The Purpose-Driven, Channel-Agnostic, Experience-Centric Future Of Retail

The onset of the pandemic accelerated many movements such as a shift toward digital, sustainability and touch-free operations that had begun to shape the retail industry before it, and they’ve largely been sticky in the two years since. Now, with the United States possibly entering an endemic phase of the coronavirus, stores and brands are wondering how the dynamics stoked by the pandemic will affect retailing long term.

“One of the biggest questions that we continually get from our retailers is, OK, so what does this mean for my store?” said Andrew Davis, a partner at McKinsey & Co., during Beauty Independent’s In Conversation webinar last Wednesday on the future of retail. Tyler Harris, an associate partner at the management consulting firm who joined Davis and Sanford Stein, author, trend forecaster and founder of discussion and professional networking platform Retail Speak, for the webinar, asserted, “The consumer has really changed in some pretty demonstrative ways.”

Below, we summarize the demonstrative ways Stein, Harris and Davis laid out that consumers and retailers are changing across spending behaviors, brick-and-mortar stores and operations.

Consumer Behavior

“Phygital” shopping or the convergence of shopping online and in physical locations is the new normal. As such, omnichannel capabilities will stay critical factors influencing consumers’ shopping decisions. In longitudinal studies tracking consumers’ behavior, McKinsey discovered that 50% to 70% of those who tried omnichannel shopping options like curbside pickup or self-checkout in the last two years are likely to choose them again.

The research shows gen Z and millennial shoppers are looking for less interaction with store associates during transactional activities. That doesn’t mean retailers should abandon customer education from its staff. Younger consumers are still interested in consultative services such as sales associates helping them find the right foundation for them or inform them on whether a serum is appropriate for their skin.

Harris said omnichannel customers have greater value to retailers than customers who solely shop at stores or online. “They spend more and they shop more, so that person who’s using both this curbside pick up and shopping across channels is really playing out to be the most valuable in the equation,” she said.

McKinsey’s research indicates retailers should prioritize buttoning up cross-channel integrations and fast delivery operations. Nearly 90% of consumers cited two-day shipping as expected. One-third of those consumers expressed that same-day delivery will be the next iteration of delivery they will count on. McKinsey’s research also indicates retailers that pay special attention to mission-driven brands could start seeing returns from that attention.

Harris said, “A couple of years ago, we saw consumers saying that they wanted more purpose-driven brands and things of that nature in retail, but what we are actually seeing now is this inflection point where we’re going from consumers saying they want it to actually paying more for it.”

Brick-And-Mortar Retail

Brick-and-mortar stores historically tried to circulate as many people as possible through their square footage to drive purchases. While that’s often still true, physical retail’s role is morphing. Retailers are being advised to map out various store archetypes and think about meeting customer needs in each of their unique environments. For example, not every storefront should operate as a flagship designed to aid in brand discovery and product testing, and not every store should be thought of as a high-volume vehicle.

Instead, retailers should take a holistic phygital strategy. Some are turning store real estate in less desirable or economically slow locations into mini fulfillment centers or online pickup destinations. Davis said Target, Walmart, Whole Foods and Bed Bath & Beyond have gone that route. Smaller retail formats in unexpected locations are coming into favor as mall traffic declines. Nordstrom has debuted so-called local stores billed as convenient service hubs for online order pickup, returns and express alterations.

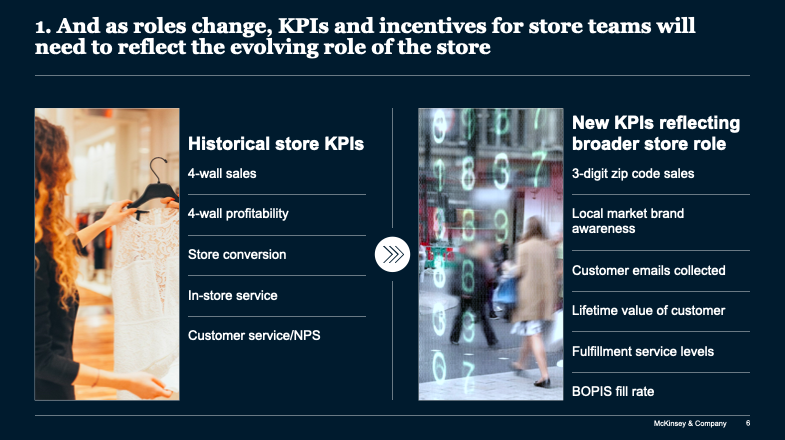

“The store of the past, where you would have a certain number of stores within an MSA [metropolitan statistical area] based on the number of sales that you thought you could do, has totally been flipped on its head,” said Davis. Stein chimed in that brands and retailers should be zeroing in on lifetime customer value in a unified commerce universe as their new playbook for how to evaluate a store’s success.

Gross sales of a geographic area around a store–the store’s sales plus the e-commerce sales from the area– is an important measurement for examining lifetime customer value. Harris said, “Just because a sale isn’t made in a store doesn’t mean that that person didn’t go to the store to browse and be influenced for the purchase.”

Store Operations

Several updates to store operations are being made. Retailers are resetting their labor model to increase efficiency by bringing in technology to assist. For instance, they could only offer self-checkout (Amazon’s grab-and-go retail model eliminating checkout altogether is an extreme illustration of the move away from manned checkouts), and incorporate augmented reality (AR) try-on technology to cope with labor shortages.

“The store is changing in every way that we can imagine. It’s becoming a showroom. It’s becoming a place to build the brand,” said Stein. “It’s becoming a place to have experiences. And, more importantly, it is a key to the customer experience.”

Stein emphasized training should motivate sales associates to deliver the dynamic experiences consumers desire from retail. He compared sales associates to micro-influencers. “They are becoming brand ambassadors because that face time, that interaction that is happening between the customer and that representative of the brand…if that isn’t as insightful as informative or exciting as it ought to be, they [the customer] don’t need that store,” said Stein. He advised incentivizing sales associates not to push for in-store sales in particular, but encourage sales in whatever venue customers are most comfortable.

A bifurcation of the retail market could be on the horizon. Retailers with money, technology and strong brand equity like Amazon and Target are anticipated to pull away from the pack, while retailers lacking in those areas could erode or shutter. Stein argued that mid-level retailers don’t have stellar chances of success going forward, but indie retailers can thrive. They won’t win by competing in the race for money or technology. Instead, they could win by concentrating on their mission, expertise and captivating experiences.

“It’s probably never been a better time for a good independent retailer that’s really focused on their niche, on their customer and on what makes them unique,” said Stein. “What is at the top end is gotten better on every level in terms of product, in terms of selection, in terms of private brands, in terms of the customer experience, and now because of the flattening of everything, the independent retailer has the best chance they have ever had to be successful because they can personalize better than the top-end, big-box player. They can know their customer better than the big player can. And the technology that’s becoming so essential to all retailers is beginning to be as accessible to the small player as it is to the big player.”

Davis concurred and stressed that prioritizing customer experiences and differentiation is essential. “The winners moving forward will disproportionately invest in things that are tougher to compete on,” he said. “So, what are diverse assortments that can only happen here? How do we invest in technology to make the customer value proposition better? How do we think about all of this integrated connection and commerce, and how do I go and win better with those folks that I have today?”

To watch a replay of the retail episode of Beauty Independent’s In Conversation webinar series and replays of other episodes, visit the replay library.

Leave a Reply

You must be logged in to post a comment.