QVC Parent Company Qurate Retail Group Shutters Gen Z Livestreaming App Sune

QVC and HSN owner Qurate Retail Group is closing Sune, a livestreaming app it introduced a year and a half ago in a bid to draw gen Z consumers, as it sets its sights squarely on older consumers and turning around its primary business.

In a Thursday email to customers announcing the closure, the company states, “We have been incredibly grateful for the opportunity to connect you with the talented and creative makers and brands on Sune. Your support and patronage meant the world to us and have made our journey truly special…while this was a difficult decision, we remain deeply appreciative of the trust and enthusiasm you have shown us.” Customers will be able to purchase from the app until Dec. 2, and all orders and returns will be honored through Dec. 31.

A Qurate Retail Group spokesperson tells Beauty Independent, “The decision to sunset Sune aligns with our recently announced growth strategy focused on building on our proud legacy in TV and expanding into a live social shopping company. Our Sune business has been an incredible source of innovation and learning, and those insights will be valuable as we move into this next phase of growth.”

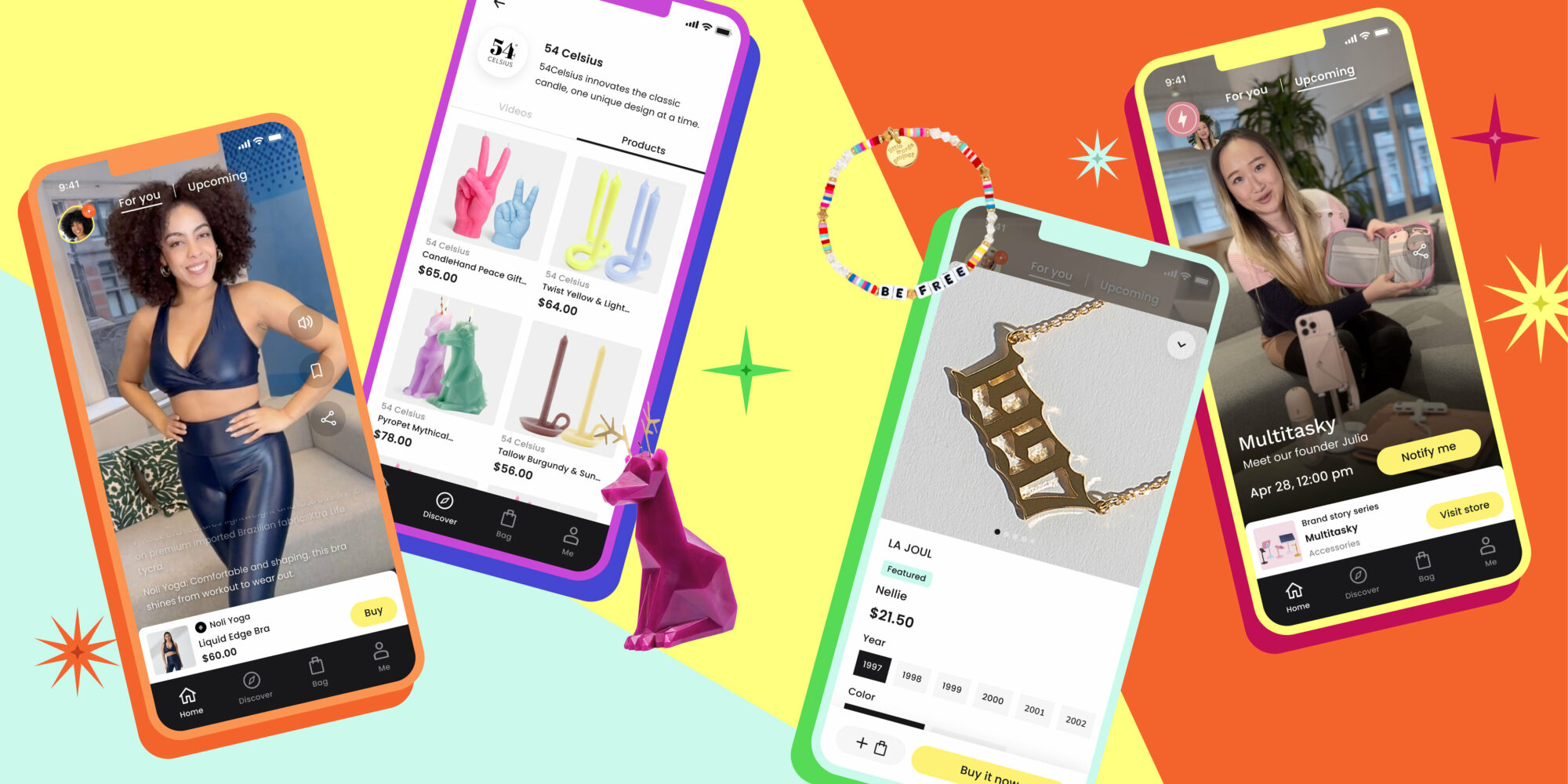

Operated separately from Qurate Retail Group’s other properties, Sune targeted consumers aged 18 to 34 years old with live shows and shoppable short-form video reviews and tutorials. It featured products from emerging brands across several categories, including health and beauty, stationary, food and drink, accessories and wellness. At the time of Sune’s launch, it had 90 beauty brands such as HiBar, Kinfield, Cleo+Coco and Poppy & Pout. Fluency Beauty, French Girl, Elvis + Elvin and Happy Plant Botanicals are a few of the brands currently listed on the app. Brands on Sune managed their own storefronts and fulfillment.

Speaking with Beauty Independent about Sune last year, Brian Beitler, CEO of Sune and former CMO of QVC and HSN, said, “This is our way of looking at growth and innovating on growth for the next three or four decades. We want to build this place where consumers can come and have the joy and wonder of window shopping, but they just do it with their thumb. And, over time as we learn more about consumer preferences, we’ll begin to personalize that experience more.”

The Sune experience was cut short by higher order priorities at Qurate Retail Group parent company Qurate Retail Inc. It’s been bleeding sales—last year, they declined 10% to $10.92 billion, and they slipped 5% to $2.34 billion last quarter—and is trying to turn the tide by rechristening Qurate Retail Group as QVC Group next year and pushing the gas pedal on social media by leveraging creator affiliate storefronts, livestreams and organic and paid media. It also plans to develop custom content for social media platforms like YouTube, TikTok and Facebook and dive deeper into streaming with commerce on YouTube TV, Sling, Roku, Hulu and Netflix.

