Sephora’s Spring Savings Event Sales Decline As Competitive And Economic Pressures Mount

Feverish beauty industry competition and consumer unease are among several factors contributing to sales during Sephora’s spring Savings Event sliding from last year.

Data from market research firm YipitData shows that makeup and haircare sales for the event, which ran from April 4 to 14, were each down around 15% in stores and online, and skincare sales slipped more than 25%. A bright spot, sales in the fragrance category rose a high single-digit percentage from last year.

Sephora’s Savings Event offered 20% off beauty purchases—and 30% off Sephora Collection products specifically—to Rouge members of the beauty specialty retailer’s Beauty Insider loyalty program who spend $1,000 or over at it a year. Very Important Beauty Insider or VIB members who spend at least $350 annually at Sephora were eligible for 15% discounts, and entry-level Beauty Insiders were eligible for 10% discounts. Sephora extended the sale from April 17 to 21. YipitData’s information doesn’t cover the extension.

Rouge members had early access to the sale from April 4 to 8, when VIB and Beauty Insiders were permitted to join. Per YipitData, sales online and in stores at Sephora dropped a double-digit amount in the Rouge-only period from April 4 to 7 on a yearly basis, with skincare experiencing the steepest drop-off. Fragrance sales dipped moderately in the Rouge-only period, and VIBs and Beauty Insiders powered the category’s gains for the Savings Event.

In omnichannel distribution at Sephora, Kayali and Hourglass were popular during the spring Sephora Savings Event with Rare Beauty and Fenty underperforming their year-to-date sales in the period. DedCool and Lawless Beauty reported Savings Event sell-outs.

