ShopMy’s Playbook For Transforming Content Creators Into Salespeople For Beauty Brands

ShopMy was literally and figuratively crowned influencer monetization royalty Monday when Meghan Markle launched a page on its platform with 25 high-low beauty picks, including RMS Beauty’s Luminizer, CND Shellac’s Satin Slippers, Saie’s Glowy Super Gel, Lottabody’s Control Me Edge Gel, Laneige’s Lip Sleeping Mask and Saint Jane’s Luxury Lip Oil, which promptly caused a 600% spike in traffic to the brand’s website and a 50% surge in sales of its lip oils.

While most personalities in its realm certainly don’t have the Duchess of Sussex’s power to instigate purchases—several items listed on her page immediately sold out—she speaks to the type of influencers and brands in ShopMy’s court. Among the more than 200 brands active in Opportunities, a program it launched last year offering creators fees on top of their regular commissions, are beauty’s notable up-and-comers like Crown Affair and Dr. Diamond’s Metacine. According to ShopMy, the latter netted $30,000 in sales and a return on investment of 6.4X from a recent Opportunities effort. The company estimates Opportunities’ cost per click at 40 cents, 53% lower than Instagram advertising.

Founded by Harvard University- and MIT-trained technologists Tiffany Lopinsky, Harry Rein and Chris Tinsley in 2021, ShopMy raised $77.5 million in a series B round in January at a valuation of $410 million, up from an $80 million valuation in March 2024. All told, ShopMy has raised $99.4 million over three rounds. Its valuation still pales in comparison to its biggest rival, LTK, formerly known as LikeToKnow.it and RewardStyle, which received $300 million in funding in 2021 at a $2 billion valuation, but its prestige positioning and promise of ongoing rewards to both brands and influencers has it nipping on 14-year-old LTK’s heels.

Beauty Independent chatted with Lopinsky about requirements for participating in ShopMy’s programs, shifting commission rates, Substack and converting influencers into salespeople.

If I’m a beauty brand that wants to get on ShopMy, what should I know about it?