Qurate Retail’s turnaround efforts have been prolonged. In 2022, it initiated what it calls Project Athens to strengthen and expand its core competencies in video shopping by reducing costs and optimizing its brand portfolio. Discussing Project Athens in the latest earnings release, president and CEO David Rawlinson says, “The team has materially improved the business, becoming a more profitable, leaner and more nimble organization. We are transitioning to the next phase of our strategic growth as we enhance our capabilities to reach aggregated audiences on primarily social and streaming platforms.”

“Our Sune business has been an incredible source of innovation and learning, and those insights will be valuable as we move into this next phase of growth.”

Qurate Retail has a history of testing shopping initiatives and ending them when they don’t meet expectations. In 2016, it launched millennial-focused television channel BeautyIQ with round-the-clock beauty programming. BeautyIQ went digital-only in 2019 and was shuttered two years later.

This year, Qurate Retail decided to pivot from chasing younger consumers to concentrate on its principal consumer cohort of women 50 years old and older. In August, it premiered a campaign entitled Quintessential 50 (Q50) spotlighting 50 female celebrities and personalities in the age group. In a release about the campaign, Annette Dunleavy, VP of brand marketing at QVC and a member of the Q50, said, “QVC has a longstanding relationship serving the 50+ customer, and we’re uniquely positioned to launch this dedicated effort that we hope will spur a cultural shift in attitude and behavior towards women over 50.”

Beyond Qurate Retail’s struggles, Sune was unleashed in a global livestreaming environment dominated by Amazon and TikTok that upstarts have found difficult to penetrate. TikTok is often referred to as QVC for younger consumers and its e-commerce marketplace TikTok Shop has become a top-five beauty retailer in the United States, according to information market research firm NIQ supplied the publication Women’s Wear Daily.

Several livestreaming startups have disappeared or shifted course to stay relevant. Supergreat, which raised over $30 million in venture capital funding, closed last year and its employees were absorbed by fellow livestreaming company Whatnot. Newness terminated its livestreaming model and rebranded to beauty e-commerce app Iris last year after raising $3.5 million in funding in 2021. Trendio, a livestreaming platform launched by former Amazon and CVS executive Alex Perez-Tenessa in 2022, has become an artificial intelligence-powered technology company that aims to optimize brands’ content on TikTok.

Leave a Reply

You must be logged in to post a comment.