XRC Ventures Expects Wellness Deal Activity To Pick Up

After a slowdown in vitamin and supplement brand deals, XRC Ventures predicts activity will pick up over the next two to four years.

As covered in the venture capital firm’s second quarter report on health and wellness, the prediction is based on investor enthusiasm for the space, big trends such as longevity and GLP-1 adoption that could lift consumer demand for the foreseeable future, and strategic buyers’ unsatiated appetite for transactions. The report highlights a survey from management consultancy McKinsey & Co. finding that 82% of Americans consider wellness a top priority in their everyday lives, and data from retail and consumer insights provider SPINS showing that 77% of them regularly take vitamins and supplements, which constitute a $60 billion-plus market.

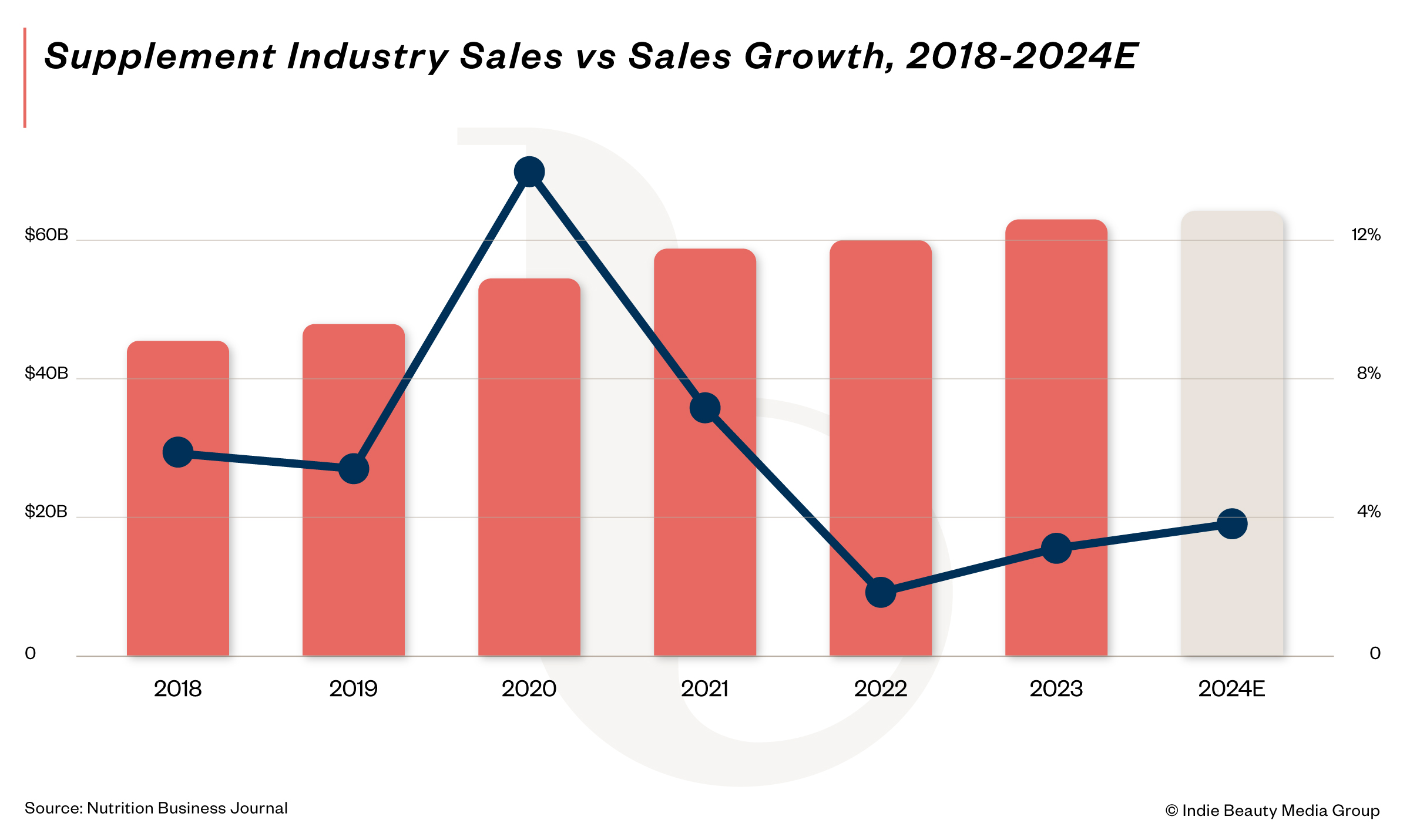

“Health and wellness are the new wealth,” writes XRC Ventures, noting sales of vitamins and supplements increased 3.9% last year following a meager 1.9% bump in 2022. The firm explains, “VMS sales boomed during the pandemic as consumers invested in health but faced a hard landing in 2022. VMS sales started to normalize in 2023, and we think growth will continue in 2024, driven by both dollars and units.”