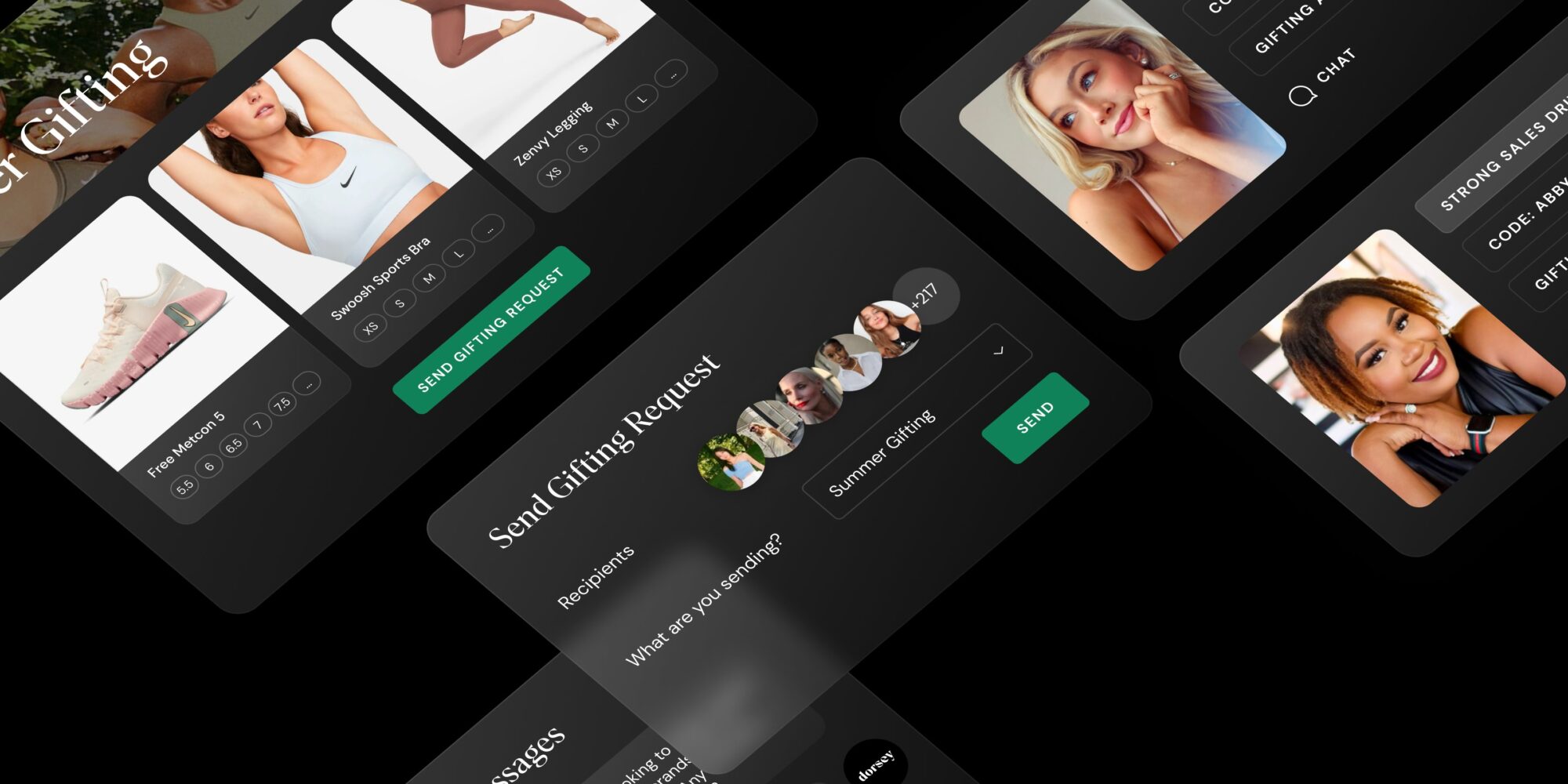

We have about 50,000 brands that we just have a commission rate with, and we have about 650 brands using our platform to build, grow and maintain a distributed salesforce. So, it’s everything we’ve been doing on influencer creator front and taking that lens of, this is actually a salesforce. My job on the platform is to find people who could sell for the brand really well and introduce them to the brand usually through gifting.

We have an automatic Shopify integration for gifting, giving commission, seeing if they promote you organically. One of the main things that brands do on the platform is, once you identify someone who can sell for you, how do we keep them engaged on a consistent basis? Normally, brands have different tools to keep the salesforce selling. Of course, any new launch, they’re regifting them. They’re offering to restock things if people run out.

For beauty brands, we have Opportunities. A brand can upload X amount of budget, and it goes out to creators. Let’s say creators are earning 15%, it could be like, this month, in addition to earning 15% commission, you’re going to get X amount of bonus for sharing the brand three times. That is for beauty brands that don’t launch on a monthly cadence, but have a longer cycle. One of the annoying things about affiliate is you’re waiting for it to happen, where Opportunities can be always on.

For beauty brands in particular, one of the things that we do that’s very helpful is let’s say it’s a clinical skincare brand, you can go on and see who’s talking about other clinical skincare brands and moving product to find people who are actually a good fit rather than randomly gifting to any creator.

Are there certain thresholds brands must meet to be a part of your different programs?

We have about 100,000 creators on the platform, and they’re getting gifted to and reached out to by brands. We have to think about, when they receive this gifting request, what is going to be the percent likelihood that they accept, and after accepting it, what is going to be the likelihood that they post because they like the product?

We let any brands get set up with the affiliate side. We can’t really let every brand on [for gifting] because otherwise the creators aren’t accepting and not sharing it. We’re trying to make sure that the creators aren’t bogged down by just any random brand. We look for organic indicators. We usually look for at least 25 creators on the platform having organically mentioned them. Creators can link anything, it doesn’t matter if we have commission set up or not. Even if it’s a new brand, but they’ve already had press and other sources of validation, creators are looking at that.

