Rhode, Maëlys And Phlur Top Consumer Edge’s List Of Fastest-Growing DTC Beauty Companies For 2025

Celebrity-driven and viral beauty brands, including Hailey Bieber’s Rhode, Maëlys and Phlur, have had the strongest direct-to-consumer sales growth in beauty this year, according to a new report by data analytics firm Consumer Edge on the top 40 and 20 DTC beauty companies in the United States and United Kingdom, respectively.

The report entitled “The State of Retail 2025 Beauty” identifies Rhode, which is being acquired by E.l.f. Beauty for up to $1 billion, as the top fastest-growing selling American DTC beauty brand for the first half of this year, with sales almost tripling from the same period a year ago. Maëlys, the body care brand that’s gone viral on TikTok for B-Tight Lift & Firm Booty Mask and grew sales 460% year-over-year, came in second on Consumer Edge’s list.

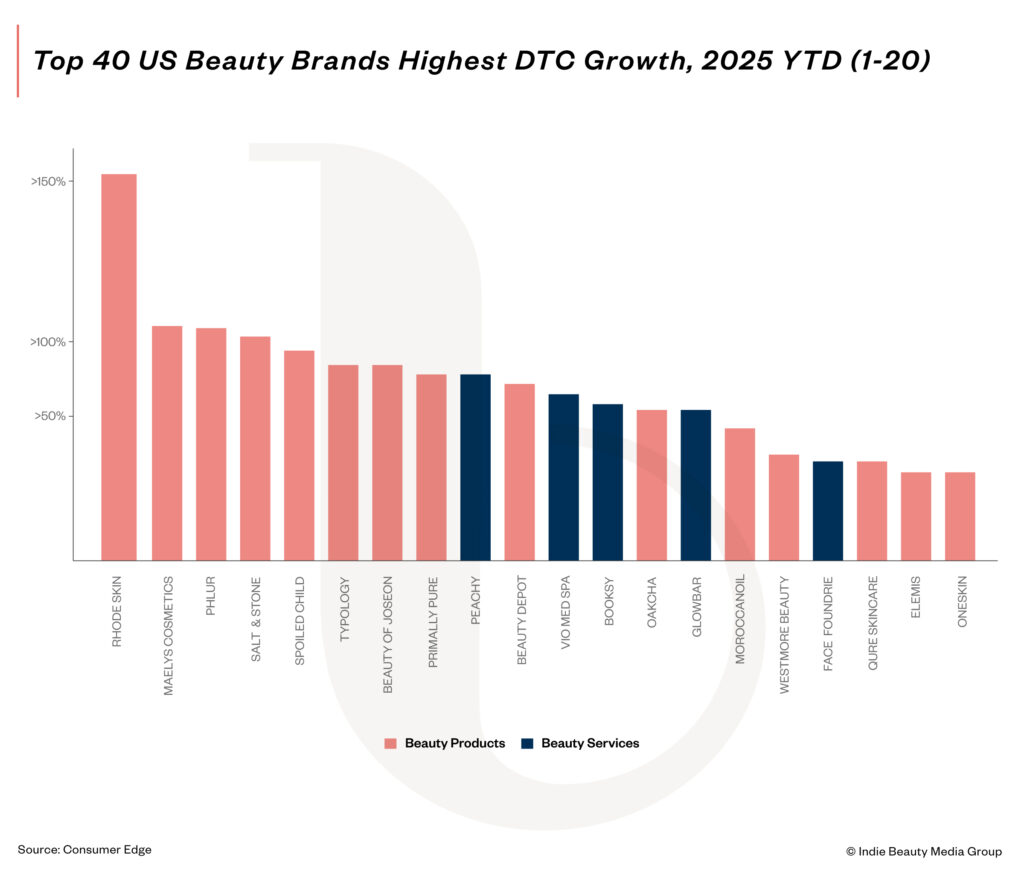

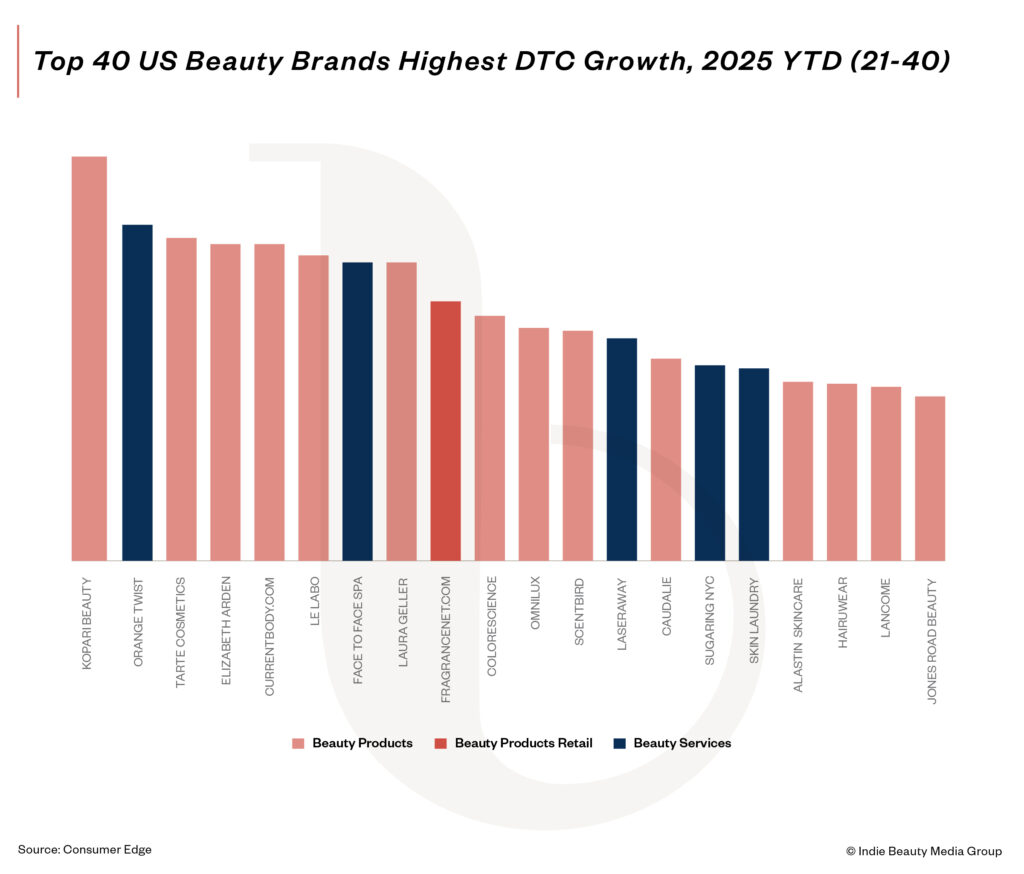

Clean fragrance brand Phlur, another TikTok favorite with scents like Missing Person, rounded out the top three. Axios has reported that Phlur has hired investment bank Raymond James to explore a deal. Deodorant brand Salt & Stone, artificial intelligence-driven skincare brand Spoiled Child, K-Beauty powerhouse Beauty of Joseon, natural skincare brand Primally Pure, dupe fragrance brand Oakcha, skincare device brand Qure Skincare and skincare service providers Glowbar, Peachy and V/O Med Spa also made Consumer Edge’s top 20.

Without disclosing exact percentages, Consumer Edge figures that Rhode’s DTC sales have increased over 150% year-to-date. Maëlys, Phlur and Salt & Stone’s DTC sales have increased over 100% in the same period. Spoiled Child, Typology, Beauty of Joseon, Primally Pure and Peachy’s DTC sales have ticked up over 50%.

The firm tracks anonymized credit and debit card transaction data for over 10,000 U.S. and European beauty and personal care brands. For retailers and service providers, Consumer Edge captures spending that occurs both online and in stores.

The report reads, “The DTC Beauty sector in 2025 presents a fragmented yet opportunity-rich landscape. While overall spend has slowed in the U.S. and U.K., brand-level performance tells a different story: digital-native, science-driven, and socially amplified brands are leading growth, while traditional players and legacy formats fall behind.”

