All In On Weight Loss, Hims & Hers Shakes Up Teledermatology With Sudden Closure Of Apostrophe

Hims & Hers spent an estimated $16 million to run a 60-second Super Bowl commercial on Feb. 9 in which, against the backdrop of Childish Gambino’s “This is America,” it railed against the American health care system propping up profits at the expense of patients with pricy branded weight loss drugs and promoted its affordable alternatives, eliciting a backlash from lawmakers about omitting safety warnings and social media critics about fat-shaming.

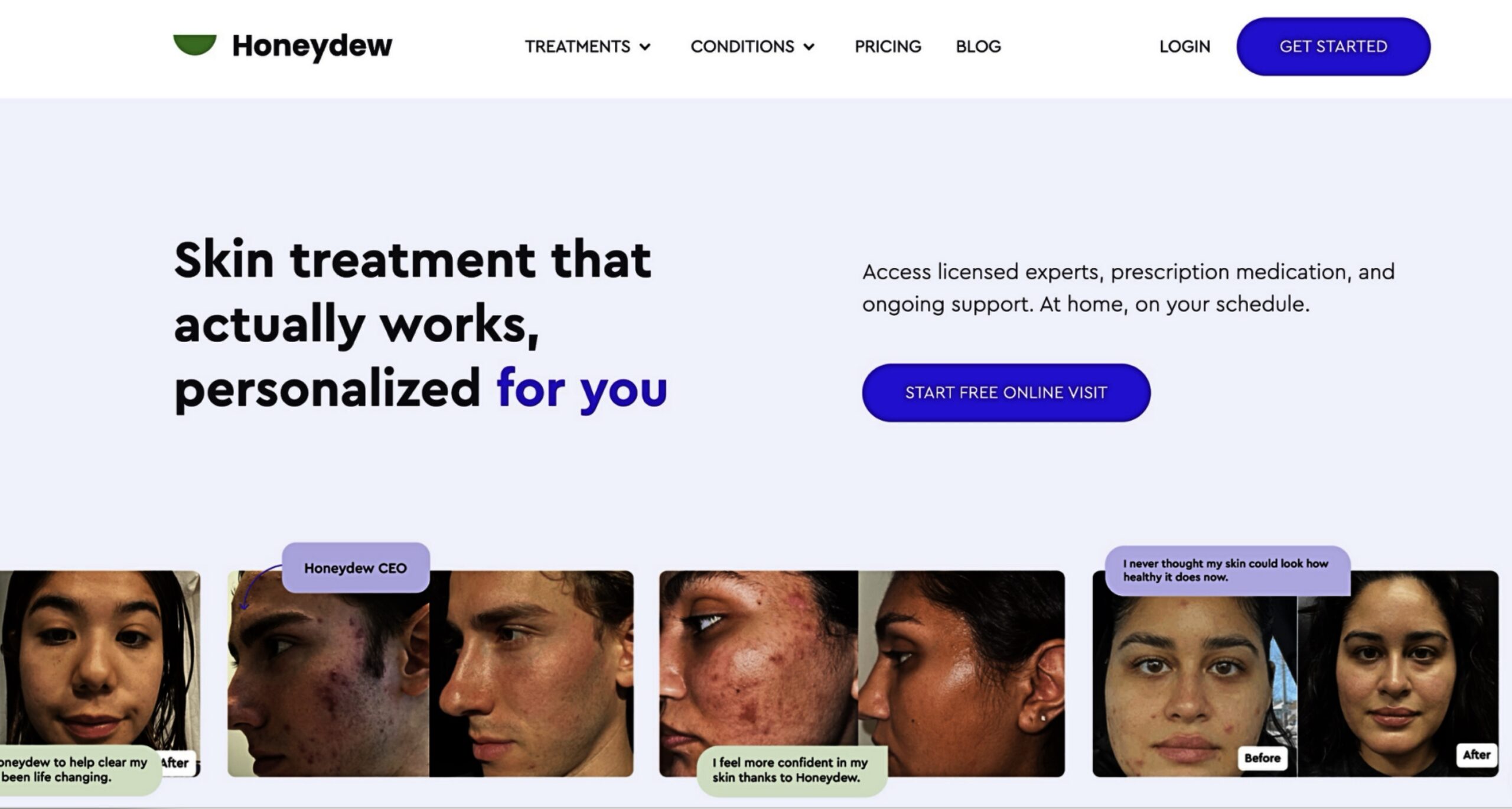

Beyond the backlash and the irony of a company with 79% gross profit margins in 2024 attacking pharmaceutical companies with similar gross profit margins, the commercial stood out to David Futoran, co-founder and CEO of acne treatment startup Honeydew, for its silence on erectile dysfunction and hair loss, categories responsible for most of Hims & Hers’ sales, not to mention skincare prescriptions, an area it dedicated $190 million to in 2021 to buy teledermatology service Apostrophe. This year, Hims & Hers envisions erectile dysfunction, hair loss and skincare accounting for two-thirds of its predicted $2.3 billion to $2.4 billion revenues.