Not all of them are the big Sephora brands. For example, one of the first beauty brands that actually helped us on onboard a lot of creators before they were in Sephora was Dieux. There was an incredible community of beauty creators who loved that brand, and they joined ShopMy so that they could talk about Dieux and earn commission. Then, we could obviously help Dieux find other creators to give to commission to.

What about commission rates?

They range probably between 15% and 30%. Looking across verticals, beauty definitely is on the higher side. Some brands go even higher than 30%. Of course, a lot are viewing affiliate as a growth strategy.

When you look at a brand’s influencer budget, a lot of the focus has shifted from getting posts on people’s feed or on TikTok to affiliate, whether that be giving higher commission rates and paying more out that way or doing what I was describing our Opportunities feature does of just giving people bonuses to secure guaranteed link sharing, which they can all track. The difference between a brand versus tying it to affiliate being you can go back to your CMO and be like, “This is the return that our influencer budget got.” So, we see a lot more being shifted there, and because of that, better commission rates.

How does ShopMy make money, and how’s it doing?

We make money in three main ways. One is brand subscriptions. When I mentioned we have 50,000 brands we have rates with and then about 650 that are using our dashboard, they pay a monthly fee to access it. That ranges between $1,000 and $7,000 depending on exactly which features they’re accessing.

The other bucket is the fee on transactions. Depending on how we’re integrated with the brand, we’re either on a revenue share for commission or we’re getting a fee usually like a 2.9% fee on all the transactions touching ShopMy, whether that be from the commissionable links or discount codes. The third bucket is the fee on the paid campaigns that the brands do. When they upload a budget to do Opportunities or other partnerships, we’re getting a fee on that.

Our business has been great. I’ve talked to so many CMOs that are like, “We have to figure out our ambassador program.” That’s what I see as a code word for, “We have to turn influencer into an acquisition channel, not just a brand channel.” ShopMy is the place for them to do that because we have the tool set for them to manage the salesforce as well as a pool of over 100,000 potential salespeople for them to look at. Because that shift is clearly happening in the industry, we’ve benefited from that.

What are things brands are doing that’s turning their ambassador program into an acquisition channel?

Basically, at every beauty brand, it’s someone’s job to give away product. It’s usually not tracked very well. It could be tracked in Google Sheets, but there’s no consistent database. I see every gift to someone as a chance to see if they can be a salesperson for the brand, if they can move product. If you gift without trying to tie it to affiliate or see if the person posted, it’s a waste of a gift.