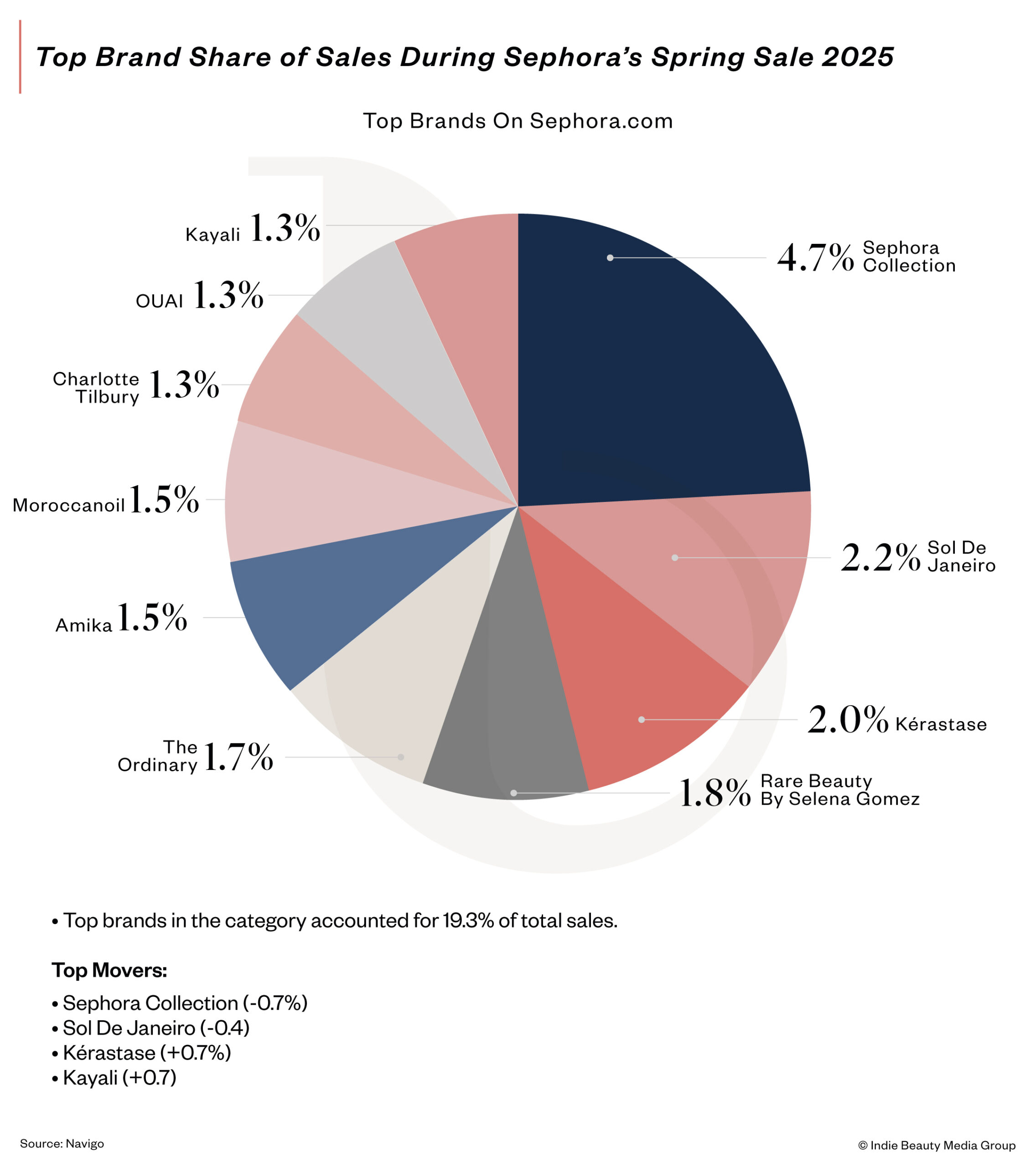

According to Navigo Marketing, an agency that partners with beauty brands to grow e-commerce sales across Amazon, Ulta Beauty and Sephora, the top 10 brands on Sephora’s website during the event were Sol De Janeiro, Kérastase, Kayali, Ouai, Sephora Collection, Rare Beauty, Charlotte Tilbury, Moroccanoil, Amika and The Ordinary. Sephora Collection and Sol De Janeiro, which accounted for 4.7% and 2.2%, respectively, of the Sephora Savings Event online sales, registered decreases from online sales last year. Kérastase and Kayali notched year-over-year increases.

Sephora is facing mounting pressure from Amazon and TikTok Shop. Cécile Cabanis, CFO of Sephora owner LVMH Moët Hennessy Louis Vuitton, noted in the luxury goods conglomerates earnings call on April 14 that Sephora’s American e-commerce business is challenged by competition from Amazon, which is poised to become the No. 1 beauty retailer this year. “We have a bit less momentum when it comes to e-commerce, especially because Amazon is being very aggressive and being aggressive is mostly regarding pricing,” she said. “We try to avoid this technique.”

According to transaction data from Earnest Analytics Orion compiled by publication The New Consumer and investment firm Coefficient Capital in a report on beauty and consumer trends in 2025, sales from TikTok Shop, where health and beauty is the top-performing category, are larger than Sephora’s sales. It took a couple of years for TikTok Shop to hit $2 billion in sales versus two decades for Ulta. The New Consumer and Coefficient Capital highlight that TikTok Shop thrives on discounts and bundles. Its value proposition could be blunting the lure of Sephora discounts.

Retail sales in the United States have been bumping along, advancing .2% in February and 1.4% in March. Consumer confidence in the country has been cratering, and The Conference Board’s Consumer Confidence Index fell last month to its lowest level since January 2021. With consumer confidence wavering, Bellamy Grindl, founder and CEO of retail consultancy Retailytics, says, “The reality is consumers are more selective with their discretionary spend, and promotions are no longer a guaranteed lever to drive volume.”

While Savings Event extensions aren’t unusual, some customers interpreted this year’s extension as a strategy to entice spending from customers particularly reluctant to part with their dollars in a shaky economic environment. “This is a recession indicator if I’ve ever seen one,” stated a TikTok user with the handle @tafavoti in a video posted on April 19. “The timing of this big sale where they make a ton of money, I’m sure, was based around a lot of other crazy economic things that were happening, so I’m guessing a lot of people weren’t dropping $500 to $600 bucks at Sephora like they usually do twice a year.”

