Weedwashing: How Brands Are Trying To Cash In On Beauty’s Biggest Trend

Cannabis beauty moved precipitously from the fringes to the mainstream last month when two formidable beauty players, Origins and Andalou Naturals, plunged into the category previously reserved for independent beauty and wellness brands willing to take chances on a risky ingredient.

The fresh crop of pot beauty newbies, which includes upcoming Sephora entrant High Beauty, has glommed onto bud buzzwords and catchphrases like “calm,” “destress” and “blissed out,” and filled formulas with compounds such as hemp stem cells that capitalize on the cannabidiol (CBD) trend, but don’t incorporate CBD, a non-psychoactive cannabis constituent derived from hemp plants.

With the green rush sweeping multiple industries, beauty brands big and small are angling to get a piece of the action. As they vie for store shelves and CBD consumer dollars, the marketing of cannabis beauty products is being increasingly questioned by cannabis insiders calling beauty brands’ bluffs. They assert weedwashing is becoming rampant as beauty products without CBD purport to have the attributes ascribed to it and attempt to cash in on the CBD curious without satisfying their CBD curiosity.

“It’s actually riding the wave of the benefits that people use CBD for both topically as well as internally,” says Dorian Morris, founder of Undefined Beauty, a brand using a CBD isolate in its skincare. “They’re like, ‘Let’s look at all the CBD benefits and figure out which words we can use from a claim standpoint.’ They’re basically assuming that consumers are going to see ‘cannabis’ or ‘cannabis skincare’ and automatically assume it’s CBD.”

Often with marijuana leaf-adorned packaging covered in green-hued text, recent launches are formulated with CBD-less hemp seed oil. Andalou Naturals’ CannaCell range, Origins’ Hello, Calm mask, Milk Makeup’s Kush High Volume Mascara, High Beauty’s collection and even pot beauty stalwart The Body Shop’s hemp assortment are produced without a trace of CBD.

“There’s certainly benefits of hemp seed oil when you use it [to] cook, but hemp seed oil does not have the cannabinoids, terpenes and phenols that the concentrate has, and that’s where the real medicinal and healing benefits come from. [Hemp seed oil is] just the same as any other cold-pressed unrefined organic oil like rosehip oil, raspberry seed oil and jojoba oil. What we’re talking about is a completely different thing.”

Beauty Independent reached out to Origins and Andalou Naturals for comment about the possibility that they are misleading customers by selling cannabis beauty products that don’t contain CBD. Andalou confirmed that the hemp stem cells in its CannaCell range don’t include CBD, but didn’t specifically comment on the issue of consumer confusion. Origins declined to comment.

