergies the way a strategic acquirer is. This leaves an increased focus on what everything looks like under the hood.

With the number of beauty companies that shut down from COVID to the present, we’ll expect to see firms leaning into:

- Multiple revenue streams or avenues for growth. Is there an opportunity to expand distribution, product categories, markets etc.?

- Diversified customer base. We’re seeing consumers are showing less loyalty to specific brands and focusing more on the greatest value they can get per $1 spent. Having a diversified customer base can help mitigate the risks of changing consumer preferences, economic downturns, and market changes. Don’t put your eggs in one basket. We can’t be reliant on one narrow consumer base to drive all of our growth

- Financial management, particularly around cash flow and margins. Cash is king, and PE firms want to see that you retain revenue down to the bottom line.

- Andrew Ross Senior Advisor and Venture Partner, XRC Ventures

Private equity (PE) is one route to find a great next home for our founders and their beautiful brands, and, of course, to generate a good return for our limited partners. The mix has not really changed what we do, although by design our structures are more aligned with strategic buyers. It is critically important for founders to understand what a PE liquidity event is and how it might differ from acquisition by a strategic.

For emerging brand founders, PE usually means that you are a long way from “done” despite how exhausted you might be getting to a liquidity event. You can take some money off the table, but generally will have to roll much of your equity and continue (or even accelerate) a path to success, only this time as a minority owner reporting to a board with a lot of financial and operational scrutiny and a time-bound window for success.

You may switch to a “professional” management team, but chances are you will have to work as hard or harder. This requires really heavy due diligence by brand founders to ensure that there’s trust and alignment on vision with the PE Firm, a collective belief in the PE financial case and strong conviction that PE resources are more than just capital and can help you create more value than you could remaining in control.

Given PE valuation and modeling approaches, profitability and cash flow become even more important factors in valuation at the time of the PE transaction, all the more reason to get them right as early as possible.

- Ashleigh Barker Director and Head of Beauty and Personal Care, Lincoln International

Just as subcategories in beauty go through ebbs and flows of market dominance, the same dynamic is playing out between strategic and private equity M&A buyers. This is the result of several variables impacting the market today.

Many of the traditional strategics are navigating leadership changes or other external priorities, causing M&A to become less of a priority. For strategics in a position of strength, they are increasingly discerning with the deals they spend time on now that they face less competitive pressure from counterparts on the sidelines.

Private equity buyers are also holding significant dry powder in their funds, giving them firepower to offer competitive valuations and making them more active players. There is also an influx of private equity buyers seeking to enter the category, which creates a broader buyer universe for brands exploring a sale.

For emerging brands, the path to a strategic exit may take longer as private equity often acts as an intermediary step. However, it also means more “bites of the apple,” which lead to much more lucrative outcomes for founders and management teams.

- TINA BOU-SABA Investor

Private equity’s dominant role in beauty M&A is unlikely to diminish. PE as an asset class has amassed more capital than ever and has an enormous amount of dry capital to deploy. The beauty industry is large and has many of the characteristics that PE investors seek, from growth-y brands at one end to massive contract manufacturers in the buyout space.

It bears repeating that selling a business is hard, period. I observe that many talented entrepreneurs nevertheless underestimate the challenges associated with achieving an exit of any size. So many things have to go right, and there is a significant amount of luck and timing at play. Behind the headlines of big exits, there are months, if not years, of focused work in support of driving a successful sales process.

I mention this because it is important for beauty founders (and their investors) to recognize that the future acquirer of their company is as likely to be a financial firm as it is to be a strategic. This has crucial implications for how the company is capitalized and how its financial model is built. Financial buyers value profitability and cash flow and generally value a business based on its EBITDA. It is extremely unlikely that a PE firm would buy an unprofitable, overcapitalized beauty business.

I see so many companies (in beauty and other consumer categories) that lack the financial characteristics for a PE exit and don’t have the size, strategic fit or profitability profile for acquisition by a strategic. This is a tough spot for founders to be in. I’ve seen companies completely overhaul their business models to prioritize profitability over growth, which can take years of hard work to achieve in order to better position their company for an exit.

Glossier is perhaps a very high-profile example of this, but I see it at smaller scale frequently these days. I’d encourage founders (and their investors!) to have clarity around “what makes a good business in my space” and then relentlessly execute against this. We all really need to be eyes wide open here.

As someone who started her career on Wall Street, I’ve always been highly focused on business fundamentals. As an emerging growth investor, I certainly look at opportunities through the lens of what is possible, and I accept the risk that some early bets won’t work out. That is part of the job. But I try to balance that healthy optimism with a focus on building solid businesses that will have exit optionality.

This is very different from how early-stage VCs look at the world, which is appropriate, given the range of outcomes for a beauty business compared to that of a tech company. Over the past several years, the framework for investing in emerging beauty brands has diverged significantly from that of tech companies, which is completely appropriate.

- ODILE ROUJOL Founding Partner, Fab Co-Creation Studio Ventures

PE are professional investors. They simply realized this is an attractive vertical. They can enter with a few hundred million (versus other more costly verticals) and consider having a multiple of 2X to 4X in only a few years while helping the brands to become global and adding their expertise in e-commerce, supply, retail and more.

As an early-stage VC, I like having investors add their network and superpowers to the cap table. If they respect the founders and culture, that’s even better. I believe they push companies toward sustainable growth and a clear path toward EBITDA, which can be pretty healthy compared to the crazy growth a few years ago.

