Walmart Introduces The Body Lab’s Body Care Customization Concept

The Body Lab is enabling Walmart shoppers to concoct body care the way they want.

The latest customization brand from the maker of Strands, a science-driven premium direct-to-consumer brand started in 2020 using results of scalp and hair testing to individualize haircare, and The Hair Lab, a mass-market offshoot of Strands that entered the megachain in 2022 with haircare products and hair concern-specific doses, it’s rolling out to 2,000 stores with four $8.94 body washes and four $9.94 body lotions based on skin benefits and eight $1.94 fragrances doses that can be mixed with them to generate more than 35 possible scent combinations.

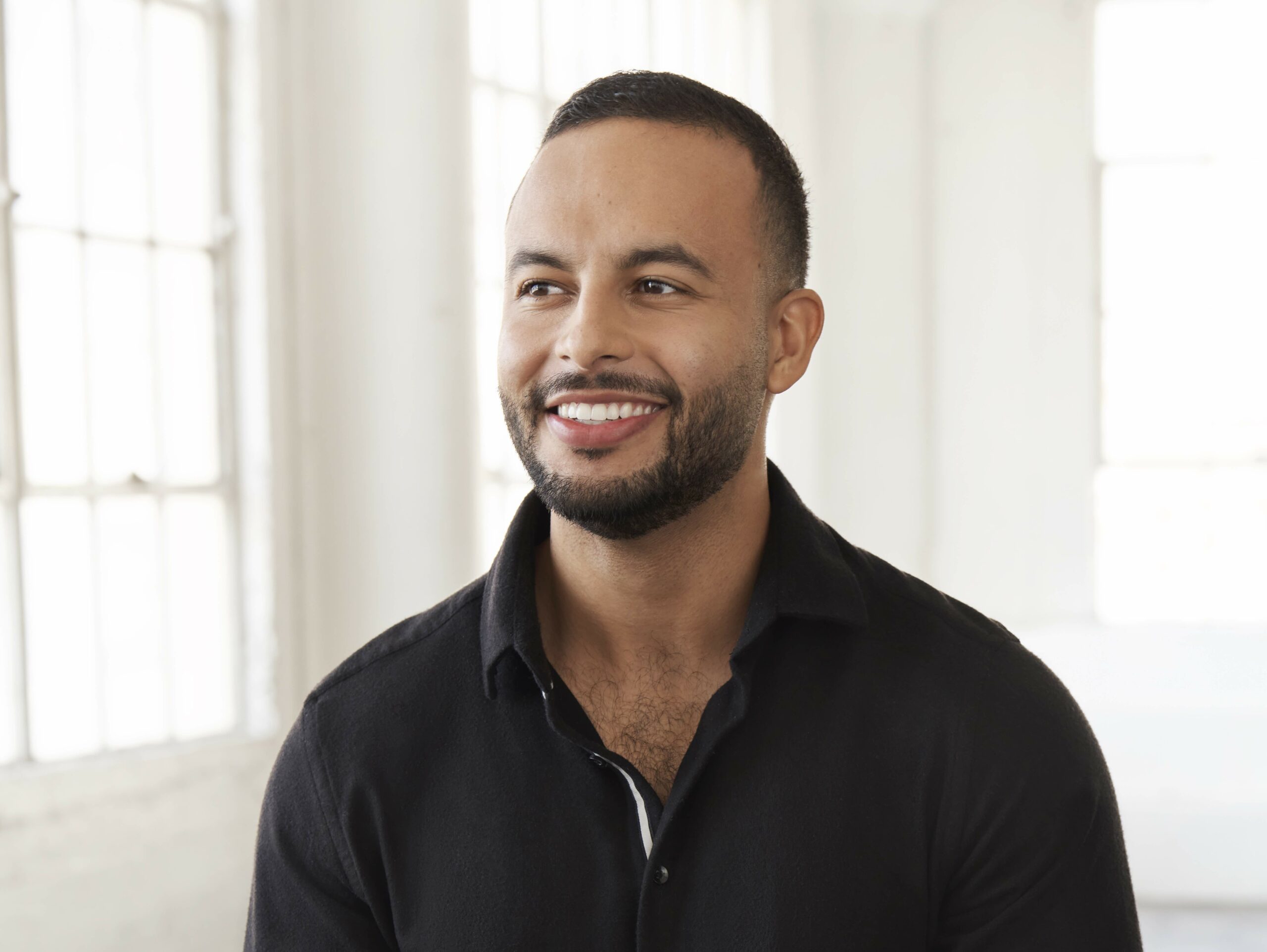

The Body Lab seeks to fill a gap in body care, a category that’s been surging of late, according to market research firm Circana, it detected between products focused on skincare benefits and products focused on fragrance. “Why does the consumer have to compromise?” asks Eric Delapenha, founder and CEO of The Body Lab, The Hair Lab and Strands. “This is prime ground for disruption through customization.”