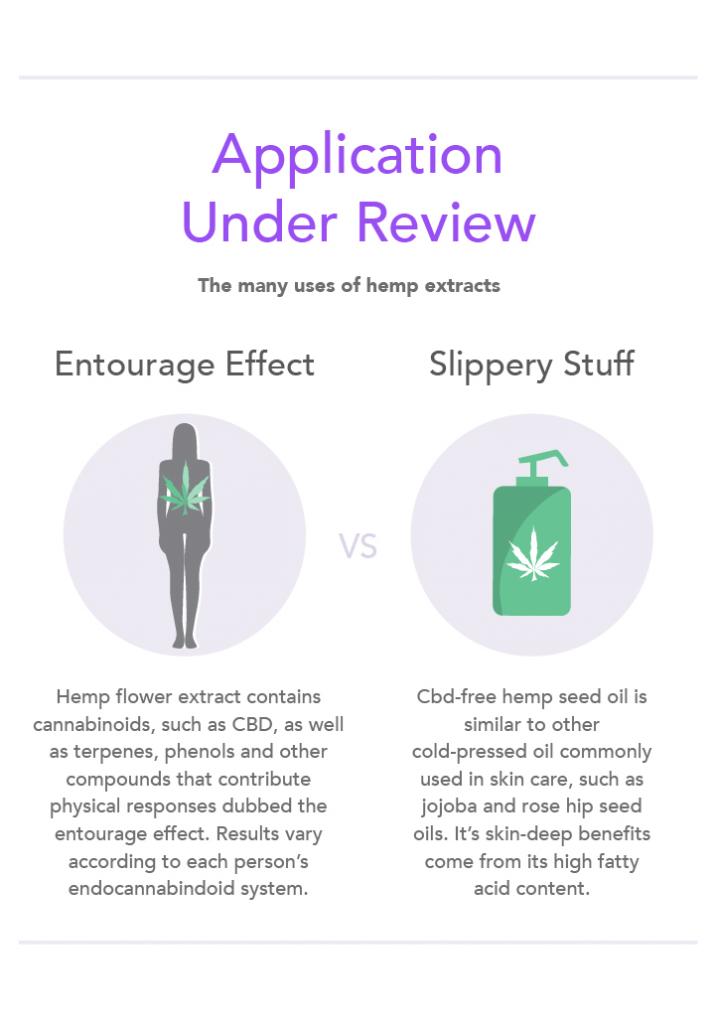

A growing body of study backs up the benefits of CBD for chronic pain, post-traumatic stress disorder, anxiety and skincare concerns such as acne. It’s extracted from the flowers of cannabis plants, and isn’t found in hemp seed oil, hemp oil or hemp concentrate extracted from the seeds of hemp plants—ingredients that are cheaper than CBD and spreading across the skincare space.

“It’s a difference between pressing the seeds versus pressing the flowers, and it creates a completely different product with a completely different profile,” explains longtime beauty ingredient safety and cannabis activist Jessica Assaf. “There’s certainly benefits of hemp seed oil when you use it [to] cook, but hemp seed oil does not have the cannabinoids, terpenes and phenols that the concentrate has, and that’s where the real medicinal and healing benefits come from. [Hemp seed oil is] just the same as any other cold-pressed unrefined organic oil like rosehip oil, raspberry seed oil and jojoba oil. What we’re talking about is a completely different thing.”

With the CBD craze in its infancy, consumer awareness about the difference between hemp seed oil and hemp oil is low. Brands with products lacking the substance, but positioning their marketing messaging around it are taking advantage of the lack of consumer comprehension.

“It’s a bit alarming from a consumer standpoint,” says Morris. “Education is going to be important, knowing that hemp seed oil or cannabis sativa oil comes from the seed, which is a very moisturizing botanical, but is not going to give you the same benefits that CBD does. The onus is going to be on brands like mine and others within the category to teach the consumer that CBD has so many more benefits than its cousin, hemp seed oil. The ones that I focus on from an education standpoint are the antioxidants and the anti-inflammatory benefits. It’s three times as antioxidant rich as vitamin c.”

“The onus is going to be on brands like mine and others within the category to teach the consumer that CBD has so many more benefits than its cousin, hemp seed oil.”

As more established companies introduce CBD-free products promoted with cannabis-conjuring names, imagery and copy, it’s likely that consumers’ initial experience with weed-centered beauty won’t deliver the benefits that are believed to result from full-spectrum cannabinoids. The so-called entourage effect, the ideal outcome of CBD proponents say is only capable through employment of the whole plant, isn’t possible with ingredient decks sans full-spectrum CBD.

Assaf, who’s launching an online cannabis education platform and product line, Prima, later this year, argues consumer disappointment stemming from use of CBD-style products without CBD is troubling for the entire CBD segment. “If their first experience with hemp is through a product that’s just made with hemp seed oil, it’s doing a disservice to the true impact and benefit of the plant because you’re only going to experience the superficial benefits of fatty acids as opposed to cannabinoids, which are found in our bodies and perfectly bind to receptors in our bodies to promote homeostasis,” she says. “It’s like scratching the surface versus really changing our system and allowing us to feel radically better.”