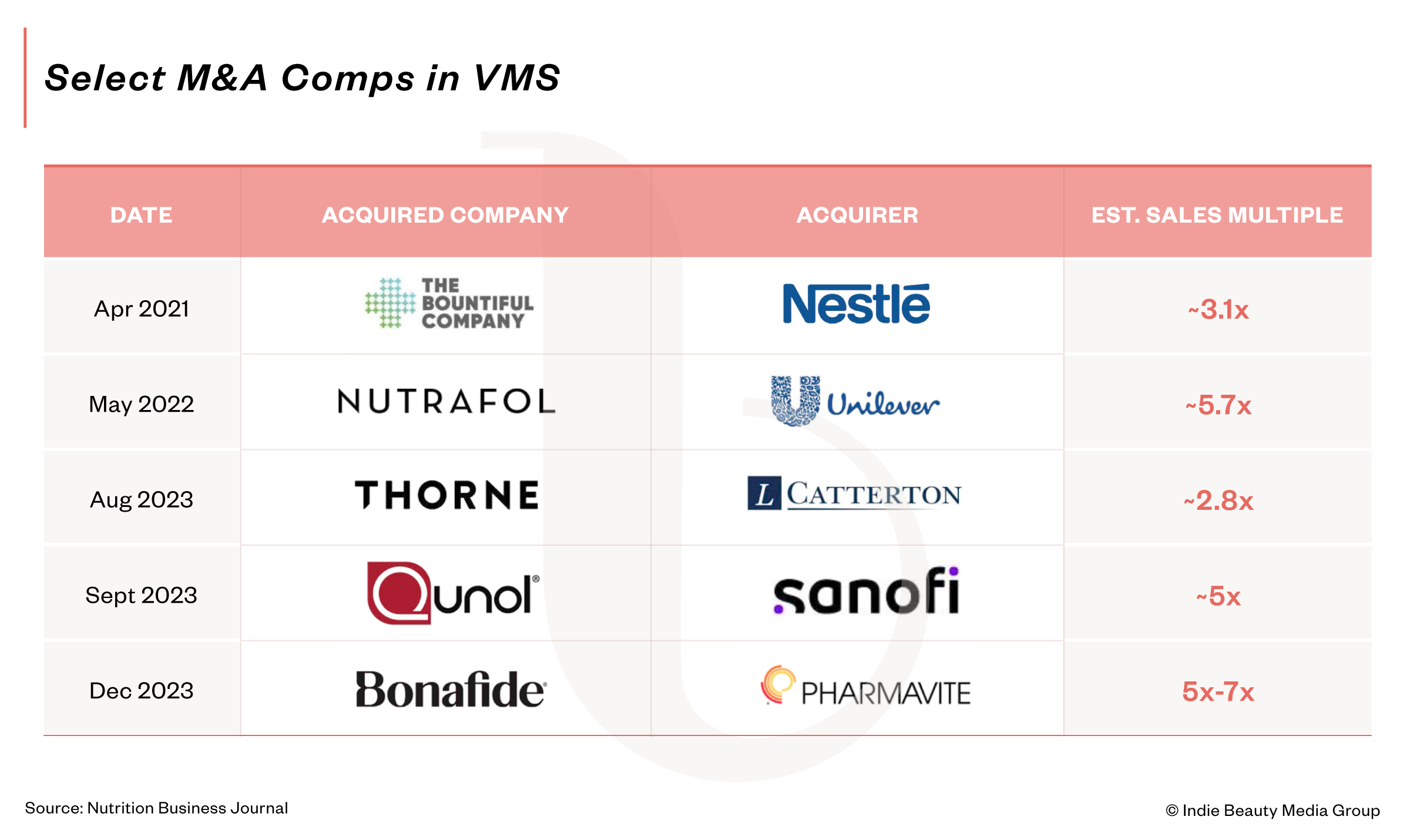

To take advantage of the growth, Diana Melencio, general partner at XRC Ventures’ Brand Capital Fund, expects strategic buyers to enter or reenter the category. She points out both Nestle and Unilever acquired six supplement companies—Olly, Liquid IV, SmartyPants and Nutrafol are examples—from 2017 and 2022 and pulled back on acquisitions lately to integrate them, but could emerge as players once again, and she anticipates beauty conglomerates the likes of Estée Lauder, L’Oréal and Shiseido possibly jumping into the wellness field. Similar to beauty deals, multiples for vitamin and supplement deals have ranged from 2X to 7X sales in recent years.