“Those massive business lines have been less prioritized than weight loss,” says Futoran. “They are all in on weight loss.”

More evidence of Hims & Hers being all in on weight loss came Friday, when the company abruptly announced its termination of Apostrophe, first with an Instagram post quickly riddled with hundreds of comments from frustrated people worried about how they’re going to obtain their prescriptions and later with an email. The email informed customers their subscriptions would be promptly cancelled and refunds for those entitled to them were to be processed in the next few weeks, but the Apostrophe platform would be disabled in 30 days. They could start a free online visit with a Hims & Hers provider, but Hims & Hers doesn’t offer all the same treatments as Apostrophe.

“This is a very surprising turn of events,” says Tony Hommes, an Apostrophe customer and skincare content creator with the handle capri.corneum on Instagram. “I know they were acquired by Hims & Hers in 2021, but if that platform was completely absorbing the Apostrophe infrastructure, why isn’t it ready to go? Why wouldn’t they want to retain subscribers by transferring them to the new platform instead of canceling subscriptions and upsetting their customer base?”

Apostrophe’s seemingly hasty closure raises questions about the future of teledermatology as several companies playing in it maneuver for a slice of the weight loss market projected to surpass $150 billion in under a decade. Like Hims & Hers, GoodRx and Nurx span skincare and weight loss drugs, among several categories. Forecast to reach $8.17 billion by 2030 in the United States, up from $3.01 billion in 2022, the teledermatology business is a fraction of the weight loss business. Hims & Hers estimates there are 100 million obese Americans. Half that amount has acne.

As it pivoted to weight loss last year, Hims & Hers’ share price soared 172% and reached an all-time high of nearly $73 in February this year. Lately, the stock has slumped, and it was down around 45% from its high to $39.95 on Friday. The slump has been chalked up to price reductions of Wegovy, Ozempic and Zepbound, and the U.S. Food and Drug Administration declaring an end to shortages of branded GLP-1 drugs that allowed patients to get compounded alternatives.

Still, Wall Street places a premium on Hims & Hers’ subscription-based healthcare model. On Friday, its market cap stood at $7.85 billion, while the market caps for beauty companies Coty, Edgewell and E.l.f. Beauty, respectively, were roughly $5 billion, $1.6 billion and $4 billion. When it went public via a special purpose acquisition company or “blank check” company in 2021, Hims & Hers was valued at $1.6 billion. Now, it has 2.2 million subscribers and anticipates it will have 10 million in five to six years.

In light of Apostrophe’s comparatively small total addressable market, Drew Fallon, CEO and co-founder of Iris Finance, a financial platform for consumer brands, thinks Hims & Hers made the right choice to ditch it. “Apostrophe is in a hard market to differentiate from, and I believe that Hims & Hers should continue to focus on becoming the digital distribution node for modern advancements in medicine, not necessarily beauty products like Apostrophe,” he says. “They also will want the market to value them as a health tech company, and this further strengthens that positioning.”

“This is a very surprising turn of events.”

Teledermatology’s size is hardly nothing—every person has skin—and it’s even larger as teledermatology startups are exposed to the nonprescription skincare industry worth $26 billion. Apostrophe’s exit from it leaves competitors Curology, Musely, Dermatica, Script, Heyhoney and a forthcoming offshoot of Il Makiage owner Oddity angling for its customers and dominance. Musely is offering 30% off acne treatments for Apostrophe customers, and Curology and Honeydew representatives have been active on Apostrophe’s social media reminding people about their services.

Jack Jia, founder and CEO of Musely, argues Apostrophe’s limited scope hurt it. Although it offered an array of medications for acne, rosacea, eczema and anti-aging, he contends its reliance on acne medications as the main source of its revenues was insufficient for long-term success. Musely has products for anti-aging, breakouts, hyperpigmentation, haircare and body care, and Jia discloses its profitably achieved 160X growth in six years with a few million dollars in total cash burn.

“The acne treatment market for young people ages 13 to 25 is saturated with telehealth providers, capped at a finite $2 billion market size in the U.S. Apostrophe’s closure follows the major struggles of Proactiv and Curology, highlighting the challenges of sustaining growth in this segment,” he says. “In contrast, the broader skincare and wellness market is expanding rapidly, with increasing demand from middle-aged consumers ages 30 to 90.”

With sales spiking at Honeydew, where they multiplied 7X from 2023 to 2024, Futoran doesn’t envision the exodus from Apostrophe moving the needle for its business significantly. “I am sure we will get some new customers that are transferring their care from Apostrophe,” he says. “I’m not sure how impactful those numbers will be on our business. The market is so big, and there are so many people that don’t have access to care.”