Some brands with products featuring CBD are considered by cannabis experts to be weedwashed, too. They advertise products as supplying the benefits of CBD, but the products don’t have sufficient doses to produce the desired effects. It’s unclear exactly the correct dosages, though, that are required to achieve those effects. Additional research is needed to ascertain definitive dosage levels. Still, experts are beginning to lay out dosage guidelines for consumers.

Dr. Annabelle Manalo and Assaf state topical CBD formulations for inflammation and pain relief should contain at least 500 milligrams of CBD to be impactful. “These 50-milligram creams, 100-milligrams creams, they’re just on the market to make a quick buck. Unfortunately, that’s 95% of the market,” says Manalo. Assaf advises consumers to look at the other ingredients in product formulations because certain carrier oils, specifically MCT or medium-chain triglyceride oil, ramps up the bioavailability of CBD. “It’s not enough to just think about milligrams per dose,” she says.

Pinpointing correct dosages is complicated by the individual nature of reactions to CBD. “Everybody’s different, how their skin and their endocannabinoid system reacts to cbd being introduced,” says Victoria England, founder of Tulip, a brand with skincare and body-care products infused with full-spectrum CBD. “Some people have never had that relationship happening in their body before, and it could take a little time for the receptors to really start working.” Assaf agrees, and suggests the consumers should experiment to figure out what works for them.

“These 50-milligram creams, 100-milligrams creams, they’re just on the market to make a quick buck. Unfortunately, that’s 95% of the market.”

“Sprinkling in cannabinoids at the end of a formulation will not do anything and is just for marketing purposes,” she says, emphasizing, “I may take a CBD product and fall asleep, whereas you may take a CBD product and stay awake because our bodies are so different. Part of this is understanding your own individual system and demanding the information, so you know you’re getting the best cannabinoid profile, which translates to the best chance of feeling better.”

CBD information — or misinformation — is proffered against the backdrop of a legal landscape that makes it hard for consumers to distinguish between products that do and do not have CBD. Up until last month, when the DEA moved some cannabidiol to a Schedule 5 drug classification characterized by a low potential for abuse, all CBD was classified as a Schedule 1 illegal substance. Schedule 1 drugs like heroin and cocaine are deemed to not have medical applications and have high potential for abuse. Robitussin AC is a Schedule 5 drug.

This strict government treatment of CBD has led to the e-commerce payment processing of companies selling CBD products to be shut down without warning by federally-backed banks. To steer clear of shutdowns, brands formulating with CBD have avoided the word “CBD” in packaging or marketing materials, opting to swap it out for terms like “hemp extract.” The verbiage swaps lump brands with CBD products into the groups of brands like Andalou and Origins with CBD-free products harnessing the CBD trend.

“I’ve chosen not to put CBD on my packaging, so that people can sell it and not be at risk,” says England, reporting that not putting CBD on the packaging has helped with retail pickups. “I’ve had some larger retailers wanting to bring it in and looking at it like, ‘Well it doesn’t say CBD on in it, let’s just bring it in.’ That mentality actually works.” In the absence of the word “CBD” appearing on a product, Assaf and Morris counsel consumers and retailers wanting clarification on whether a pot-y looking product contains CBD to check ingredient lists for terms like cannabidiol, full-spectrum hemp or PCR, which means phytocannabinoid-rich, hemp oil or PCR hemp extracts.

“Even your top name brands that are making hundreds of millions of dollars a year, what they say is in the bottle is not in the bottle. A lot of these products, we’re finding, aren’t made in proper facilities. It’s a really cloudy industry all across the board.”

Partially due to the legal ambiguity surrounding CBD, companies get away with broadcasting their products contain amounts of CBD that are not really in the formulations. Manalo has tested roughly 200 products and discovered the dosages in them fell short of what was declared by the brands behind them. She says, “Even your top name brands that are making hundreds of millions of dollars a year, what they say is in the bottle is not in the bottle. A lot of these products, we’re finding, aren’t made in proper facilities. It’s a really cloudy industry all across the board.”