“There is interest from the larger beauty conglomerates in getting into the space because you can’t ignore it,” says Melencio. “What you ingest impacts your hair, impacts your skin, and I think that beauty rituals will include supplements as part of that overall health of skin and hair.”

Optimism about strategic buyers’ interest in vitamin and supplement brands is having a positive influence on earlier stage investors’ inclinations toward the category. In conversations with 10 VC investors, including Selva Ventures, JamJar Investments, Lerer Hippeau and Fab Co-Creation Studio Ventures, XRC Ventures found 80% plan to invest the same or a greater amount in health and wellness this year. However, investors are adamant the brands they back have defensible and differentiated positioning and intellectual property that can fill gaps in potential acquirers’ businesses.

“Health and wellness are the new wealth.”

As she’s assessing brands, Selva Ventures principal Madeline Kaplan says she’s zeroing in on “exceptional product, early proof points that they are solving a big problem for consumers [and a] strong team that is passionate, professional and self-aware.” Emily Bullman, an investor at JamJar, is focusing on three Ps: “People – Is this an exceptional, ambitious, complementary founding team? Product – Is the product resonating with consumers? Are people coming back and telling their friends? Potential – Is the market opportunity big enough, and are the competitive dynamics attractive enough for the brand to scale effectively?”

Summarizing the VC perspective, XRC Ventures’ report asserts health and wellness “is a trend that we believe will persist though consumer investors will be more selective. More so than in other Consumer categories, the science is key – is there something truly unique about this product, and can the brand prove that it actually works? But the science won’t go far unless it has the right brand and marketing to support it.”