He continues, “With customization, the promise of it is that you’re delivering a product that is matched to the consumer and through the additional investment of their time into that experience of customization, they are getting higher satisfaction and higher performance. You can’t necessarily deliver a consumer higher satisfaction by just giving them the same product they would’ve already chosen.”

The skin benefits addressed by The Body Lab’s body lotions and body washes are smoothing (the hero ingredients are glycolic and lactic acid), anti-aging (retinol and lactic acid), moisturizing (squalane and hyaluronic acid) and calming (colloidal oatmeal and bisabolol), and its fragrance doses designed to be mixed into the body washes and body lotions are French lavender, midnight jasmine, coconut milk, fresh eucalyptus, vanilla bean, sandalwood sunset, summer citrus and peach nectar.

“This is prime ground for disruption through customization.”

Pitches to retail buyers during which they’re walked through The Body Lab’s fragrance blending concept has validated it. “I’m from Jamaica, and coconut is an essential part of my fragrance. A lot of other people like coconut as well, but we all like subtle changes in coconut. I like coconut sandalwood. Another person liked coconut citrus, and another coconut eucalyptus,” he says. “The light bulb goes off in their head that, not only can I solve for the compromise of choosing between a skincare benefit and fragrance, but I can customize my fragrance to my own specific profile and create a stronger emotional connection with my product in the shower.”

In its first year on the market, The Body Lab projects it could reach $10 million in retail sales. Last year, The Hair Lab reports it eclipsed $10 million in sales. It’s in nearly 2,500 Walmart stores with three $8.94 shampoos, three $8.94 conditioners, three $9.94 leave-in conditioners, three $9.94 scalp serums and 10 dose sets priced at $2.94 each. There are two new $2.94 scalp dose sets available on Walmart’s and The Hair Lab’s websites as well.

“People shop us for two core reasons. They see themselves as an individual, and they love the idea of customization. There’s also this value play where you’re able to get up to five different claims or benefits from your haircare product at The Hair Lab for under $30 when you shop everything altogether with the doses,” says Delapenha. “If you were to get five claims going to shop the normal set in Walmart or any other store, you’re going to spend $80 to $100.”

The Body Lab doesn’t anticipate its sales being greater than The Hair Lab’s sales in the immediate future, but its sales could ultimately exceed The Hair Lab. At Walmart, body care is a bigger business than haircare, and Delapenha explains body care products tend to turn at faster rates than haircare in mass-market retail, and trial rates are higher in body care than haircare. Down the line, The Body Lab plans to encourage trial with seasonal fragrances. At $1.94 each, Delapenha believes it will be a no-brainer for Walmart shoppers to pick up seasonal fragrance doses that speak to their mood at the moment.

“I can customize my fragrance to my own specific profile and create a stronger emotional connection with my product.”

The Body Lab is informed by learnings from The Hair Lab. Early on, The Hair Lab figured its core customers would be millennial moms. However, the brand became a hit with younger consumers, and today consumers 25 years old and under account for around half of its customers in DTC distribution. Millennial moms make up 35% of its customers. The Hair Lab’s online hair diagnostic, including a question about age, has been done over 1 million times. Visitors to The Hair Lab’s site can click on a tab to land on The Body Lab’s site.

To appeal to gen Z and gen alpha consumers, The Body Lab’s packaging is different from The Hair Lab’s packaging. Gen Z and gen alpha customers viewed The Hair Labs packaging as too clinical. To be less clinical, The Body Lab’s fragrance dose packaging contains vibrant images of the ingredients constituting the fragrance notes. Its body wash and body lotion bottles feature vivid colors that fade upward to white to represent the blending process and graphics of the fragrance doses being mixed into the body washes and body lotions.

As it was pursuing millennial moms, Delapenha says The Hair Lab “spent a lot of money out the gate working with different marketing agencies that were doing our paid ads and influencers, and none of that worked right until we really brought it in-house.” Now, with its in-house marketing and advertising efforts, The Body Lab and The Hair Lab are leaning into TikTok and Instagram Reels, smaller content creators and an ambassador program established three months ago that has surpassed 2,000 ambassadors.

The Hair Lab and The Body Lab are expanding beyond Walmart in mass-market retail, and retail launches are slated for later this year and next year. The company behind the brands has reached roughly breakeven and is on pace to be profitable month-over-month in two months. It’s raised almost $10 million in funding, and KarpReilly, backer of Freck, Izzy and Mother Science, is among its investors. Delapenha says, “Given our profitability profile, we don’t expect the need to fundraise going forward.”

Leave a Reply

You must be logged in to post a comment.