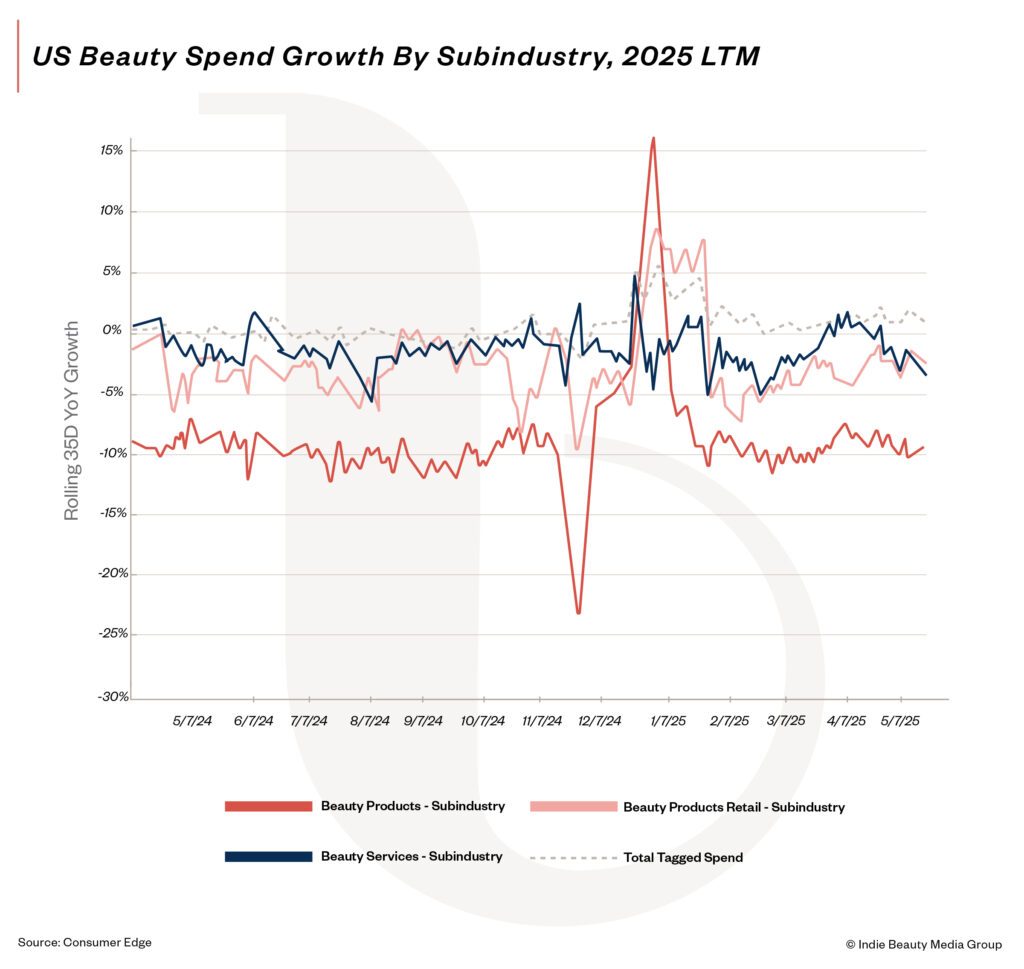

The acceleration of Rhode, Maëlys and Phlur comes amid a broader U.S. beauty slowdown that Consumer Edge is monitoring across products, retail and services. All three channels underperformed spending growth for the beauty industry as a whole in the past year, and DTC saw the largest decline, with an average dip of 10%. Consumer Edge attributes the decrease to consumers diverting their spending to Amazon and big-box chains like Walmart and Target.

Michael Gunther, VP and head of insights at Consumer Edge, points out that value-conscious customers may be attracted to retailers’ increased promotions. He says, “If a consumer is being more discerning with their spend and doesn’t necessarily have loyalty to a single brand, they might turn to a retailer versus buying direct.”