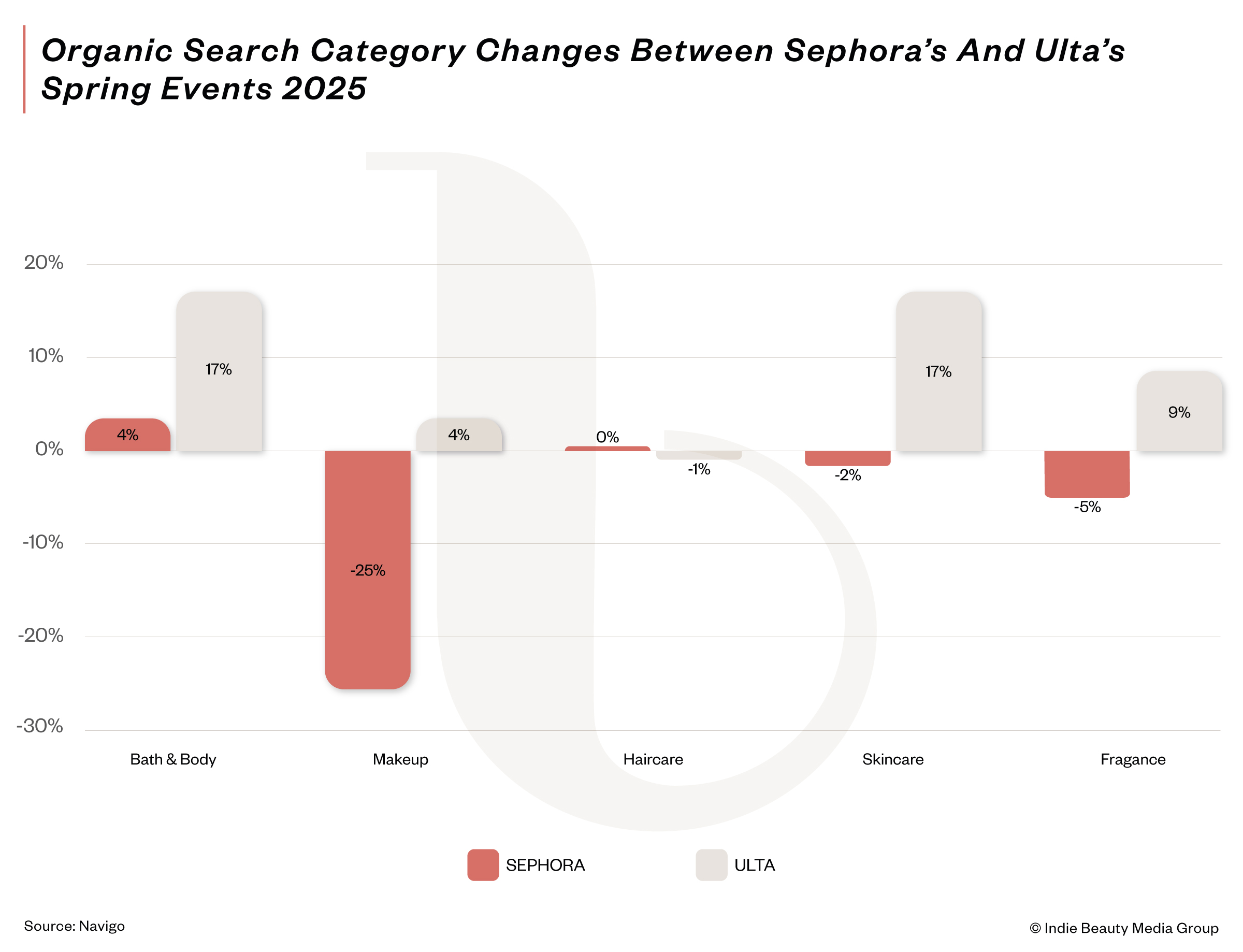

Jacob St. John, founder and CEO of Navigo Marketing, isn’t convinced that economic rockiness is fully to blame for Sephora’s Savings Event results. He notes that beauty sales started April soft across Amazon and Ulta and Sephora’s sites. However, Ulta’s online sales have picked up as the month went on, and St. John conjectures that Sephora brands’ comparative absence on Amazon has hurt Sephora.

“Ulta is allowing brands to go on there now because they know that a rising tide raises all ships so that, as these brands grow, they’re going to get more traffic,” he says. “A lot of these brands, they have to put paid towards Sephora, and it doesn’t work as well because people want to buy on Amazon. They’re essentially kicking their brands back down and saying that they have to listen to us.”

The omnipresence of Amazon is undeniable. According to a survey of almost 8,000 American shoppers over the age of 18 conducted between March 31 and April 7 by consumer data firm Prosper Insights & Analytics, 71.9% of Ulta shoppers and 74.4% of Sephora shoppers report that they have Amazon Prime accounts.

Cierra Sherwin, founder and CEO of beauty brand consultancy First Production Beauty, says, “The speed of Amazon, the value found on TikTok Shop and Ulta’s rapid expansion as a key competitor are key factors in Sephora’s struggle to maintain their position.”

Still, Sephora’s position remains solid, and it came into the spring Savings Event with momentum. After strong performance in 2024 in which it propped up LVMH’s sales quarter after quarter, Sephora’s sales grew again in the first quarter of this year. It was crowned American teens’ top beauty retailer over Ulta in investment bank Piper Sandler’s semiannual survey of teen consumers released earlier this month.