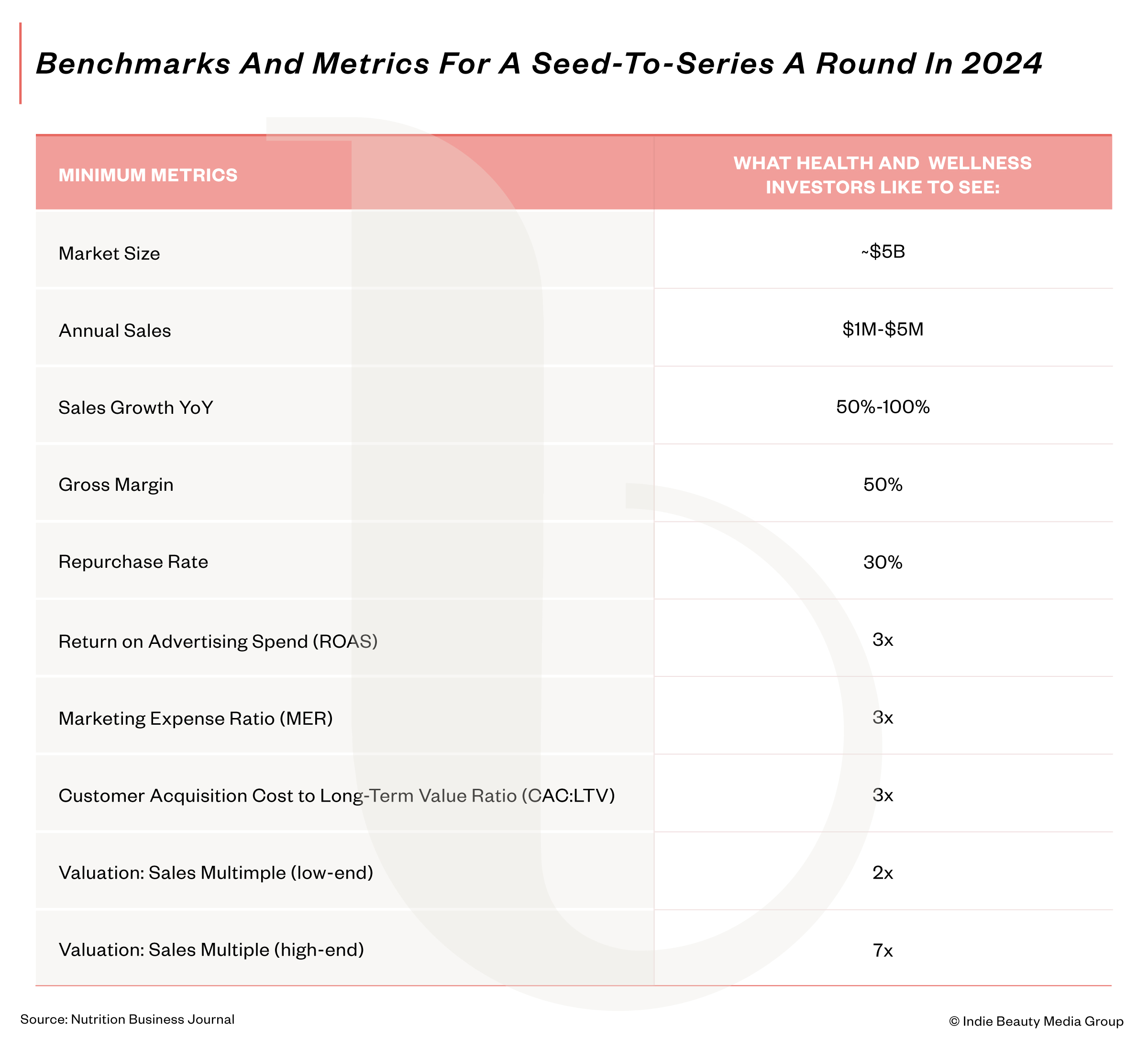

Exploring financial metrics VC investors are honing in on for vitamin and supplement brands, the report relays they’re staying away from pre-product investments and gravitating to brands with at least 50% gross margins (60% to 70% gross margins are even better) and sales doubling annually. Repeat purchase rates of 30% and return on ad spend of 3X are desirable metrics, too.

The report brings up that there’s been a softening of sales among supplement brands rooted in direct-to-consumer distribution and a consolidation of smaller supplement brands that have struggled to scale. With elevated costs in the online environment, Melencio mentions investors are emphasizing retail as a contributor to the sales mix. A strong Amazon presence is critical in the supplement space as well.

“There is interest from the larger beauty conglomerates in getting into the space because you can’t ignore it.”

Referring to retail, Melencio says, “That’s not only to diversify your channel, but also to be less dependent on paid, which is [underpinning] a lot of the challenges we are seeing…What we’ve seen with the retail channel is that it’s increasingly more profitable than the DTC channel because of how CAC costs have risen.”

Turning to Amazon, she elaborates it “will be the primary channel for replenishment…Every brand really does have to spend more time, more money in that channel, particularly in VMS, where repeat purchase and consistency of use is particularly important. On the testing side, I do think that more stringent testing and potentially a higher regulatory bar for claims is good for the consumer, but it will mean that it’s more mature companies entering these channels due to the capital requirements and time to run the additional testing.”

Diving into vitamin and supplement trends, the report cites SPINS data as revealing the ingredients saffron, barberry, algae and inositol are climbing 25% and above in the natural channel as consumers seek solutions for mood support, weight loss, fertility, and brain and cellular health. It singles out AG1, Supergut, Calocurb and SoWell as brands that stand to benefit as consumers on GLP-1 drugs purchase products for nutrient deficiencies. Longevity-related startups on the firm’s radar are Tally Health, Novos and Avea.

More trends XRC Ventures envisions having ongoing effects on the vitamin and supplement category are nootropics and adaptogens, non-pill form factors, women’s health, mental health, beauty ingestibles, and performance nutrition and hydration. It names Thesis, Blume, Fungies and Plant People as nootropic and adaptogen brands to watch, and Neuro, The Good Patch and NuStrips as intriguing brands specializing in non-pill form factors. Thesis and SoWell are in XRC Ventures’ portfolio.

The firm identifies Apothékary, Hey Freya and PYM as brands addressing mental health, and Cure, Buoy and Key as brands in the performance nutrition and hydration segment. Love Wellness, Hum Nutrition and Imaraïs Beauty are beauty ingestible brands with compelling propositions, and Perelel, Resist and Sabi are movers and shakers in the women’s health world.

Leave a Reply

You must be logged in to post a comment.