Beauty and wellness brands trying to be on the up and up can conduct third-party testing, and supply information on testing to consumers and stores. Tulip conducts third-party lab testing for its CBD products. “We test for CBD potency so we can prove it’s in there,” says England. Malano urges brands to go a step further and place third-party certification paperwork in product packaging. “We should define what’s in the bottle by showing some certificate of analysis,” she says. “I liked the idea of an inlet that could show a link to results of where the hemp or cannabis is grown. Is it organically grown? Can you show me that it was grown there? You say there’s 500 milligrams of CBD, just prove it.”

Regulation is emerging, and dispensaries in a handful of states, namely Nevada, California and Oregon and Washington, require hemp handlers to produce certificates to prove traceability and certificates of analysis. Beefed-up regulation in the form of paper trails is welcome, but it’s not a panacea for quality control. Christie Tarleton, a hemp farmer and co-founder of Yuyo Botanics, a specialist in sublingual CBD tinctures and topical creams, has detected falsified certifications.

“Anyone can provide a certificate of analysis, and we’ve run into where people have been falsifying their certificates of analysis,” she says, stressing that smaller CBD companies should connect one-on-one with customers and tell their stories openly to gain trust. On top of Yuyo Botanics’ control over the farming of the hemp in its products, the extraction of the CBD tapped for its products is done by a family-run operation down the road from the farm. Photos of the farm are on the brand’s website.

“We want people to trust that what we’re doing is meaningful. We’re helping people. We’re not sketchy,” says Tarleton. “Transparency is what people need to navigate this space.”

“We want people to trust that what we’re doing is meaningful. We’re helping people. We’re not sketchy. Transparency is what people need to navigate this space.”

England, whose husband is a second-generation hemp farmer, echoes Tarleton’s sentiment. She says independent companies making quality CBD products can leverage their backgrounds to separate themselves from the industry behemoths jumping on the weed movement for easy money. “The small indie brands that don’t have a lot of big investors or they’re not in big retailers yet [are] able to do the real work because they don’t have people telling them no or legal saying, ‘We can’t do this,’” she says. “Companies that that are up there and have big contracts with Sephora, I’m sure they don’t want companies like mine to be successful. That’s going to blow them out of the market because they don’t have an authentic story.”

Indie brands, of course, aren’t immune to the practice of weedwashing. Assaf, England and Morris cited Herbivore Botanicals’ recent Instagram announcement of its “greenest product yet,” a hemp seed oil product, as an example. The post racked up over 700 comments, notably those from consumers noting hemp seed oil doesn’t contain CBD and calling out Herbivore for using misleading terms like “blissed-out skin” and “a glow that’s lit” to publicize a product with no CBD. Contacted for comment on the product, a representative for Herbivore Botanicals informed Beauty Independent that the brand is placing the production of it on hold for the moment “pending reformulation.”

CBD authorities contend the issue of weedwashing will worsen before it improves as CBD’s momentum and the chase for profits from it soars. “A lot of big companies want to do CBD products, but they’re doing this to gain traction and attention around the fact that they’re going to do cannabis products, but they’re actually not doing it,” says England. “I think that’s deceiving.”

Takeaways

- Many new cannabis beauty products are being formulated with hemp seed oil, an extract that does not contain CBD or cannabidiol, the substance believed to be responsible for benefits such as pain relief, and the reduction of stress and anxiety.

- Some cannabis advocates argue the companies launching CBD-free products are intentionally capitalizing on a lack of consumer knowledge about the difference between CBD and hemp seed oil by using marketing messages related to CBD.

- The consumer confusion and marketing obfuscation involving CBD are taking place against the backdrop of a shifting legal landscape for the ingredient. Until recently, all CBD was classified as a Schedule 1 illegal substance under federal law. Some CBD has now been classified as Schedule 5, which indicates low potential for abuse. Robitussin AC is a Schedule 5 drug, too.

- For a topical CBD formula claiming to relieve skin redness and inflammation, experts suggest consumers look for at least 100 milligrams of CBD per ounce of product. For pain relief, there should be at least 300 milligrams of CBD per ounce of product.