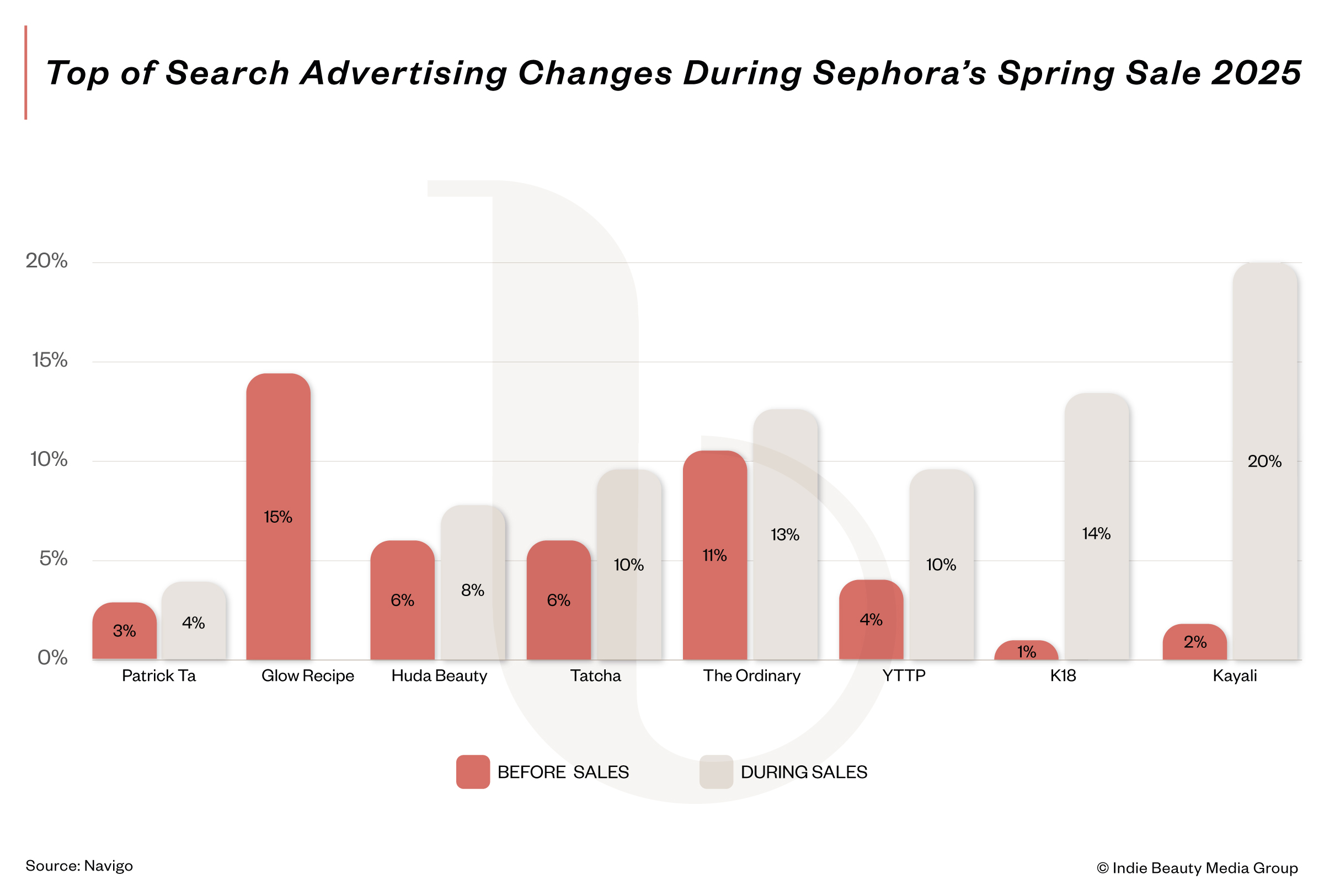

To battle the noisy competition and challenges to its e-commerce, Sephora poured digital marketing dollars into spotlighting brands in its Savings Event such as Kayali, K18 and Youth To The People. St. John asserts the retailer has an uphill battle online. Data from Navigo Marketing tracks organic search falling on Sephora’s site, and brands that are paying for placement on it garnering less return on their investment as they fight for fewer eyeballs. Specifically, organic search declined 22.4% from April 4 to 9 from the year-ago period, while sponsorship activity increased 8.6%.

Navigo Marketing finds the brands with strong performances online during Sephora’s spring Savings Event relied heavily on paid media, with the exception of Rare Beauty, which didn’t participate in any paid media placements. Over 55% of Ouai’s and Kérastase’s keyword searches were paid, according to Navigo Marketing. Charlotte Tilbury and Amika were close behind.

Ulta’s Spring Haul event, which ran from March 28 to April 5, boosted organic search on its site 11%, with paid media activity growing 131.8% year over year, according to Navigo Marketing. Following its biannual 21 Days of Beauty promotion, Spring Haul offered savings of up to 40%.

“Ulta is fighting back with their marketplace that’s coming out later this year and leaning more heavily into paid sponsorship on their site. That’s how they’re trying to make up dollars. Sephora is way, way behind. They’re seeing search decrease on their platform and they’re seeing their sponsorship isn’t nearly as effective as Ulta and Amazon sponsorships,” says St. John. “So, the brands that are on sephora.com are getting squeezed more and more because of Sephora’s inaction around losing market share to Amazon.”

Leave a Reply

You must be logged in to post a comment.