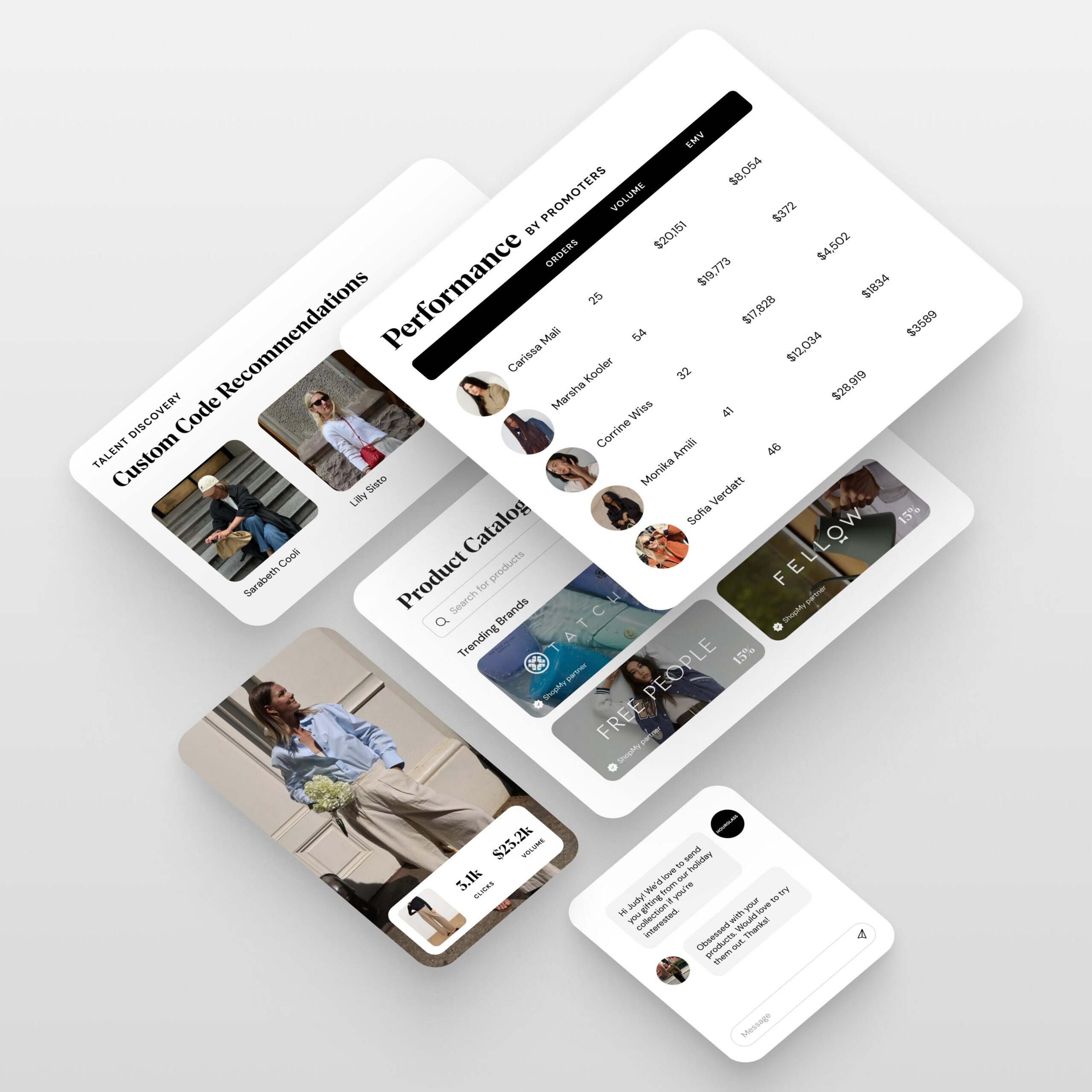

What the brands are doing on our platform is one, finding people to gift to. Let’s say they’re a smaller independent beauty brand, and they know that they resonate very well with people who talk about other smaller independent beauty brands, being able to see that and, most importantly, the amount of product they’re moving, that’s been the No. 1 thing that’s missing. The industry has basically been flying blind for the past 10, 15 years.

Someone’s follower count doesn’t tell you how much product they’re moving. The brands can see, for each person, how much product they are moving on a monthly basis. What is their AOV? What are brands they’re talking about the most?

Then, the actual work of packaging up and shipping out gifts takes so much time. We have Shopify integration that has automatic order placement. If I’m a brand and picked 100 people to gift to, made a list, sent them what we call them Lookbooks, as the creators accept them, it places an order for $0 on the brand’s website and gets shipped out like a normal order. The creators then get it, the brand knows when it got delivered, the creator gets notified, and if they like it and want to share, they’re incentivized to do so by having commission.

All of these things are not new to the industry, it’s just the connection of everything. The person who’s in charge of gifting and the person who’s running an affiliate program are at opposite ends of the marketing spectrum. Combining those two things is a big part of the platform and both can perform better if they’re leveraged as a growth function. They’re able to see after they gift who posted and drove sales. The people who drive sales, we always recommend to the brands, these are the people who you need to be communicating with and considering for Opportunities.