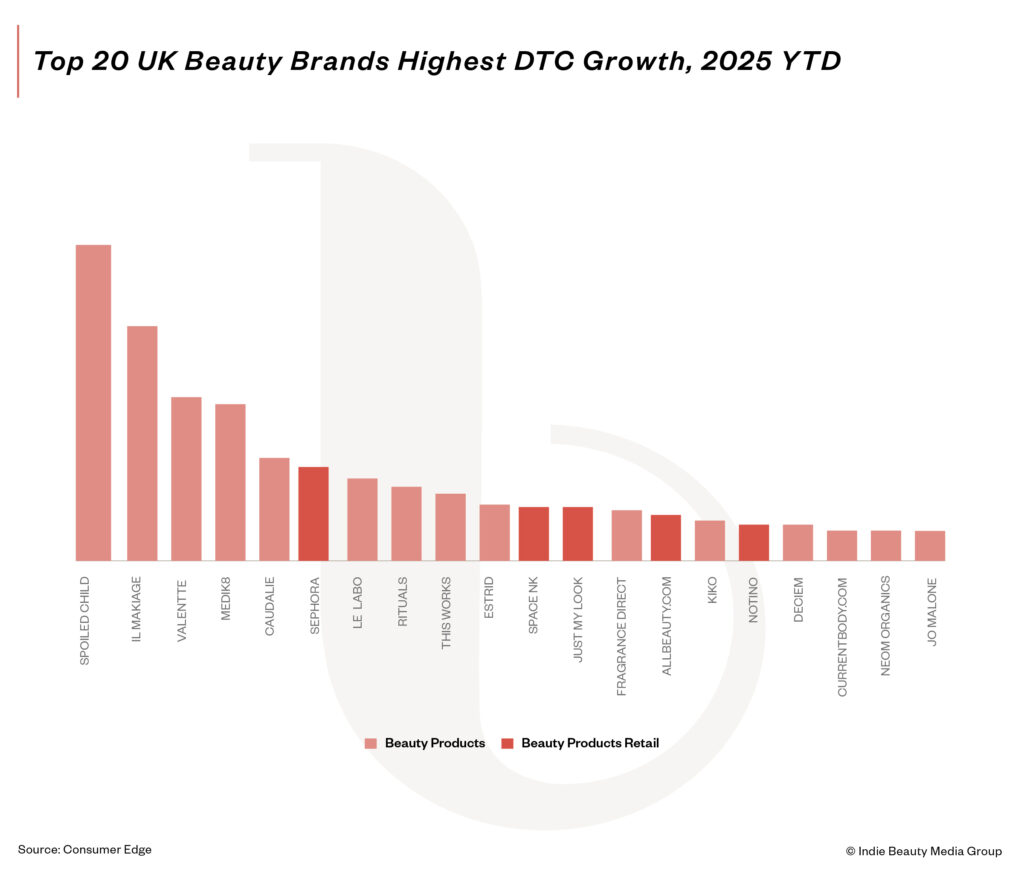

British beauty retailer sales growth outperformed growth in DTC, beauty services and beauty spending as a whole in the past year. The report mentions Sephora and Space NK’s brick-and-mortar expansion and exclusive launch strategies as probable reasons for the channel’s strong performance. Online beauty destinations Allbeauty and Just My Look are helping to drive growth, too.

Consumer Edge lists Spoiled Child, Il Makiage, Valentte, Medik8 and Caudalie as five top-selling British DTC beauty brands this year. Medik8 is being acquired by L’Oréal for an estimated $1.1 billion. This Works, Estrid, Kiko Milano, Deciem, Currentbody and Neom Organics are additional brands in the U.K.’s top 20.

Similar trends are captivating beauty customers in the U.S. and Britain. Consumer Edge highlighted social media virality, science-backed beauty brands, medical aesthetics, AI-powered personalization, affordable and artisanal fragrances, sensorial wellness products and at-home beauty devices as a few standout trends.

With buying power surging in the trillions of dollars, millennial and gen Z shoppers are transforming the global beauty industry. Gunther says, “18- to 34-year-olds continue to shape the market through digital-first shopping habits, ingredient literacy and a preference for transparent, inclusive and community-driven brands. CE data shows that gen Z is flocking to clean, minimalist and digitally-native brands.”

In the U.S., beauty shoppers between the ages of 18 and 34 years old are gravitating to skincare brands Rhode, Agency By Curology, Primally Pure, Typology, Spoiled Child and Prose this year. Beauty retailers have had mixed performance with younger shoppers so far this year. Echoing recent results from investment bank Piper Sandler’s survey of American teens, Sephora gained approximately .8% in market share with beauty customers between the ages of 18 and 24 years old. Ulta Beauty lost momentum with the same cohort. However, Ulta picked up points with shoppers between the ages of 25 and 34 years old.

Large beauty service chains such as Sport Clips, Supercuts, Great Clips, European Wax Center, Milan Laser and LaserAway saw their market share decline with customers between 18 and 34 years old this year, some as much as one or two points. The report reads, “This suggests a shift away from legacy chains and standardized service formats toward more customized, brand-forward experiences, like Glowbar or Face Foundrie, which saw slight gains among 25–34s.”

In the U.K., the brands Rituals, Estrid, Jo Malone and Charlotte Tilbury registered the most traction with customers between 18 and 34 years old. Beauty retailers Sephora, Space NK and Lookfantastic gained considerable market share with that group. On the flip side, beleaguered The Body Shop and Superdrug each lost over three points of market share with young beauty shoppers.

With social media-driven trend cycles churning out faster than ever, Gunther emphasizes beauty companies have to be agile and forward thinking to thrive. He notes, “Success hinges on brands staying one step ahead of evolving consumer expectations.”

This article was updated on June 27 with new information on brands’ DTC sales growth.