- Manica Blain Founder, Top Knot Ventures

I think the increase in percentage of exits to financial buyers (i.e., private equity) over strategics in the last couple of years has been largely driven by uncertainty over whether the brand is simply having “a moment” or if it will be a long-lasting legacy brand. I think this has particularly been true for brands that may have grown and scaled very quickly.

For a financial buyer considering the purchase of a brand, especially a financial buyer looking to add significant leverage (i.e., debt) to that asset, cash flow will be more highly scrutinized than intangible brand value. Why? Because that cash flow the business generates will be necessary to pay down the leverage over the financial buyer’s hold period, thus (hopefully) resulting in a strong cash-on-cash returns on equity for that financial buyer over their hold period (typically five-ish years).

The implication for investors in early-stage beauty is a renewed focus on cash flow and profitability as growth at all costs is not just unsustainable as a business model, but if no strategic buyer bites in the ultimate sale process, you can hopefully at least exit to private equity if cash flow dynamics are strong enough.

I also often think about an exit to private equity as being an appropriate in-between stage for a brand that isn’t quite ready for a strategic exit yet. Maybe there is too much concentration in product (i.e., a hero SKU that accounts for too much in sales of the overall business) or within a channel of distribution (i.e., sales are too concentrated within a specific retailer).

As a former private equity investor myself, I think that investment theses that center around correcting a specific flaw (or risk) like this with the right game plan, deep networks and resources are particularly interesting and attractive opportunities. And I think there have been quite a few private equity players chasing down these opportunities over the last couple of years, and I see this continuing.

- Anna Whiteman Partner, Coefficient Capital

PE’s continued interest and activity in beauty is not surprising given the sustained growth of the category in aggregate, relative sector profitability, especially as it relates to broader consumer, controlled distribution footprint and more. Even in the face of declining M&A activity in the sector, there remain green shoots that keep potential investors excited about the future of beauty.

Coefficient Capital and The New Consumer’s Trend Report suggests that beauty and personal care remain incredibly relevant for U.S. consumers, especially younger consumers who are coming into their prime spending years: 56% of gen Z consumers say they “care a lot” about their general appearance, higher than 45% of the overall population. Also, 55% of gen Z consumers say they purchase beauty products at least monthly versus 40% of the overall population. The consistent excitement and, further, loyalty of the beauty consumer are pillars around which investors can feel confident in their immediate deployment cycles.

Strategic lethargy over the last several years has opened up a window for sponsors to become more aggressive at the later stages, especially around businesses that have managed to sustain growth while pivoting to profitability over that same time period, yet still remain out of reach to strategic players. As strategics recalibrate their portfolios toward growth in the coming years, investor activity today should prove fruitful in the near future.

- Elizabeth Lim Founder, Elizabeth Lim Strategy & Consulting

The growing presence of private equity in beauty M&A has reshaped the industry in ways that have deeply influenced my approach to strategic growth, brand evolution and consumer connection. This shift has pushed me to think even more intentionally about scalability, operational excellence and long-term value creation, ensuring that every decision is rooted in both financial strength and brand integrity.

I’ve seen firsthand how today’s market landscape rewards precision in positioning, innovation and storytelling. Investors may focus on measurable, high-growth potential, but I believe the brands that truly stand out are the ones that go beyond financial performance to build deep cultural and emotional connections with their consumers. More than ever, differentiation is critical, not just for investors, but for creating brands that people genuinely love and trust.

From a consumer perspective, private equity’s involvement often means greater access to innovation, wider distribution and stronger brand engagement. Of course, rapid scaling presents challenges, particularly when it comes to maintaining ingredient integrity or sustainability commitments. But I’ve also seen many brands use investment as a way to double down on quality, transparency, and mission-driven initiatives, proving that financial success and consumer trust can absolutely go hand in hand.

For emerging brands, this evolving landscape sets a higher bar for success, but it also opens up new opportunities for those who can carve out a distinct, purpose-driven niche. I’ve learned that blending creativity with smart business strategy is essential, and that finding the right investment partner—one that truly aligns with a brand’s vision—can make all the difference in achieving sustainable, values-driven growth.

Ultimately, private equity’s expanding role reinforces the importance of balance, leveraging financial expertise while staying deeply connected to consumer needs and market trends. Brands that navigate this shift with clarity, authenticity and strategic foresight are the ones best positioned to stand out in today’s beauty landscape.

- Susan Lin Partner, Felix Capital

We don't think it's really changed what we do, and we remain focused on partnering with companies and founders with great fundamental attributes—a differentiated brand with great products, building an authentic community, fostering customer love and repeat and focusing on scaling capital efficiently.

We also look for brands that we think can appeal to multiple potential acquirers at exit, which could be many years in the future, whether they are strategic or PE. We do think the prevalence of PE acquirers means financial discipline and having strong margins/profitability and sustainable unit economics become even more important for founders /companies. This is important for strategies as well, but they typically realize more operational synergies.

In terms of impact on consumers, we don't necessarily see significant impact. Most PE funds are looking to hold an investment for a relatively short three to five years before exiting, ideally to strategics, and are unlikely to want to change the brand or product significantly, although sometimes unintentional changes occur, for example, if the founders step away from the business.

- MEGHAN MCLAUGHLIN Executive Director, Moelis

PE has always been an important part of the client ecosystem for Moelis. It plays a fundamental role in providing capital and expertise to help companies grow that ultimately provide new products and services to consumers.

PE is also an attractive alternative to strategics in M&A processes given there are hundreds of potential PE buyers versus a few dozen strategic ones, and PE buyers have paid competitive prices in recent years.

If you have a question you'd like Beauty Independent to ask investors and investment bankers, please send it to editor@beautyindependent.com.

Leave a Reply

You must be logged in to post a comment.