I get this question from beauty brands all the time: We gifted to someone, she posted, and she drove a ton of sales, now what should we do with her, and how can we get this to be more consistent? That is the whole point of Opportunities. Let’s put the good salespeople on salary to secure guaranteed coverage month-over-month, and they’re benefiting from it.

What are examples of Opportunities campaigns?

The idea of the Opportunity is they basically upload budget, and we’re looking at the people who they’ve gifted to and people who’ve talked about them previously. They put in a number of links to be shared throughout the course of the month. Let’s say it’s three links. Anytime throughout the course of April they upload say $10,000. We would say, “You should pay this creator a $300 or $1,000 bonus for three links.”

If the creator accepts it, it starts automatically tracking, so once they share the three links, they get paid. If they don’t complete it, it goes back into the brand’s budget. Again, it’s really getting the people who move product, what is the amount we need to pay them to guarantee that they’re going to do that this month?

Taking a step back, it’s meant to remove the back and forth that happens with casting campaigns. We did this webinar once with creators and brands, and one of the creators was like, “My least favorite thing when working with brands is when I have to go back and forth six times and I have to reshoot the content six times, and I just want to throw up my hands and be like, why don’t you just go hire an actress to read your script?”

That’s not really utilizing creators for what they’re good at. They’re good at knowing their audience and how to talk to their audience. Opportunities is meant to work with them in a way that is very effective. Even for someone who maybe has 1000 followers, it’s worth paying them a $15 bonus to just secure X amount of links this month. It’s scaling that whole community ambassador piece.

What do you see in terms of the content creators who are moving product?

It’s very, very, very hard to tell by looking at someone’s Instagram if they can move product or not. Even if they have great engagement on their Reels, you still don’t know. We have over $50 million a month in sales flowing through the platform. Of course, every transaction is attached to a creator. The brands are able to see, oh, she only has 2,000 followers, but she moves $30,000 a month in product sales.

If you look at our top 100 sales drivers on a monthly basis, it’s anywhere between 1,000 followers to millions. There’s a lot in that 10,000 to 500,000 range. It’s really about having the right followers, not the amount. Even if you have 9,000 followers, they could be 9,000 people who watch all your Stories and can afford the stuff you talk about.

Beauty brands have really ridden TikTok trends. Do you detect a move away from the TikTok trend overload?

What we do is almost the opposite of the trend cycle. It’s more long term. On TikTok, content being consumed on the For You Page is more based around what’s viral and trending. A lot of the product on our platform is being moved through Instagram Stories, Instagram Broadcast Channels, YouTube description boxes, Substack, people’s own blogs.

It’s more about the creators’ relationship with the audience. They can move a lot of product if it’s a brand they have been talking about for a long time and now it’s on sale. So, they’re like, the brand I talk about all the time is having a friends and family sale today. That’s why we resonate more with brands that have a higher price point because it takes a lot more education and trust to buy something that’s more expensive than something on TikTok Shop.

The trust and authenticity piece is harder to build, but it has incredible payoff when you find the right people and figure out a strategy for compensating them. It’s not about the trends, it’s truly empowering them.

You just mentioned Substack. What should brands be doing with Substackers?

We first came across Substack from seeing in the data. We saw these creators who were moving a lot of sales, and they didn’t have a ton of Instagram followers, and we were like, where are they doing this?

How brands should look at it is not that different from other creators. If they have a community on Substack, you should be finding and reaching out to these people. Because a lot of the discovery on our platform is based on how much product they’re moving, by that nature, they’re finding a lot of Substackers, and they should be gifting them and then giving commission and Opportunities as well.

If someone is paying you $5 to access what you’re saying on a monthly basis, they’re definitely clicking through your links. Those people have a lot of trust, and they are great potential people for beauty brands to get to. So, it’s been a really good platform for all of our brands, including beauty.

Leave a Reply

You must be logged in to post a comment.