Apostrophe was launched as YoDerm in 2012 by Chris Minnich, Ryan Hambley and Ben Holber, who served as CEO until its closure, and rebranded as Apostrophe in 2017. In a country where it can take weeks to see a dermatologist in the office, it speedily matched patients with dermatologists to recommend treatment plans, and along with that function, built a compounding pharmacy to produce customized oral and topical dermatological medicines. It raised under $7 million pre-acquisition. By contrast, Curology has reportedly raised at least $84 million and profitably achieved $200 million in 2022 sales.

Before it sold to Hims & Hers, under the guidance of then head of brand Lisa Guerrera, co-founder of skincare brand Experiment, it grew its name recognition second only to Curology in the teledermatology field and assembled a network of influential skincare authorities like Dieux co-founder Charlotte Palermino, Naturium co-founder Susan Yara and dermatologist Muneeb Shah to cosign on its medications. Guerrera says, “Our biggest competitive advantage was efficacy.”

But Hims & Hers had skincare prior to Apostrophe—and it will have it after. Rather than Apostrophe’s skincare, Futoran figures its compounding pharmacy was at the center of Hims & Hers’ deal for it. “I don’t think they even cared much about skincare when they bought Apostrophe, and I think they kept Apostrophe running for so long because it was a profitable company,” says Futoran. “They were making money, but given how low of a priority it was, they never fully integrated it and fully invested in it.”

With its compounding facility, Apostrophe was able to tailor prescriptions in a fashion its competitors didn’t. Hommes mentions his Rosacea Triple Cream from Apostrophe has a combination of the ingredients azelaic acid, metronidazole and ivermectin not available at other teledermatology services he can use.

“It feels to the consumer that they are getting the dermatologists at home by buying their products.”

“Apostrophe’s point of difference was their options and customization. You could select ingredients you wanted if you had the knowledge or they would recommend something, whereas Musely has set formulas they don’t really change,” says Hommes, adding the service that will gain from Apostrophe’s exit will be “whichever one has the most options for treatments will get the customers since they want to continue what works for them, and if one service doesn’t offer their particular treatment, they’ll look elsewhere.”

Chasing growth, teledermatology providers have looked to cosmetic products. Curology entered Target in 2022 with a skincare line. Apostrophe developed a sunscreen it could’ve possibly extended to retail, but Hims & Hers hasn’t had tremendous results in its five years wholesaling products. Last year, it generated $1.4 billion in online sales and just $38.6 million in wholesale sales. In stores, teledermatology providers encounter crowds of both established and insurgent skincare brands, notably those from dermatologists.

Guerrera posits the onslaught of dermatologists on TikTok and with their own brands has weakened the positions of teledermatology providers. She says, “There’s so much more access to dermatologists now online not in a one-to-one setting, but in a one-to-many setting, and you see so many dermatologists launching brands—Dr. Shah and Dr. Idriss—and I think the lines have blurred a lot where, instead of dermatologists trying to get more people to come to them, in a way it feels to the consumer that they are getting the dermatologists at home by buying their products.”

Outside of consolidation, Guerrera doesn’t detect a path forward to substantially greater growth for teledermatology providers. “Apostrophe was one of the few companies that was, when I was there, poised to go further in terms of what we could prescribe because we had real dermatologists and were able to prescribe oral as well as topical solutions,” she says. “Now other companies can do that as well, and I don’t see it going much further because the next steps for dermatologists are in-person things.”

Anna Chacon, a dermatologist formerly contracted by Apostrophe and Hims & Hers, reasons Apostrophe’s closure “reflects broader trends and challenges within the telehealth sector, including market consolidation and the evolving landscape of consumer needs and expectations.” Exploding amid the pandemic, telemedicine has declined from its pandemic peak and faces uncertainty with Medicare coverage possibly stopping. Despite the shifts, by 2026, 25% to 30% of medical appointments in the U.S. are on course to be handled by telemedicine.

Between Musely, Curology, Dermatica and Honeydew, Chacon suggests the winner will best balance technological innovation, user experience and effective clinical outcomes. In general, she concludes teledermatology providers that prosper will deftly personalize treatments, integrate with a range of healthcare services, zero in on customer engagement and satisfaction, and harness artificial intelligence and machine learning to improve the accuracy of virtual consultations.

“Teledermatology is well-positioned to continue its growth trajectory, driven by the increasing demand for dermatological services and the convenience factor,” says Chacon. “The visual nature of dermatology makes it particularly suited for telehealth as many skin conditions can be effectively diagnosed and managed through high-quality images and video consultations.”

Acknowledging telemedicine has tempered from its pandemic levels, Futoran remains confident in its acceleration and Honeydew’s business concentrating on serious skin conditions that require prolonged treatment. “People are realizing not only can I do more simple medications online, but I can manage something like Accutane online. Why do I have to go to the dermatologist every 30 days to get a refill of my medicine that I’m going to be on for eight to 12 months?” he says. “People need access to medical care for their skin, and they can’t get it. I don’t think we’ve done enough to help people.”

Leave a Reply

You must be logged in to post a comment.